The center of gravity of the crypto market is gradually shifting to a new investment approach. While major players like Bitcoin and Solana still command market attention, a lot of retail attention is moving to product-first presales.

For instance, the Avalon X (AVLX) presale, priced at $0.005 and backed by Grupo Avalon’s near $1 billion development pipeline, is combining real estate solidity with blockchain’s access.

Experts believe that it has the potential to be one of the top blockchain real estate projects in the industry and can even defeat Bitcoin price and Solana in terms of ROI. With only 3 days left until the major price increase Avalon X presale gains traction across crypto whales.

Join the Avalon X team for a live AMA today, October 10th on their official X.

What Does the Recent Bitcoin Price Prediction Mean?

Bitcoin’s recent surge to $122k is mostly driven by massive ETF inflows and safe-haven rotations. This illustrates how deep liquidity invites staying power. CoinShares and other trackers reported record weekly ETF capital flows into digital assets, with Bitcoin leading the charge.

The sheer scale of the market cap kind of stops Bitcoin Price from getting a 100x run. For it to achieve those numbers, humongous fresh capital flows will be required. Comparatively, a new altcoin like Avalon X is much more likely to witness 50x or even 100x growth multiples.

Why is Solana Price Down Today?

Solana’s story is a bit different. Solana price USD spikes are often tied to developer momentum, low fees, and retail liquidity. SOL’s on-chain activity and daily volumes make it a favorite for traders seeking quick turnover.

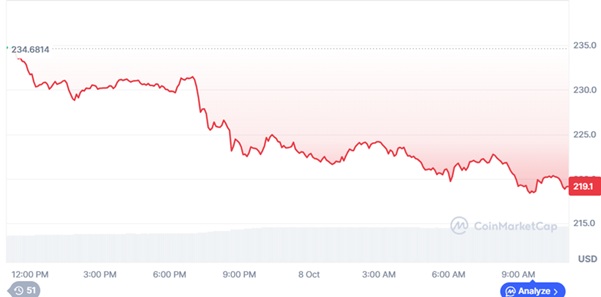

However, platform speed wins rely on continued ecosystem build-out and usage. If developer sentiment or TVL lowers, SOL’s leadership can be tested. For instance, the price of the altcoin has gone down by more than 6% in the past day. It is currently traded near $219.

How is Avalon X’s Model Different?

The Avalon X crypto does something different to retain its staying power in the markets. Its AVLX coin is a real estate-backed cryptocurrency that unlocks hospitality utility, staking benefits, and is backed by Grupo Avalon’s tangible developments.

This gives the Avalon X token a real and stable backing, which is uncommon in most RWA crypto presales. It’s a token that uses blockchain technology to provide real services rather than just speculative liquidity. The capped 2B supply and burn mechanism makes it a long-term bet as well.

Moreover, today, consumer demand for travel experiences is growing. Avalon X exactly taps into this growing demand with its exclusive access and membership perks.

To market the product to the masses, Avalon X has organized two large-scale giveaways that are getting huge traction on social media. The Avalon X $1M crypto giveaway promises $100k in AVLX to ten winners, and the crypto townhouse giveaway is also up for grabs for one lucky winner. The luxury townhouse is located in the gated Eco Avalon development which has already been built. The project has introduced a referral program alongside the giveaways designed to reward community participation. Users will receive 10 bonus entries for each successful referral, along with an additional 10% in tokens, giving them even greater chances to win and earn.

Moreover, the CertiK audit and the ongoing presale success are already proving that investors have confidence in Avalon X’s product and its roadmap. The presale has already achieved more than 50% of its presale target and has sold over 30 million tokens.

Should You Go for Avalon X over Bitcoin & Solana?

Investments naturally depend on an individual’s risk appetite and goals. However, for those targeting 100x crypto coins 2025, Avalon X (AVLX) definitely makes a strong case for itself.

Moreover, with the Avalon X giveaways and the other bonuses running currently, now is the correct time to invest in the altcoin for maximizing gain potential. With only

Join the Community

Website: https://avalonx.io

CoinMarketCap: https://coinmarketcap.com/currencies/avalon-x/

Telegram: https://t.me/avlxofficial