Trust is the cornerstone of every thriving business partnership. Absent trust, collaboration deteriorates, clients are hesitant, and your team is disengaged from the organization’s intended outcome. Trust-building cannot be built on established promises, rather it requires visibility, consistency, and openness in the work being done. However, in many organizations, disconnected tools facilitate trust-erosion. Data is scattered about many different apps, sign-offs become lost in emails, and employees function in silos. Rather than nurturing trust, disconnectedness creates distrust.

For this reason, modern project management tools are changing the game. By consolidating communication, planning and decision-making, they deliver clarity and accountability at work. When employees can see the work and values connected to the strategy, and clients receive reliability in the transactions, that’s trust something that is no longer abstract, but tangible. Lark is one example of a platform that is designed for transparency; the connectedness of the systems gives the organization a trust advantage that is critical for growth.

Lark Base: Clarity for collective work

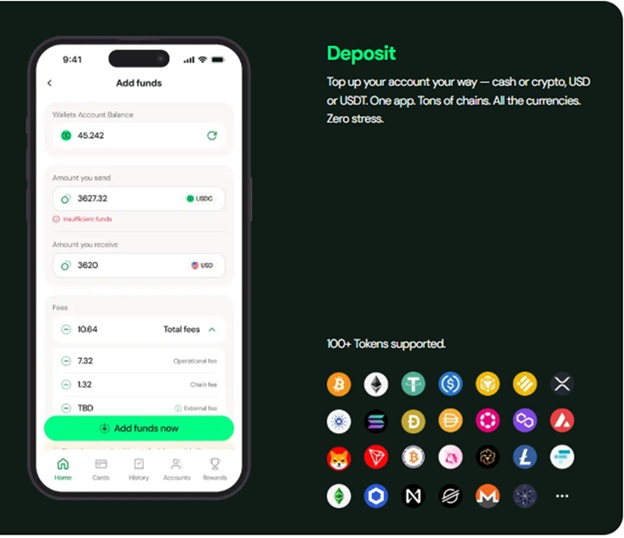

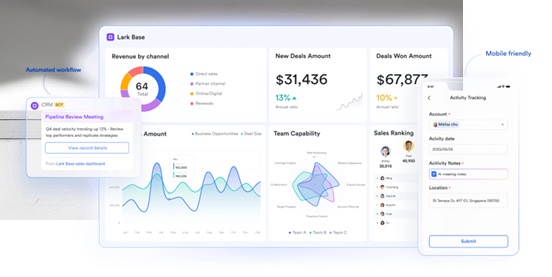

Transparency begins with visibility. When teams track projects in separate spreadsheets and tools, leaders often struggle to see progress clearly. Employees are left guessing about priorities, and accountability becomes blurred. Lark Base addresses this by creating a single hub where projects, data, and responsibilities are visible to all.

Taking sales teams for an example: With the capabilities of tracking, syncing, automating, and analysing, Lark Base can help the team to build up a CRM app to manage customer relationships. Because it all lives in one system, departments no longer compete with conflicting versions of the truth. Leaders see real-time updates, and employees know their contributions are recognized and aligned with broader goals. This visibility fosters trust internally, as individuals no longer feel their work is hidden or undervalued, and externally, as clients see consistent progress reflected in shared updates.

Lark Docs: Transparency through collaboration

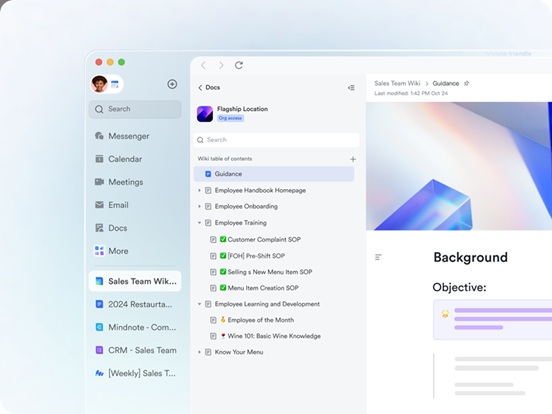

Documents can often demonstrate how much value an organization assigns to transparency. When drafts or reports are circulated without transparency and real feedback is lodged in an inbox, collaboration feels closed off and fragmented. Employees may feel like they are outside the process, and clients may not have confidence in a process that is so opaque. Lark Docs solves this shared thinking by promoting what are called living documents, where collaboration occurs openly in real time.

With Docs, teams can co-edit reports, strategies, or plans together and avoid the inefficiencies of drafts. Feedback lives in comment form, visible to everyone involved, so no view is “dropped.” If a product launch plan continues to evolve or change, every stakeholder can see how the new plan was developed and what decisions led to it. Docs can also link to Base projects or Calendar events, preventing ambiguity because information drives execution. Not only is this shareable format and transparency a better way to work together, but it creates a better situation for all employees and clients, who feel they are part of the process.

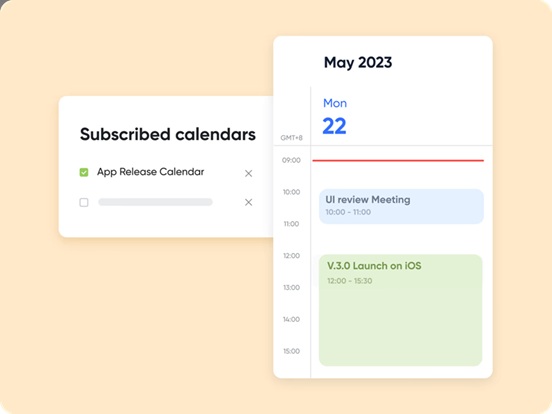

Lark Calendar: Making commitments visible

Trust is built not only on words but on commitments kept. Yet in many organizations, deadlines are unclear or schedules live in isolated systems, making it easy for commitments to slip. Lark Calendar makes time management transparent by embedding deadlines and events directly into workflows.

