The cryptocurrency investment landscape is changing in 2025 as more investors branch from the traditional single-asset portfolios to opportunities that offer diversified passive income. One way investors are able to increase their exposure to various digital assets simultaneously is through cloud mining.

However, the best cloud mining results do not rely on profits alone, but also depend on sustainability and the ability to scale ROI easily. RockToken is among the top free cloud mining sites that offer these benefits and more. With RockToken’s transparency, security, and efficiency, over 10,000 of the world’s best and brightest miners continue to consistently invest in its contracts.

Below, we look at an overview of 8 trusted free cloud mining sites driving industry success through multi-asset investment opportunities and steady passive returns.

1. RockToken- Making Cryptocurrency Accessible and Profitable to All

According to the platform’s spokesperson: “RockToken seeks to democratize cryptocurrency profits affordably, sustainably, and transparently.”

Rocktoken ensures everyone has a fair opportunity to participate in cloud mining and earn scalable daily profits without breaking the bank. The ecosystem has been highly secured and fortified to ensure both retail and institutional investors can comfortably earn without choosing between safety and profitability. Notably, this cloud mining gold mine commits to 100% green energy operations and ESSG compliance. RockToken is also gaining popularity as a long-term investment opportunity that will serve investors now and in the next generation effectively by delivering both crypto mining returns and staking rewards.

Sustainable Practices With Zero-Carbon Mining

Many countries are restricting the operations of cloud mining farms that rely on national grids and fossil fuel plants. From the Middle East, Europe, to the US, green mining companies are sprouting, and RockToken rises among the top providers, relying fully on wind, solar, and hydro plants. As a result, institutional miners that observe zero-carbon investment goals are settling in RockToken, earning steady daily returns, hardware-free. Using renewables reduces the cost of operations, which is the highest recurrent burden on mining companies, and increases investment returns.

Scalable Contracts and Cumulative ROI

One of RockToken’s competing advantages is its contracts that are both customizable and scalable. An investor can purchase a contract that earns $150 daily, reinvest consistently, and in a month, they take home over $500 daily. In a single year, especially with the increased block rewards, RockToken is capable of tripling investors’ returns. This efficient free cloud mining platform is turning everyday investors into cryptocurrency super earners: it promises to mint the next wave of millionaires sustainably and effortlessly.

Sample Contracts With Cumulative Daily Returns

| Cloud Mining Plan | Cost | Price/ TH | Duration | Expected Return |

| Genesis Pass | Free | $24.75 | 1 Day | 1.00% |

| Satoshi Pack | $199 | $24.00 | 3 Days | 2.00% |

| Halving Plan | $500 | $24.50 | 5 Days | 1.25% |

| Lightning Miner | $3,000 | $24.00 | 7 Days | 1.36% |

| HashPower Plan | $8,000 | $23.50 | 10 Days | 1.50% |

| DeFi Vault | $27,999 | $23.25 | 14 Days | 2.00% |

| Validator Pack | $69,999 | $21.85 | 7 Days | 2.85% |

| Whale Reserve | $149,995 | $20.95 | 7 Days | 3.50% |

How To Join RockToken and Start Earning

It’s simple:

- Go to the RockToken website and create a mining account.

- Receive a free trial credit to learn the platform’s profitability and risks.

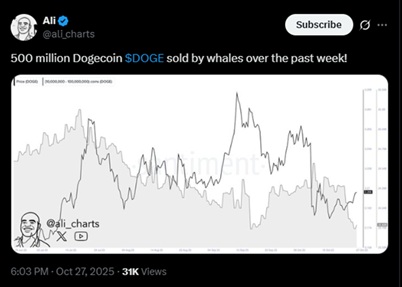

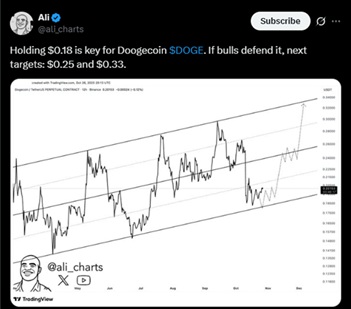

- Deposit capital and purchase a contract for BTC, DOGE, LTC, and any other desired asset from the provided list.

- Start receiving daily payouts only 24 hours after activating the contract.

2. Genesis Mining- Experienced in Mining, Reliable

Genesis is the most experienced cloud mining provider that has operated since 2013. On its cloud mining platform, investors can mine various assets, including BTC, DASH, and ETH, without individual equipment. Genesis Mining is:

- Preferred by larger investors who do not mind the lower daily rates and enjoy income stability.

- Efficient, especially after the infrastructure overhaul that has reduced its energy use by 40% in 2025.

3. BeMine- Easy Fractional ASIC Ownership

While most cloud mining companies either offer hash rate rentals or cloud hosting, BeMine sells fractions of ASICs. The platform is enabling its users to co-own mining hardware and mine top currencies affordably. BeMine offers:

- Variety through multi-coin mining opportunities..

- An easy exit where its investors can peer-to-peer transfer their ASIC fractions unrestricted.

- An 11-day free trial period for new users.

4. NiceHash- A Reliable Hashpower Buy-and-Sell Platform

NiceHash is one of the largest hash rate marketplaces globally. The platform allows its users to either trade their excess mining power or purchase hash contracts from trusted providers. If you are a hardware miner seeking to increase your chances of solving entire blocks individually, this is the platform to join. NiceHash’s unique advantages include, but are not limited to:

- A variety of algorithms that enable users to mine multiple currencies in addition to Bitcoin.

- A great user experience that favours beginners and casual investors.

5. IQ Mining- Ideal for Long-Term Contracts

IQ Mining is a reliable platform offering cloud mining services for multiple, top-performing cryptocurrencies and stablecoins. It focuses on long-term contracts of 1 year or above. In its efficiency, IQ Mining offers:

- A free trial to introduce beginners to the platform’s profit capabilities.

- Additional income through cloud yield farming.

6. MultiMiner- Facilitates Multi-Device Mining Operations.

Multi-miner is a graphical interface that investors use to manage their cryptocurrency mining operations through their computers. It is compatible with miners of diverse assets, including BTC, LTC, DASH, and more. Mutiminer is:

- Trusted globally

- Convenient for beginners, giving them limited free cloud credits to kickstart the cloud mining journey.

7. KuCoin- Exchange + Cloud Mining

As a diversified and established cloud mining ecosystem, Kucoin enables investors on its exchange to seamlessly switch to cloud mining. Users earn compounding returns by mining assets like BTC, KAS, and more. Among its features:

- Multiple investment opportunities under one roof.

- Balanced liquidity due to its link to one of the largest exchanges.

8. Binance- Well Equipped and Trusted.

Like KuCoin, Binance offers cloud mining pool services, allowing investors on the exchange to easily transition into mining. This platform supports mining algorithms for multiple cryptocurrency assets in addition to Bitcoin. The Binance cloud mining platform is:

- Well-equipped for larger cloud mining loads.

- Reliable in delivering stable returns from long-term contracts.

- However, Binance charges electricity and maintenance charges.

Conclusion

Each of the reviewed platforms offers multi-currency cloud mining services for investors globally. These platforms are also succeeding in bringing cryptocurrency profits closer to everyone: they simplify entry and reduce the capital barrier. But RockToken is peculiar;

RockToken emphasizes scalability, sustainability, and transparency, which are driving adoption in 2025. Moreover, its short-term cloud mining contracts yield competitive daily crypto rewards without hardware. And better yet, first-time users are provided with a free trial plan where they can test the platform without risking any capital.