As 2025 draws to a close, the crypto market is once again lighting up – and this time, it’s fueled by AI-integrated innovation, multichain expansion, and DeFi disruption. Traders are asking one question louder than ever: which crypto will explode in 2025? The latest trend suggests that AI-enhanced ecosystems could dominate the next cycle, turning smart investments into generational wealth.

The top contenders this quarter include a mix of blue-chip giants like Bitcoin, Ethereum, and Solana, alongside rising challengers like Blazpay – an AI-powered DeFi platform that’s rapidly redefining what the best crypto ai coins can deliver. While the market corrects, smart investors are positioning early in presales and utility-driven projects that offer low entry and high scalability.

Below is a closer look at 10 coins every investor should watch closely this quarter – from long-term leaders to emerging innovators primed for exponential returns.

Current Market Overview (as of October 18, 2025)

| Coin | Current Price | Market Cap | 24h Change | Key Highlight |

| Blazpay (BLAZ) | $0.0075

(Presale) |

$735K

raised |

+67% sold | Multichain AI & DeFi |

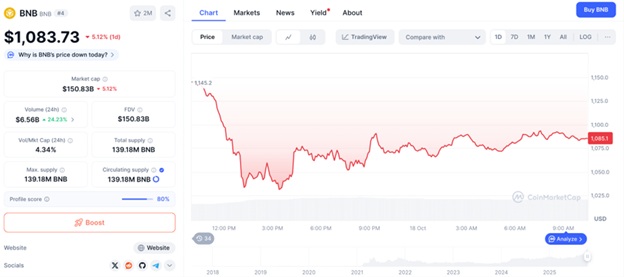

| BNB (Binance Coin) | $1086.49 | $158.3B | -5.74% | Testing $1,000 support |

| Solana (SOL) | $183.46 | $85.5B | +0.78% | Active trading volume |

| Bitcoin (BTC) | $106,730 | $2.13

trillion |

+0.24% | Near key resistance |

| Cardano (ADA) | $0.626 | $22.3B | +0.25% | RSI oversold |

| TRON (TRX) | $0.311 | $27B | +0.76% | Stable range |

| Ethereum (ETH) | $3,846.86 | $462.8B | +0.37% | Holding resilience |

| Polkadot (DOT) | $2.91 | $4.09B | -4.38% | Short-term bearish |

| Sui (SUI) | $2.43 | $6.3B | -0.43% | Cooling after rally |

| XRP (XRP) | $2.32 | $130.5B | -1.57% | Consolidating below $2.85 |

1. Blazpay – The AI-Powered Underdog With Explosive Potential

If there’s one project redefining the best crypto ai coins narrative in 2025, it’s Blazpay. Currently in Phase 2 of its presale, priced at just $0.0075, Blazpay has already raised over $735,000, with 67% of tokens sold. The platform merges AI, Multichain DeFi, and seamless trading infrastructure, offering one of the lowest-risk entry points among new crypto projects this year.

AI SDK and Perpetual Trading: A Unified Future

Blazpay’s integrated AI SDK enables developers to create smart DeFi products that operate across Ethereum, Solana, BSC, and Polygon, eliminating silos that plague traditional crypto ecosystems. Its Perpetual Trading Suite gives users real-time access to leveraged trading and automated market insights – a rare combination at the presale stage.

This convergence positions Blazpay as a frontrunner among the best crypto ai coins to buy in Q4 2025 – a project bridging accessibility, innovation, and yield potential at once.

$2,000 Investment Scenario – The Quiet 1000x Setup

Imagine entering the Blazpay presale at $0.0075 with a $2,000 allocation, securing roughly 266,666 BLAZ tokens. If Blazpay even reaches $0.75 post-listing – a realistic target given AI+DeFi demand – that same investment could surge to $200,000.

That’s a 100x return before listings, making it a potential Best 1000x crypto contender for those entering early.

Price Forecast for 2025–2026: Analysts Turn Bullish

Analysts forecast Blazpay could reach between $0.25 and $0.80 after exchange listings, with further upside toward $1.50+ by mid-2026 if institutional partnerships continue. As one of the best coins to invest in before mass listings, Blazpay’s trajectory mirrors early Solana or Avalanche stages – low entry, massive reward.

