Ethereum is worth around $3,880 now, but there’s a gem under $0.003 that has taken the space by storm. Some experts even think LILPEPE could deliver gains of up to 45x before Ethereum reaches its expected $8,000 level. How could something like LILPEPE, still well under a cent, hold that kind of upside? In this piece, we’ll look at what makes Little Pepe stand out and how it might grow into a key part of the crypto world.

Ethereum’s Road to $8,000 Has Some Bumps Ahead

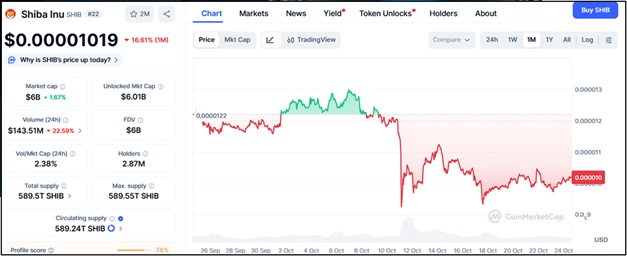

ETH is now trading for around $3,880. Despite an overall positive narrative, there are still signs that this $8,000 figure won’t come in immediately. Since then, it has remained within the 3,950 range, down 0.5% over the past 24 hours.

A couple of things add to the questions about Ethereum’s near-term path:

- Chart Challenges: Ethereum hits substantial barriers around $4,277. A drop below $3,950 could lead to declines, and a fall to $2,879 is possible if support levels fail. Short-term investors should be cautious.

- Significant Player Shifts: A recent $390 million move from DeFi spot Aave to Binance has raised eyebrows. It suggests big holders are playing it safe, bracing for wider market dips. Bearish market activities like this could slow Ethereum’s push to new highs.

With these in play, Ethereum’s climb to $8,000 might take longer than some expect, opening the door for smaller tokens—especially those with innovative plans—to pull ahead in the meantime.

Meet Little Pepe (LILPEPE): A Meme Coin with Real Aim

Data on Ethereum’s Layer-2 world builds a strong case overall. With yearly trade volume set to top $10 trillion by 2027, ways to capture value in scalable, affordable networks matter a lot. In this setup, a fresh project like Little Pepe ($LILPEPE) shows numbers worth noting, making it a possible standout in the high-payoff meme coin space.

Main Features of LILPEPE:

- Affordable Trades: While Ethereum faces high gas costs, LILPEPE offers a lower-cost alternative. This works well for small payments and frequent deals, which are key in meme-driven spaces.

- Starting Point for New Meme Efforts: LILPEPE brings its own launchpad—PEPE’s Pump Pad—to help grow fresh meme projects. This additional role underscores the need for LILPEPE as the primary token for launching and backing new ideas.

- No-Tax Trades: LILPEPE cuts out taxes on transfers, a snag for many meme tokens. Dropping these costs lets buyers move in and out easily, leading to better flow and steadier prices.

- Growth from Community: A considerable strength for LILPEPE is its group of supporters. With over 44,000 holders and more than 39,000 Telegram members, it has a firm base of involved folks driving its progress.

Tokenomics: Thoughtful Path to Value Growth

LILPEPE’s tokenomics aim to build not just quick hype but steady, lasting advance. Here’s a look at the main parts of its model:

- Overall Supply: LILPEPE caps at 100 billion tokens, a significant number that keeps it accessible while leaving room for major upside.

- Presale Wins: The presale did $27.2+ million in sales, higher than expected. With a price increase from $0.0010 to $0.0022 in a presale, active buyers are already doing their job.

- Staking & Vesting: High staking rewards up to 782% APY, which is offered to reward long-term holders whilst preventing the need to sell tokens. In addition, 10% of staking rewards will be made available during the TGE to prevent sudden supply floods and create demand.

- Release Plans: LILPEPE uses a careful vesting timeline with a 3-month cliff for presale folks, then 5% unlocks each month. This prevents messy big sell-offs, a common issue for new tokens.

The 45x Play: A Thought-Out Shot

At $0.0022 now, a 45x jump would put LILPEPE around $0.099. That might sound bold, but with its tokenomics, community backing, and spot in the expanding meme world, it’s within reach. For context, 45x would mean a market cap of nearly $1.98 billion based on the initial 20 billion tokens in circulation. It’s a big step up, but reasonable given the market scale and LILPEPE’s focus on real use.

Final: A Worthwhile Bet with Upside

Ethereum’s climb to $8,000 might hit pauses, but Little Pepe (LILPEPE) gives a strong option for those after better potential payoffs. Under $0.003, LILPEPE’s fresh take—Layer-2 scaling, low costs, no-tax trades, and community-led growth—makes it a meme token with practical applications in a fast-changing field. If you’re after a token with big growth room and a building network, Little Pepe (LILPEPE) might turn out to be the next standout in meme coins.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

$777k Giveaway: https://littlepepe.com/777k-giveaway/