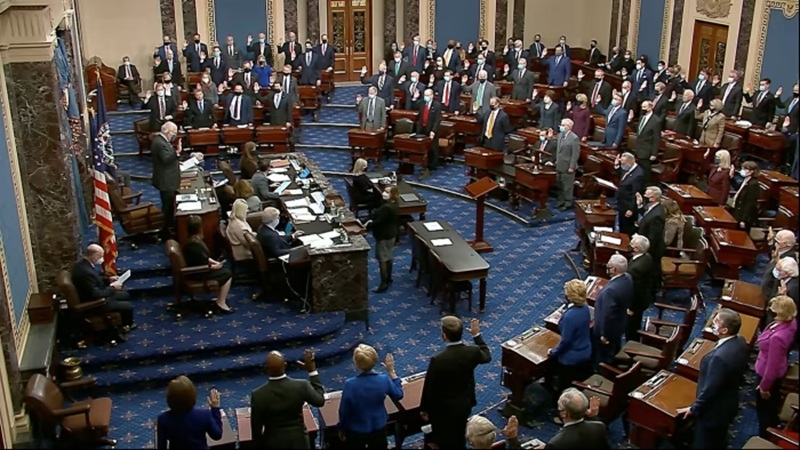

After 40 days of political paralysis that brought much of Washington and key U.S. agencies to a standstill, the Senate on Sunday night voted 60–40 to advance legislation that could end the longest government shutdown in American history later this week.

The bipartisan agreement offers the first sign of relief for hundreds of thousands of federal workers and a nation increasingly burdened by the economic fallout of the funding lapse.

The deal, forged after weeks of tense negotiations among Senate leaders and the Trump administration, funds several key agencies—including Agriculture, Veterans Affairs, and the Food and Drug Administration—through the end of the current fiscal year, and temporarily funds all remaining agencies through January 30, 2026. The Trump administration also agreed to rehire all federal employees laid off during the shutdown and to hold a Senate vote in December on extending Obamacare tax credits set to expire at year’s end.

“After 40 long days, I’m hopeful we can bring this shutdown to an end,” Senate Majority Leader John Thune said before the vote.

Negotiations were led by Thune, Senate Appropriations Chair Susan Collins, and a coalition of Democrats, including Angus King, Jeanne Shaheen, and Maggie Hassan. President Donald Trump, who personally intervened in the final days of talks, pushed for the deal to include measures easing permitting for new power generation projects to accelerate infrastructure expansion.

The measure now heads for full debate in the Senate before moving to the House for final passage. Once approved, it would trigger immediate reinstatement of furloughed federal workers, back pay for missed wages, and a temporary freeze on additional layoffs until January 30.

While the political breakthrough signals the beginning of the end of the shutdown, the economic consequences are already significant and still unfolding. The Congressional Budget Office estimates that the government stoppage has shaved several billion dollars off U.S. GDP, while disrupting multiple sectors — from transportation to agriculture — that rely heavily on federal oversight and staffing.

One of the hardest-hit sectors has been aviation. U.S. airlines canceled more than 2,700 flights on Sunday as Transportation Secretary Sean Duffy warned that air traffic across the country could “slow to a trickle” if the shutdown extended into the busy Thanksgiving travel period. The slowdown at 40 of the nation’s busiest airports has already created ripple effects nationwide, with airlines reporting escalating delays and staffing shortages.

According to FlightAware, a flight-tracking website, nearly 10,000 flight delays were recorded on Sunday alone. More than 1,000 flights were canceled on Friday and another 1,500 on Saturday. The Federal Aviation Administration last week ordered flight reductions at major airports after unpaid air traffic controllers began calling in sick in growing numbers.

The FAA cuts, which began Friday at 4 percent, were set to increase to 10 percent by November 14. They are in effect daily from 6 a.m. to 10 p.m. local time, impacting all commercial carriers. Duffy said the reductions were necessary to ensure safety amid staffing shortages, warning that delays could worsen without an immediate resolution.

The impact has spread beyond aviation. Millions of low-income Americans faced food insecurity as the Supplemental Nutrition Assistance Program (SNAP) ran low on funds. Mortgage approvals slowed as the IRS and FHA remained short-staffed. National parks, long symbols of American resilience, became littered with trash and closed facilities as rangers went unpaid. The White House itself has faced mounting criticism for the shutdown’s breadth, which economists warn could dampen consumer confidence heading into the year’s final quarter.

Under the Senate deal, federal workers will receive full back pay and reinstatement letters confirming withdrawal of termination notices. Agencies will also be barred from issuing new layoff orders before the temporary funding window expires.

Sen. Tim Kaine (D-Va.), representing one of the largest federal workforces in the country, supported the compromise after securing language protecting affected employees.

“I have long said that to earn my vote, we need to be on a path toward fixing Republicans’ health care mess and to protect the federal workforce,” Kaine said.

Still, some Democrats argued the compromise gave up too much leverage. Sen. Elizabeth Warren (D-Mass.) said she opposed ending the shutdown without first securing an extension of Affordable Care Act tax credits, calling the move “a mistake” that weakens Democratic negotiating power.

Sen. Jeanne Shaheen countered that Democrats won meaningful concessions, including a guaranteed vote on health care before year-end.

“We have a guaranteed vote by a guaranteed date on a bill that we will write,” she told reporters after the vote.

Independent Sen. Angus King added that the agreement was “the best chance we have to fix this without further hurting the economy.”

Conservative senators, meanwhile, are seeking changes before final passage. Sen. Rand Paul (R-Ky.) has threatened to delay the process unless a vote is held on removing hemp-related spending. Sens. Mike Lee, Ron Johnson, and Rick Scott also voiced concerns about the bill’s size and the potential for runaway spending once agencies reopen.

The House is expected to take up the bill later this week. Trump, speaking to reporters after attending a football game Sunday night, said he believed the end of the shutdown was near.

“It looks like we’re getting very close to the shutdown ending,” he said.

For millions of Americans—from stranded travelers to unpaid federal workers—the vote represents a long-awaited sign of relief. But economists warn that the damage to productivity, consumer sentiment, and public trust will take longer to undo. Even as lawmakers celebrate a breakthrough, the shutdown has shown that the cost of political brinkmanship now stretches far beyond Washington’s walls.