Intel shares jumped as much as 7.8% in early trading on Friday, touching an 18-month high after the U.S. chipmaker reported quarterly results that exceeded expectations, driven by sweeping cost reductions and new strategic investments.

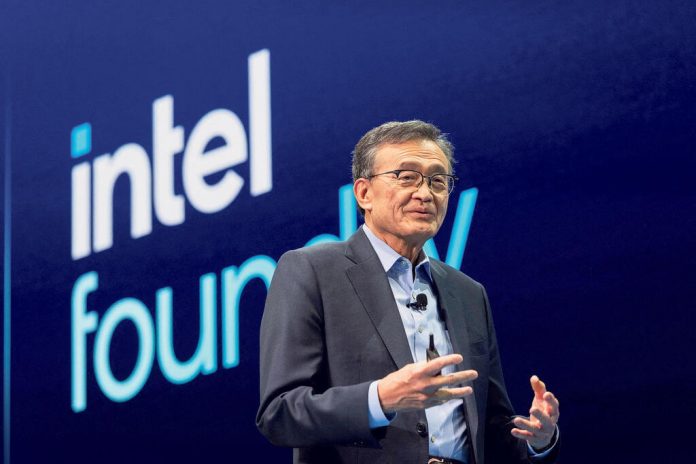

The gains, fueled by optimism around CEO Lip-Bu Tan’s restructuring plan, mark a significant rebound for a company that has spent years battling manufacturing delays, competitive losses, and shrinking market share.

After posting its first annual loss in nearly four decades in 2024, Intel’s latest results suggest the firm may finally be regaining its footing. Tan’s push to streamline operations, cut costs, and attract outside investment has restored some confidence among investors who had long questioned whether Intel could survive the rapid transformation of the semiconductor industry.

“Intel has turned a corner and is steadying the ship,” said Ben Bajarin, CEO of Creative Strategies. “It feels like a strong setup for 2026.”

The company’s shares have now surged more than 90% in 2025, outperforming rivals Nvidia and AMD. According to Refinitiv data, Intel trades at a 12-month forward price-to-earnings ratio of 71.51, compared with 30.49 for Nvidia and 40.14 for AMD — a sign that investors are willing to bet on its long-term recovery despite near-term challenges.

Backed by Big Investors and Washington

Intel’s comeback has been buoyed by major outside funding. Nvidia and Japan’s SoftBank made multi-billion-dollar investments in the company earlier this year, while the U.S. government took a direct stake as part of its broader effort to strengthen domestic semiconductor manufacturing. The moves provided Intel with a financial cushion as it sought to reset its capital strategy and refocus on profitable core operations.

Tan, who took over as CEO amid mounting investor pressure, has taken a markedly different approach from his predecessor, focusing on capital discipline over expansion. He sold a majority stake in Altera, Intel’s programmable chip division, and scaled back the company’s manufacturing ambitions — a significant shift from Intel’s earlier “go-it-alone” strategy that emphasized in-house fabrication.

Tan has also implemented an aggressive cost-cutting campaign, eliminating more than 20% of Intel’s global workforce and streamlining overlapping divisions. Analysts say these moves have begun to pay off, though they warn the turnaround is still in its early stages.

“We understand the desire to claim victory for the embattled company, but this fight is far from over; perhaps it’s better to call it a draw for now,” analysts at Bernstein said in a note.

AI Demand Outpaces Supply

Intel said demand for its chips was now outpacing supply, particularly in data centers where operators are upgrading central processing units (CPUs) to handle the surge in artificial intelligence workloads. The company’s data center business — once a key profit driver but later overtaken by Nvidia’s dominance in AI processors — has become a crucial pillar of Tan’s turnaround strategy.

However, Chief Financial Officer Dave Zinsner cautioned that Intel’s next-generation 18A manufacturing process — a linchpin of its long-term competitiveness — will not reach “acceptable levels” of production yield until 2027. That means Intel will continue to rely heavily on external manufacturing and foundry partners in the medium term.

Zinsner believes the path forward remains challenging, but the steps we’ve taken are beginning to stabilize operations and improve our long-term outlook.

A Fragile Recovery

While the latest quarter signals momentum, analysts remain cautious about Intel’s ability to sustain growth in a market dominated by Nvidia and AMD. Both competitors continue to expand aggressively into AI, edge computing, and data center markets — areas Intel once led but has struggled to keep pace with.

However, investors appear increasingly confident in Tan’s leadership and Intel’s disciplined strategy. With fresh funding, leaner operations, and a clearer focus on execution, Intel’s management says it is positioning the company for a return to sustained profitability.

For now, the market seems to agree. Intel shares were last up nearly 2% in late morning trading, extending a rally that has made the 56-year-old chipmaker one of 2025’s most surprising comeback stories in Silicon Valley.