How to Buy Blazpay Tokens

- Visit the official Blazpay presale website.

- Connect your MetaMask or Trust Wallet.

- Select ETH, BNB, or USDT as payment.

- Enter the desired investment amount (minimum $50).

- Confirm and claim tokens after presale closes.

Blazpay’s presale currently ends in 13 days, after which the price rises to $0.009375 – reinforcing urgency for early investors.

2. BNB – Holding the Exchange Powerhouse Line

BNB remains one of the best crypto coins to buy for traders who believe in exchange-based ecosystems. Priced near $1086, it’s battling to stay above its 50-day EMA support at $1046. Analysts note that if BNB can sustain above $1,000, it may retest $1,150–$1,250 levels. Despite pressure, BNB remains a long-term infrastructure asset – a reliable pick even in volatile times.

3. Solana – The Comeback Smart Chain

After retracing from $200, Solana is consolidating near $183.46. It remains a leader in high-throughput blockchain solutions, with rising developer adoption. Solana’s market cap of $85.5B keeps it firmly within the best crypto coins discussions, as its scalable infrastructure supports AI-integrated dApps.

4. Bitcoin – Stability Amid Volatility

At $106,730, Bitcoin remains the benchmark for institutional accumulation. While its growth curve is steadier than smaller projects, BTC’s dominance secures its place among the best coins to invest in during uncertain market conditions. Analysts see resistance near $110,000, with strong buying sentiment near $100,000.

5. Cardano – The Silent Innovator

Cardano (ADA) trades at $0.626 with a market cap of $22.3B. Oversold RSI levels suggest potential reversal toward $0.80 in Q4. With new DeFi partnerships forming, Cardano retains its appeal as one of the best crypto coins, integrating smart contract interoperability and long-term scalability.

6. TRON – The Steady Performer

TRON (TRX) continues to maintain stable returns, trading around $0.31. Its $27B market cap highlights strong network usage and developer retention. TRON’s strategic partnerships and DeFi lending expansions make it a moderate yet steady asset among the best crypto coins to buy for yield-focused investors.

7. Ethereum – The Institutional Favorite

Ethereum (ETH) is trading near $3,846, holding strong despite volatility. With over $462B in market cap, Ethereum continues to dominate as a base layer for most AI-driven DeFi protocols. As a cornerstone of the best crypto coins, its transition toward scalability upgrades in 2025 ensures ongoing dominance.

8. Polkadot – Undervalued and Oversold

At $2.91, Polkadot faces short-term pressure but remains undervalued given its interoperability features. Long-term projections aim toward $3.74–$4.99 in 2026. For risk-tolerant investors, DOT’s low valuation and ecosystem expansion make it the best coin to invest in at current levels.

9. Sui – The Newcomer Making Waves

Trading at $2.43, Sui continues to attract attention as a next-generation smart contract platform. Despite short-term cooling, its high trading volume ($1.9B) shows active market participation. Its AI-driven developer tools position it firmly among the emerging best crypto coins in 2025.

10. XRP – The Comeback Asset

At $2.32, XRP remains a market heavyweight. With over $130B market cap, it’s rebounding from SEC-era volatility toward renewed institutional confidence. XRP’s global remittance integrations and liquidity utility could reignite its rally toward $3+ if market momentum strengthens in Q4.

Conclusion: Market Cycles Reset, Opportunities Multiply

The final quarter of 2025 is shaping into one of recalibration – where AI-backed ecosystems, multichain innovation, and presales like Blazpay take center stage. Whether you’re chasing stability through Ethereum and Bitcoin or hunting for asymmetric upside with Blazpay and Sui, the current dip could be the defining moment for the next bull cycle.

In a market that rewards timing and innovation, Blazpay’s model may indeed mark it as the Best 1000x crypto this quarter – the best coin to invest in before 2026 turns up the heat.

Join the Blazpay Community

Website: www.blazpay.com

Twitter: @blazpaylabs

Telegram: t.me/blazpay