In a crypto market where timing and innovation decide who profits next, Ozak AI ($OZ) is fast becoming the smart investor’s new flip opportunity. While veterans of Bitcoin and Ethereum have seen impressive returns over the years, the real potential for exponential growth now lies at the intersection of Artificial Intelligence (AI) and DePIN (Decentralized Physical Infrastructure Network)—exactly where Ozak AI thrives. This project fuses AI tools, decentralized compute power, and tokenized infrastructure, creating an ecosystem that’s both technologically advanced and economically scalable. For those who made profits in Bitcoin or Ethereum and are looking for the next frontier, Ozak AI presents a chance to turn those gains into a 400x opportunity by 2027.

$OZ Presale Is Live—Early Movers Are Already Winning

The Ozak AI presale is now live and breaking records. The current token price sits at $0.012, with the next phase set to rise to $0.014 and a target listing price of $1.00. Investors have already purchased over 971 million $OZ tokens, contributing to a total of $4.06 million raised. From its earliest phase, $OZ has witnessed a 1100%+ price increase, and the momentum shows no signs of slowing. The presale model rewards early conviction, just as early Bitcoin and Ethereum adopters once benefited from their foresight.

Ozak AI’s design ensures real utility beyond speculative hype. The project’s token utility encompasses staking rewards, governance voting rights, and participation in the ecosystem’s expansion—making it not just an investment but a role in the future of decentralized intelligence.

Why Ozak AI Is Built for the Next Decade

Unlike projects focused solely on financial instruments, Ozak AI builds AI-powered infrastructure that learns, adapts, and scales. Its DePIN architecture decentralizes computational resources, enabling faster AI model execution without reliance on centralized servers. The cross-chain functionality allows seamless interoperability with leading blockchain ecosystems, giving $OZ holders access to diverse decentralized applications and networks.

Most importantly, Ozak AI upholds security and transparency through rigorous audits—including a recent one by @sherlockdefi, which confirmed zero unresolved issues in its smart contracts. For investors flipping their BTC or ETH profits, this verification offers assurance that Ozak AI isn’t just promising innovation—it’s delivering it with integrity and compliance.

Strategic Partnerships Powering Ozak AI’s Growth

What separates Ozak AI from the rest of the AI-crypto pack is its ability to attract top-tier partnerships that expand its ecosystem in measurable ways. The collaboration with Hive Intel (HIVE) gives Ozak AI’s Predictive Agents access to high-speed, multi-chain blockchain data APIs—providing insights into wallet behaviors, NFT trends, and DeFi movements. This data-driven synergy strengthens Ozak AI’s predictive analytics engine, improving its precision and market forecasting capabilities.

Its alliance with Weblume integrates Ozak AI’s market signals into Weblume’s no-code Web3 builder, empowering developers and creators to embed live AI intelligence into dashboards and decentralized applications (dApps) without needing deep technical expertise. The partnership with SINT, a one-click AI upgrade platform, enables autonomous agents, cross-chain bridges, and voice interfaces—ensuring Ozak AI’s predictive models can be executed instantly across various systems.

Further extending its decentralized muscle, the collaboration with Meganet—a bandwidth-sharing network of over 6.5 million active nodes and 77,000+ community members—accelerates compute efficiency, enabling faster, cheaper AI processing at scale. These partnerships collectively form the backbone of Ozak AI’s expanding ecosystem, ensuring long-term sustainability and global adoption.

Why Smart Investors Are Flipping to $OZ

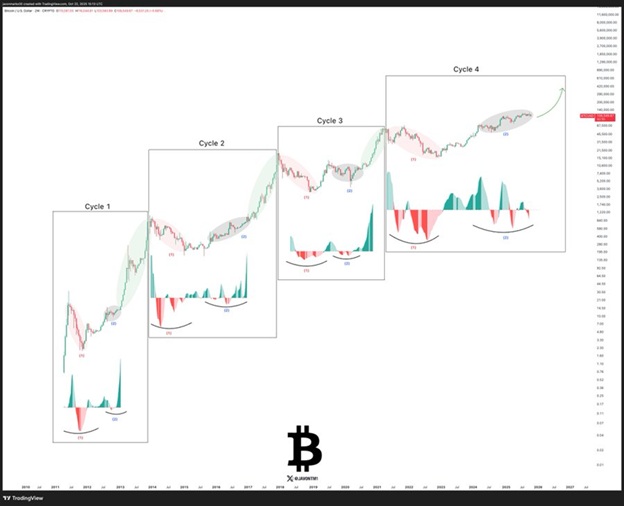

For investors who profited from Bitcoin’s early rallies or Ethereum’s DeFi boom, Ozak AI represents the logical next flip. Bitcoin laid the foundation for decentralized value, Ethereum expanded it with programmable finance—and now, Ozak AI elevates it with autonomous intelligence and infrastructure-level scalability.

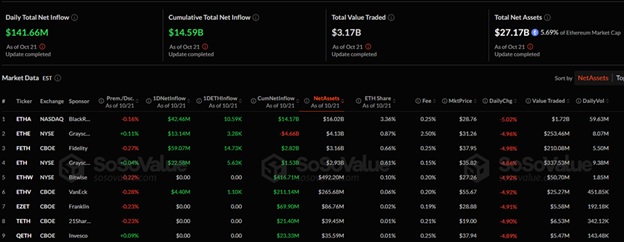

While Ethereum’s current 2025 market conditions show steady but mature growth, Ozak AI is still in its early adoption curve, with massive upside potential. Analysts project that a $1,000 investment in Ozak AI during its presale could yield up to $400,000 if the token reaches its $1 target price post-listing—a realistic milestone given its presale trajectory, ecosystem demand, and cross-chain integrations.

The Future Vision—AI Meets Blockchain for Real Utility

Ozak AI’s vision extends beyond token price appreciation. It’s building a self-sustaining AI economy where predictive agents automate decision-making across DeFi, Web3, and real-world systems. With the global push toward decentralized AI and compute, Ozak AI is uniquely positioned to lead this transformation—leveraging its DePIN structure to deliver accessible intelligence, not just digital assets.

For young investors entering crypto or experienced traders looking to flip profits into the next growth wave, Ozak AI combines innovation, verified performance, and community momentum—a rare mix that could define the next era of crypto millionaires.

For more information about Ozak AI, visit the links below:

Website: https://ozak.ai/

Twitter/X: https://x.com/OzakAGI

Telegram: https://t.me/OzakAGI