Interesting comments explaining away the core thesis of Mr Wale Edun (Nigeria’s finance minister) statement where he noted that Nigeria had the most stable economic indicators during 2013-2015: “If we think back to when was the last time when the economy was stable, when it was growing, when inflation was low, when the exchange rate was stable, and when interest rates were affordable; that period was about a decade ago.”

I expanded that conversation by adding that Nigeria during that period experienced the highest GDP per capita ever recorded. You can read some of the comments here, and the core message was this: Jonathan stabilized the exchange rate, inflation rate, etc because oil prices were high.

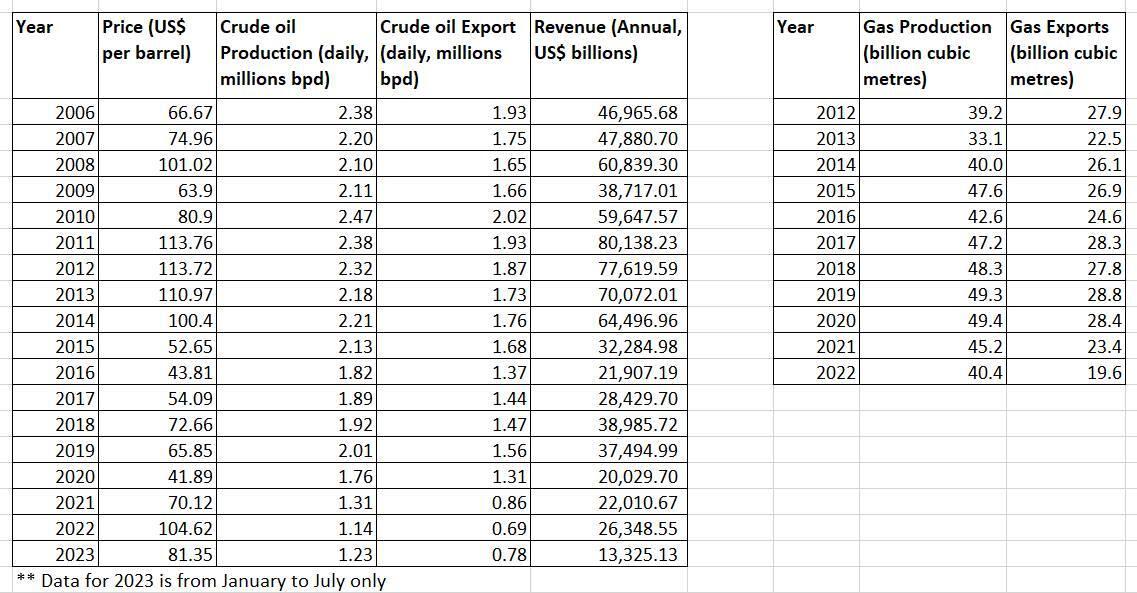

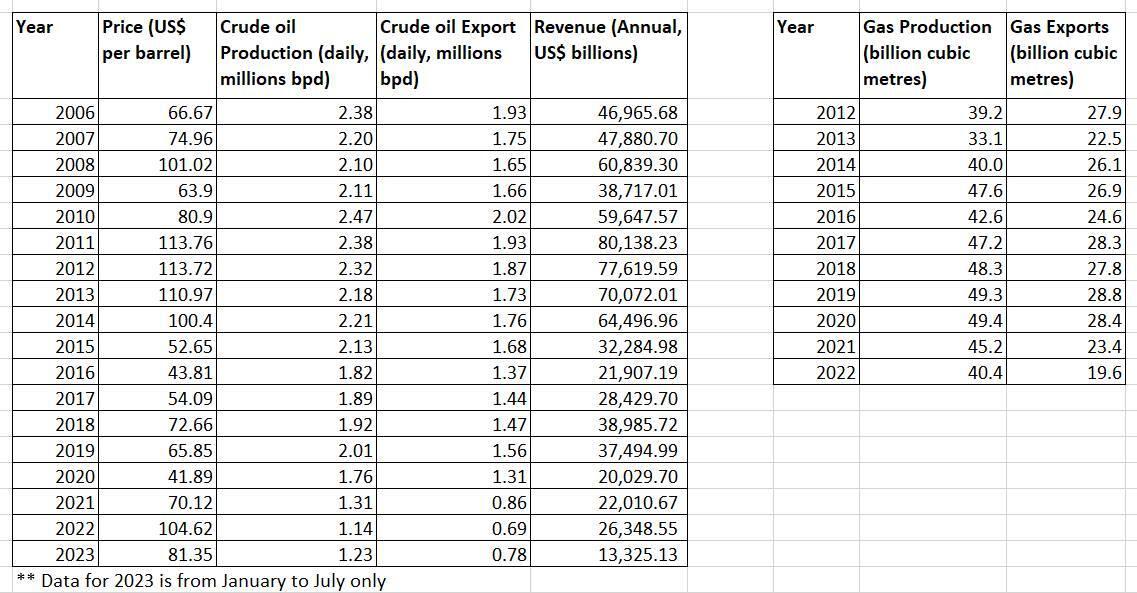

But one comment there wrote: “we can’t push competent, capacity and networking aside.” Good People, that is the deal. If you look at the numbers, and focus on the national budgets, under Buhari, in absolute Naira and USD dollars, Buhari’s government spent more money than Jonathan’s, on yearly average, and what oil money did not provide to the administration, they borrowed. Because Naira is Naira, whether from oil sale or debt, the issue here is efficiency on its management and deployment. Follow me:

- Nigeria 2013 budget: N4.99 trillion

- Nigeria 2014 budget: N4.69 trillion

- Nigeria 2015 budget: N4.5 trillion

- Nigeria 2016 budget: N6.06 trillion

- Budget 2019: N8.92 trillion

- Budget 2022: N16.39 trillion

Here is my summary: if spending money is what matters, irrespective of how that money was obtained, it may not be fair to say that Jonathan stabilized our economy because of oil. Most times, it goes beyond balance sheets to TRUST and operational capabilities. Here is the fact, despite not governing under an oil boom, Buhari spent more money in absolute Naira and US dollars, and yet did not stabilize those indicators the minister was talking about.

