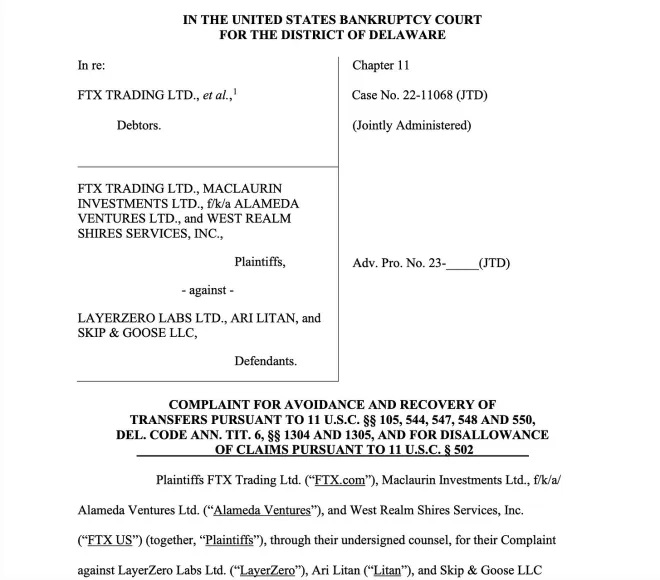

LayerZero Labs, a blockchain development company that claims to offer “zero-trust solutions for decentralized finance”, is facing a lawsuit from FTX, one of the largest cryptocurrency exchanges in the world. The lawsuit alleges that LayerZero Labs used insider information to withdraw their funds from FTX before the exchange temporarily suspended withdrawals due to a technical issue.

According to the complaint filed by FTX, LayerZero Labs had access to confidential information about FTX’s operations and security protocols as part of a partnership agreement. The complaint claims that LayerZero Labs breached the agreement and violated the fiduciary duty of loyalty and good faith by using this information to withdraw their funds from FTX on September 8, 2022, just minutes before the exchange announced that it was pausing withdrawals due to a “network congestion” problem.

FTX claims that LayerZero Labs’ withdrawal caused significant losses to the exchange and its users, as it reduced the liquidity and stability of the platform. FTX also accuses LayerZero Labs of spreading false rumors and misinformation about the exchange’s solvency and integrity, in an attempt to damage its reputation and market share.

FTX is seeking compensatory and punitive damages from LayerZero Labs, as well as an injunction to prevent them from further accessing or disclosing any confidential information about FTX. FTX’s new CEO, who took over the role from the founder Sam Bankman-Fried in August 2023, said in a statement that FTX will not tolerate any “unethical or illegal behavior” from its partners or competitors, and that it will “vigorously defend” its interests and rights in court.

LayerZero Labs has not yet responded to the lawsuit or the allegations. The company’s website and social media accounts have been inactive since September 8, 2023. LayerZero Labs was founded in 2021 by a team of former engineers and researchers from Google, Facebook, and Microsoft. The company claims to have developed several innovative products and protocols for the DeFi sector, such as LayerZero Swap, LayerZero Vault, and LayerZero Bridge.

FTX claims that LayerZero Labs breached its contract and caused damages to the exchange by taking advantage of a “network congestion” issue that affected FTX’s withdrawal system. LayerZero Labs, on the other hand, argues that it acted in self-defense and that FTX was trying to prevent it from accessing its funds. First, let us review the facts of the case. According to the complaint filed by FTX, LayerZero Labs is a DeFi project that aims to create a “zero-trust” platform for cross-chain transactions.

LayerZero Labs deposited about $1.6 million worth of various cryptocurrencies on FTX in order to trade and hedge its positions. However, on September 7, 2022, LayerZero Labs decided to withdraw all its assets from FTX, citing concerns about the security and reliability of the exchange. LayerZero Labs claims that it noticed that FTX was experiencing a “network congestion” problem that delayed or failed some withdrawal requests from users. LayerZero Labs alleges that this problem was caused by FTX’s own negligence or malfeasance and that it posed a serious risk to its funds.

FTX, however, denies these allegations and accuses LayerZero Labs of acting in bad faith and violating its terms of service. FTX admits that it had a “network congestion” issue on September 7, 2022, but claims that it was due to an external factor beyond its control: a sudden spike in gas fees on the Ethereum network. FTX argues that this issue affected all Ethereum-based transactions, not just withdrawals from FTX, and that it was resolved within a few hours. FTX also asserts that it notified its users about the issue and advised them to wait until it was fixed before requesting withdrawals.

FTX contends that LayerZero Labs ignored this advice and exploited the situation by submitting multiple withdrawal requests in rapid succession, hoping to bypass FTX’s security checks and withdraw more funds than it was entitled to. FTX claims that this behavior constituted a breach of contract and fraud and that it resulted in losses for FTX and other users.

Based on these facts, we can analyze the legal and ethical implications of this dispute. From a legal perspective, the outcome of the lawsuit will depend on how the court interprets the contract between FTX and LayerZero Labs and whether it finds evidence of fraud or negligence on either side. The contract, which is available on FTX’s website, states that users are responsible for their own transactions and that FTX is not liable for any losses or damages caused by “network delays, computer failures or malicious attacks”.

The contract also gives FTX the right to suspend or terminate users’ accounts if they violate its terms of service or engage in any illegal or unethical activities. However, the contract also stipulates that users have the right to withdraw their funds at any time and that FTX will process their requests as soon as possible.

Therefore, the key legal questions are: Did LayerZero Labs violate the contract by withdrawing its funds during a “network congestion” issue? Did FTX breach the contract by failing to process LayerZero Labs’ withdrawal requests in a timely manner? Did LayerZero Labs commit fraud by trying to withdraw more funds than it had? Did FTX act negligently or maliciously by causing or prolonging the “network congestion” issue? These questions will require further investigation and evidence from both parties.

From an ethical perspective, the outcome of the lawsuit will depend on how one evaluates the motives and actions of both parties. One could argue that LayerZero Labs acted ethically by withdrawing its funds from FTX, as it had a legitimate reason to do so: protecting its assets from a potential security breach or loss. One could also argue that FTX acted unethically by suing LayerZero Labs, as it had no valid reason to do so: preventing its users from accessing their funds or punishing them for leaving its platform.

Alternatively, one could argue that LayerZero Labs acted unethically by withdrawing its funds from FTX, as it had no valid reason to do so: taking advantage of a technical glitch or stealing from other users. One could also argue that FTX acted ethically by suing LayerZero Labs, as it had a legitimate reason to do so: enforcing its contract or recovering its losses.

Therefore, the key ethical questions are: Did LayerZero Labs have a moral duty to keep its funds on FTX or to withdraw them? Did FTX have a moral duty to process LayerZero Labs’ withdrawal requests or to deny them? Did LayerZero Labs have a moral right to withdraw its funds from FTX or to forfeit them? Did FTX have a moral right to sue LayerZero Labs or to drop the case? These questions will require further reflection and judgment from both parties.

The lawsuit between FTX and LayerZero Labs is a complex and controversial case that involves legal and ethical issues. The answer to the question: Does FTX have the moral ground suing LayerZero Labs? is not clear-cut and may vary depending on one’s perspective and values. However, one thing is certain: this case will have significant implications for the future of cryptocurrency exchanges and DeFi projects and will likely set a precedent for similar disputes in the future.