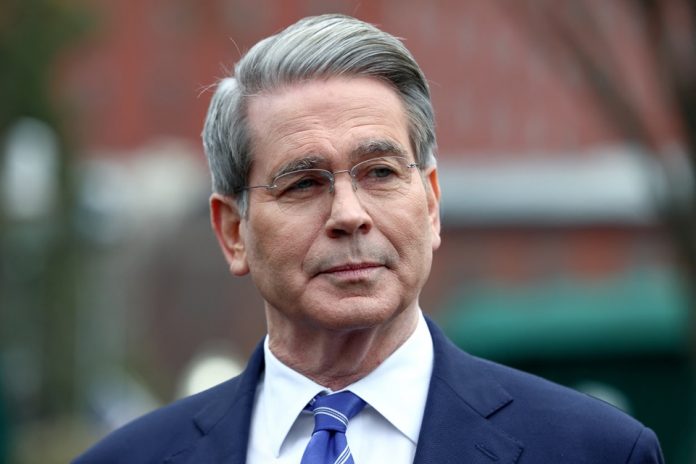

U.S. Treasury Secretary Scott Bessent on Wednesday warned that the two-week-old federal government shutdown is beginning to inflict serious damage on the U.S. economy, estimating that the standoff is costing the country about $15 billion a day in lost output.

Speaking at a press briefing in Washington, Bessent said the shutdown — which has forced hundreds of thousands of federal workers to stay home and delayed key government services — is no longer just a political inconvenience but a direct economic threat.

“We believe that the shutdown may start costing the U.S. economy up to $15 billion a day,” he told reporters, warning that the disruption was now “cutting into muscle.”

The Treasury Secretary’s remarks come amid growing alarm within financial circles over the scale of the shutdown’s fallout. Economists say the longer the impasse drags on, the greater the risk that business confidence, consumer spending, and capital investment could falter.

Bessent urged Democrats in Congress to “be heroes” and side with Republicans to bring the shutdown to an end, describing the gridlock as the single largest obstacle to sustaining the economic boom triggered under President Donald Trump’s administration.

“There is pent-up demand,” Bessent said during a CNBC event held on the sidelines of the International Monetary Fund and World Bank annual meetings in Washington. “But then President Trump has unleashed this boom with his policies. The only thing slowing us down here is this government shutdown.”

“A Modern Economic Boom Being Stalled by Politics”

The Treasury Secretary’s warning reflects growing concern within the administration that the budget deadlock could undercut one of Trump’s most important economic narratives: the investment-driven expansion that the White House has touted as proof of its fiscal and industrial policies.

Bessent said that the wave of capital inflows into the U.S. economy — particularly in technology, manufacturing, and artificial intelligence — remains robust, but that prolonged political paralysis could begin to weigh on momentum.

The wave of investment into the U.S. economy, including into artificial intelligence, is sustainable and is only getting started, he said, adding that “the federal government shutdown is increasingly an impediment.”

Trump’s administration has positioned AI and advanced manufacturing at the heart of its economic agenda, encouraging domestic and foreign firms to expand operations in the U.S. through targeted incentives and tariffs designed to rebalance trade flows. Bessent credited the Republican tax law and the tariff framework for fueling the current investment cycle, comparing the present moment to earlier transformative eras in American history.

“I think we can be in a period like the late 1800s when railroads came in, like the 1990s when we got the internet and office tech boom,” Bessent said. “The incentives are there. The growth is real. But what we’re seeing now is a preventable slowdown caused by gridlock.”

Fiscal Discipline and Deficit Decline

In a separate development, Bessent said that the U.S. budget deficit for the 2025 fiscal year — which ended on September 30 — had shrunk compared to the prior year’s figure of $1.833 trillion. Although the Treasury Department has not yet released the official data, Bessent suggested that fiscal performance had improved modestly and that the government’s deficit-to-GDP ratio could drop to the 3% range within the next few years.

“The deficit-to-GDP, which is the important number, now has a five in front of it,” Bessent said, referencing the current ratio as roughly in the 5% range. Asked if he wanted to see a “three” at the start of that figure, Bessent responded: “Yes, it’s still possible.” He added that fiscal health could improve if the U.S. manages to “grow more, spend less, and constrain spending.”

His optimism stands in contrast to figures released by the nonpartisan Congressional Budget Office (CBO) last week, which estimated that the fiscal 2025 deficit fell only slightly to $1.817 trillion — a modest improvement despite a $118 billion increase in customs revenue stemming from Trump’s tariff policies.

Economists say the CBO’s projection underscores how tariff collections, while boosting government revenue, have only marginally offset the impact of high spending levels across federal programs. Nonetheless, Bessent suggested that the long-term trajectory remains positive, arguing that the combination of growth-driven tax receipts and spending discipline could gradually restore fiscal balance.

Shutdown Threatens Broader Economic Gains

For now, however, the administration faces an urgent challenge to end the shutdown before it undermines the very gains that officials have championed. Bessent’s warning that the impasse is costing $15 billion a day adds weight to mounting calls from business leaders and lawmakers for swift resolution.

Financial analysts have echoed Bessent’s concerns, saying the shutdown risks eroding investor confidence at a time when markets are already grappling with global trade uncertainty and shifting monetary policies. Federal agencies — including the Internal Revenue Service, Commerce Department, and parts of the Securities and Exchange Commission — have curtailed operations, delaying loan approvals, tax refunds, and regulatory reviews critical to business continuity.

Bessent’s remarks suggest that the Treasury Department views the shutdown not just as a political standoff but as a test of the U.S. government’s ability to sustain its economic expansion. He praised Trump’s policies for igniting a new wave of corporate investment but cautioned that the benefits could be temporary if Washington fails to restore normal operations.

In his remarks, Bessent’s tone combined confidence in the U.S. economy’s fundamentals with frustration at Congress’s inability to act. His appeal for Democrats to “be heroes” by voting with Republicans was as much a political challenge as an economic argument — a call for bipartisanship framed around the broader national interest.

However, aides close to the Treasury Secretary say Bessent has been involved in backchannel discussions with congressional leaders from both parties to identify a short-term solution that could reopen the government without undermining Trump’s fiscal priorities.

The White House, meanwhile, has continued to emphasize its confidence that the U.S. economy remains fundamentally strong. Administration officials argue that private-sector investment, low unemployment, and growing export capacity are evidence that the U.S. can weather short-term disruptions — but that ending the shutdown would restore full momentum.