I seem to admire Mr. Edun as he seems to be a technocrat who is not interested in calling black white and vice versa. When we tend to explain away a prudent and capable management team with high oil prices, we make it look like we cannot control inflation, FX, etc unless oil price goes up.

(Disclosure: I supported Jonathan over Buhari in 2015).

Comment 1: While it’s essential to acknowledge moments of economic stability and growth, especially in a country as populous and economically diverse as Nigeria, it’s equally important to provide a more comprehensive perspective on the issue.

The points need to be considered.

- Context Matters: Economic stability depends on multiple factors, not just one administration’s actions. Global economic conditions, commodity prices, and previous policies play significant roles.

-

Oil Dependency: Nigeria’s economy heavily relies on oil. The mentioned stability coincided with a short-lived oil price boom, but the country faced economic challenges when oil prices dropped.

-

Socioeconomic Inequality: Increased GDP per capita doesn’t necessarily benefit everyone equally. Nigeria struggles with poverty and inequality, requiring attention beyond per capita income.

-

Structural Challenges: Persistent issues like corruption and infrastructure deficiencies hinder long-term economic stability and growth.

-

Long-Term Planning: Sustainable growth demands consistent policies and reforms addressing fundamental problems.

-

Diverse Perspectives: Economic assessments should consider various viewpoints and acknowledge contributions from different administrations and individuals.

Comment 2: I am trying to understand how the “context” you provide explains the decline in the economy from 2015 to today

- Dependency on oil is the same now as it has been

- Global economic problems have not worsened. And they did not affect Nigeria any worse than other countries

- What has changed about the weaknesses of the GDP as a measure of prosperity?

Comment 3: One thing you must understand is that while I am not supporting the past President Buhari Administration, I am only looking at the economy from a balanced point of view.

The points you provided are valid and your question is in order but here is my response:

- Oil Dependency: Nigeria’s economy has historically been heavily dependent on oil exports. While the dependency on oil may appear to be the same, the global oil market has experienced significant fluctuations during this period. Oil prices plummeted in 2014-2016, affecting Nigeria’s revenue and foreign exchange earnings. Even though the dependency on oil remained constant, the volatility in oil prices and production disruptions due to militancy in the Niger Delta region have been ongoing challenges.

-

Global Impact: Despite global economic problems not worsening, Nigeria’s economy was affected by its integration into the global market, impacting trade and foreign investment.

Hence; GDP, as a measure of prosperity, has limitations. It doesn’t account for income inequality, poverty, or overall quality of life. Nigeria’s economic decline highlighted these shortcomings as key facts.

Comment 4: Let me also put some figures to what Goodluck NNOROM is saying to help put things in perspective.

Average Crude Oil prices by year

2011 – $111.26

2012 – $111.63

2013 – $108.56

2014 – $98.97

2015 – $52.32 (Buhari Administration Started)

2016 – $43.67

Average daily Crude Oil production by year

2011 – 2,459,000 bpd

2012 – 2,409,000 bpd

2013 – 2,276,000 bpd

2014 – 2,273,000 bpd

2015 – 2,199,000 bpd (Buhari Administration started)

2016 – 1,898,000 bpd

In 2015 which was the start of Buhari’s administration, crude oil took a nose dive, there was a sharp decline in global prices of crude that year, meanwhile since 2011 there has been a gradual decline in Nigeria’s daily crude production which fell below 2,000,000 bpd in 2016 for the first time since 1998. As of 2022, Nigeria’s crude production stood at 1,450,000 bpd.

Please note, I am not trying to support any administration over the other, I am simply buttressing some of the facts the

Comment 5: I think we can’t push competent, capacity and networking aside. The last manager of our economy before the current administration lack some of this attributes.

How do you network and relate with your western colleagues if you aren’t at their level. Manager of our economy must have the international exposures and cloud to competitive favourably in global market.

Comment 6: I agree that efficiency does matter a lot, and if you want to look at it from another perspective, you will see why your thesis on efficiency of deployment of resources may actually be the primary explainer of Nigeria’s overall underperformance throughout the eight years of Buhari’s presidency.

Nigeria has had a primary source of revenue over the years which is its oil and gas industry. What has happened is that, that primary source of revenue has come under serious attack from criminals and economic saboteurs thereby leading to its near collapse.

And then Buhari watched our primary source of revenue collapse, he then went on a reckless money printing and borrowing spree to complete make up the shortfall in revenue, and this has led to where our economy is today. This has led to a situation where the little revenue that came into government coffers, now goes to debt servicing up to the tune of about 90% of its revenue if not more going to service debts.

Daily crude oil exports has fallen over the years and collapsed since 2021. Nigeria loses about 1 million barrels per day since 2021 from its usual highs for crude oil exports. That is the reason why there is huge dollar shortages required to defend the naira.

Like this:

Like Loading...