When a milestone is created in Base, it appears automatically in Calendar, visible to everyone responsible. Employees no longer wonder whether deadlines are real or tentative, they see them clearly alongside their other priorities. For global teams, automatic time zone adjustments ensure no one is left out of the loop due to scheduling errors. By keeping commitments visible and reliable, Calendar builds trust within teams and reassures clients that promises will be met on time.

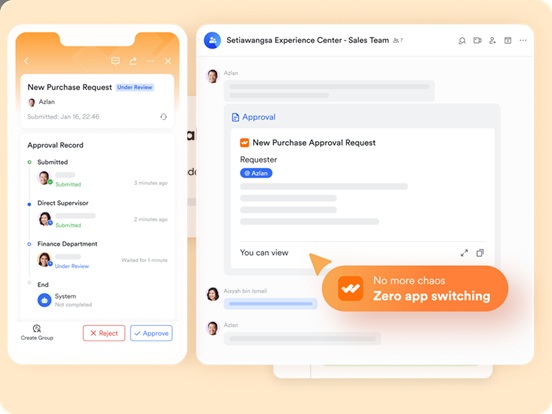

Lark Approval: Confidence in decision-making

Unclear decisions can erode trust faster than anything. When the approval process slows down, or if it seems tied to whims, employees get frustrated and clients question the reliability of the organization. Lark Approval creates a more trustworthy environment by providing a more transparent method of decision-making. Instead of requests fading into oblivion inside email chains, requests are now being made within a contextual workflow, the process is visible, and employees can follow the progress of their requests without feeling the need to nag for an update.

The same goes for managers who will know where approvals are flowing to the right people. Because Approval works as part of an automated workflow, escalations and reminders progress automatically to ensure no approval seems like forever, and the decisions are clear. Over time, this builds trust across the organization, as the consistency of outcomes both internally and externally builds confidence that decisions are made fairly and predictably.

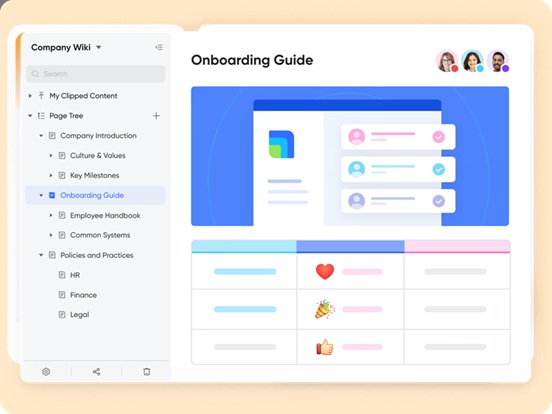

Lark Wiki: Access to knowledge without barriers

When knowledge is stored in personal files or behind conversational doors, trust diminishes. Employees who cannot access necessary information can feel left out, while newcomers struggle to build knowledge of processes expediently. Lark Wiki creates transparency by establishing a central place for organizational knowledge to reside that is always accessible.

Policies, playbooks, or best practices exist in Wiki, and employees will see a current version in real time. Teams and departments can share learnings and best practices across organizational lines, and onboarding becomes easier as new employees can easily find reliable materials from Day 1. Instead of knowledge being hoarded, it becomes collectively owned. This type of transparency creates trust, so employees can feel confident they can find the needed information without obstruction.

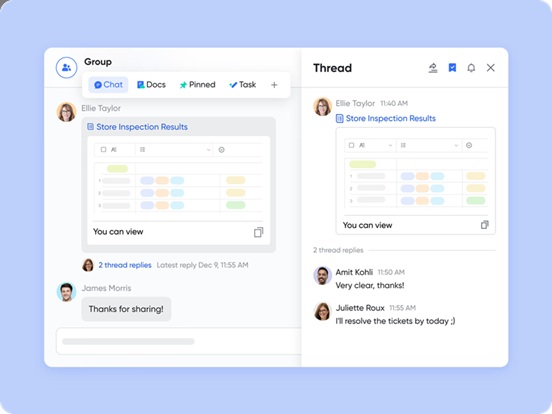

Lark Messenger: Trust in everyday communication

Trust is tested every day in communication. Quick bits of information quickly disappear in chat threads, and important decisions and discussions get lost in silos of messaging applications. Lark Messenger solves this problem by linking communication directly to workflow, so discussions are attached to the activity.

Teams can have conversations about projects and effortlessly convert tidbits of communication into tasks or connect the information with Base records. The translation features enable global teams to partner without misinterpretation, while file-sharing keeps all of the context together. The conversations do not just fade away into white noise; they now become part of the transparent workflow of the organization. This transparency establishes trust because employees see communication tied to outcomes, and clients experience responsiveness without confusion.

Conclusion

You cannot build trust based on a strong intention alone; it requires systems that make work transparent, consistent, and visible. Work that happens in fragmented tools creates opacity. Integrated systems that work on a single, connected platform will show the connection between your strategy, actions, and outcomes. Lark shows us how connected workflows provide that trust advantage that businesses need today.

Base will bring clarity to shared projects. Docs creates an environment for collaborative open work. Calendar shows commitment over time. Approval creates transparency in every decision. Wiki retains knowledge and makes it accessible. Messenger connects conversations to outcomes. Trust turns from an aspiration into practice.

In the long term, the advantage is clear. When the employee feels trusted and empowered, their engagement increases. When the client sees reliability and openness, their relationship continues to deepen. With connected platforms, transparency will no longer be an afterthought; it will be the foundation of positive, strong, enduring success for your business.