OpenAI’s landmark deal with AMD marks one of the most significant GPU supply and equity partnerships in the artificial intelligence industry to date.

The deal, which is projected to generate tens of billions of dollars in revenue for AMD, underscores the fierce race among AI firms to secure the computing power required to sustain large-scale model training and deployment.

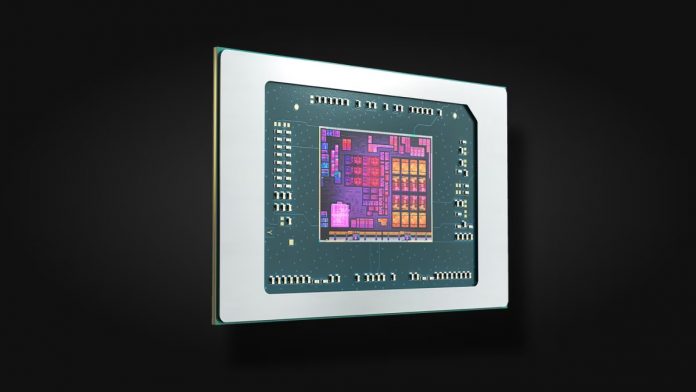

Under the partnership, AMD will provide multiple generations of its Instinct graphics processing units (GPUs), beginning with the Instinct MI450 series, which the company says will outperform Nvidia’s forthcoming Rubin CPX chips. The first gigawatt of capacity will be deployed in the second half of 2026, when the MI450 enters production.

AMD said the agreement extends beyond a traditional supply contract, describing it as a “strategic alignment” that integrates OpenAI’s software and hardware optimization feedback into AMD’s GPU design process. The collaboration is expected to shape AMD’s AI roadmap through 2030, with OpenAI serving as both a customer and a development partner.

The six-gigawatt supply commitment — enough to power about 4.5 million homes — marks one of the largest single orders in AMD’s history. AMD’s current Instinct MI355X and MI300X GPUs are already used in certain OpenAI workloads and are recognized for their performance in large language model (LLM) inference, thanks to their expanded memory bandwidth and capacity.

As part of the deal, OpenAI will also receive the right to purchase up to 160 million AMD shares — roughly a 10% equity stake — tied to performance milestones and chip deployment schedules. The first tranche will vest when OpenAI receives the first gigawatt of compute capacity, with subsequent tranches tied to additional purchases up to the full 6 GW.

OpenAI’s ownership stake will further depend on AMD’s stock performance, with the final tranche vesting once the stock hits $600 per share. AMD’s shares closed Friday at $164.67 but surged nearly 35% to $222.24 by Monday after news of the partnership broke — signaling strong investor confidence in AMD’s growing relevance in the AI compute space.

Dr. Lisa Su, AMD’s chair and CEO, described the partnership as transformative. “We are thrilled to partner with OpenAI to deliver AI compute at massive scale,” Su said. “This partnership brings the best of AMD and OpenAI together to create a true win-win enabling the world’s most ambitious AI buildout and advancing the entire AI ecosystem.”

OpenAI CEO Sam Altman echoed the sentiment, calling the deal “a major step in building the compute capacity to realize AI’s full potential.” Altman has made chip diversification a central part of OpenAI’s long-term strategy, seeking to avoid dependency on Nvidia, whose GPUs remain the backbone of most AI systems globally.

The AMD deal follows a wave of agreements OpenAI has announced in recent weeks as it races to secure AI compute infrastructure for its expanding “Stargate” network — a global buildout of supercomputing data centers with planned capacity exceeding seven gigawatts.

Last month, Nvidia agreed to invest up to $100 billion in OpenAI and supply at least 10 gigawatts of AI compute capacity. Around the same time, OpenAI and Broadcom signed a $10 billion deal to co-develop and manufacture custom AI accelerators. The company also inked partnerships with Samsung Electronics and SK Hynix to supply DRAM memory chips and support data center construction in South Korea.

Analysts say the AMD-OpenAI partnership signals a new phase in the global chip race, as OpenAI diversifies suppliers and AMD positions itself as a credible challenger to Nvidia’s near-monopoly in AI GPUs. The collaboration could also reshape competitive dynamics in AI infrastructure, especially as OpenAI pushes forward with projects designed to power the next generation of artificial general intelligence (AGI).

With this deal, AMD moves squarely into the center of the global AI buildout — one that could redefine its market standing and challenge Nvidia’s dominance over the most lucrative sector in modern computing.