With the crypto market rebounding after recent downfalls, some of the leading tokens are at the correct buy levels, and analysts see more opportunities ahead of the upcoming market boom. In the rising reunited ecosystem of Solana, alongside the innovative Layer-2 launchpad Little Pepe (LILPEPE), these five cryptocurrencies are emerging as potential leaders in performance in the fourth quarter of 2025.

Solana (SOL): Strength on Fundamentals and Institutional Support.

Solana (SOL) remains one of the most powerful Layer-1 blockchains, having recently achieved the highest networks in terms of real economic value (REV), with $223 million generated in Q3 2025 by ARK Invest. It was reported that Solana had surpassed all other chains in terms of on-chain revenue, further solidifying its position as an Ethereum alternative for developers and businesses.

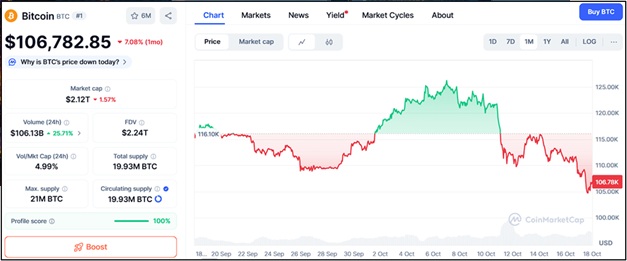

The institutional confidence is increasing, as ARK Invest continues to invest more in Solana and transitions the validator activity to SOL-oriented partners. With a market capitalization of over $106 billion, Solana’s scalability and real-life applications make its current price range of around $190-200 a great entry point for long-term investment.

Dogecoin (DOGE): ETF Buzz and Nasdaq Listing Spur New Energy.

Dogecoin (DOGE) is once again in the spotlight as it prepares to list on the Nasdaq for the first time in its history, following the merger of The House of Doge and Brag House Holdings. Its launch, backed by a $ 50 million investment, marks the introduction of the meme coin into the mainstream finance world, where crypto culture can be integrated into traditional events like games and college sports.

In the meantime, there is a revival of interest in ETFs, and several DOGE ETF applications are pending with the SEC. Dogecoin has become technically bullish on the charts, establishing sound reversal patterns and already targeting $0.25. DOGE is poised for its largest increase since the beginning of 2021, with institutional inflows coming into view.

Floki (FLOKI): Meme to Mainstream With the First Europe FLOKI ETP.

Floki (FLOKI) has recently achieved a significant breakthrough with the launch of its first Exchange-Traded Product (ETP) on Sweden’s Spotlight Stock Market, marking the company’s entry into regulated traditional finance. This accomplishment enables Floki to reach institutional investors, who can now gain exposure through securities markets – a crucial step in making meme coins a recognized and credible digital asset.

After the launch of the ETP, FLOKI increased its price by over 30 percent, and its market capitalization surpassed the value of a billion dollars. Having distributed over 16 billion tokens through the DAO to enhance liquidity and ensure regulatory compliance, Floki has successfully bridged the gap between crypto enthusiasts and conventional finance professionals.

Pi Network (PI): Experimenting with DeFi Tools before Mainnet Goes Live.

Pi Network (PI) is set to roll out its most radical update to date: the launch of its Decentralized Exchange (DEX) and Automated Market Maker (AMM) on testnet. Those functions will enable users to trade tokens on-chain, operate liquidity pools, and get rewards in the Pi Wallet properly, which will be the complete entrance of the network into DeFi.

Provided it goes according to plan, these products may form the heart of the Pi ecosystem, making it a community-based financial network prepared to move to the mainnet. This step offers a rare opportunity to witness Pi evolving into a genuine decentralized economy, driven by early adopters.

Little Pepe (LILPEPE): The Next Big Meme Coin With True Tech.

Little Pepe (LILPEPE) is rapidly emerging as one of the most exciting new tokens, with a market value under $0.01, and the potential to be both serious and meme-appealing, offering blockchain infrastructure. Unlike most meme coins, LILPEPE is built on a Layer-2 chain, enabling lightning-fast and low-cost transactions, ideal for DeFi, NFT trades, and micropayments. This technology foundation provides it with a practical utility foundation, rather than just community buzz.

The distinguishing feature of LILPEPE is its Pepe Pump Pad, a special launchpad that supports meme tokens and features anti-rug functions, liquidity locks, and secured contracts. This ensures all new projects released under the ecosystem are transparent and reliable. It is a powerful innovation that directly addresses one of the crypto market’s most significant issues: investor safety.

To add even more credibility, LILPEPE also has a complete Certik audit, indicating a focus on transparency and security, which is not the case with all meme tokens. As a way of pepping up its expanding community, the project will provide significant incentives, such as a $777,000 presale giveaway and a 15 ETH mega reward to the best purchasers. Its combination of real technology, investor security, and solid community support leads analysts to predict that LILPEPE may replicate the initial blistering performance of DOGE and SHIB, becoming the best purchase on this list.

Conclusion: LILPEPE Value Play 2025 Leader.

Although Solana, Dogecoin, Floki, and Pi Network all have a high potential for upside, Little Pepe (LILPEPE) has been identified as the one with the best combination of innovation, security, and meme-based growth potential. Its Layer-2 performance, Pepe Pump Pad ecosystem, and Certik-approved transparency make it a project that can be deployed in the real world and not a mere speculation. As an investment in the token that tokenizes community energy and makes practical use of it, LILPEPE is one of the strongest investments under 0.01 in the current marketplace, and may be one of the largest stories in the next five years.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken