- Andreessen Says More CEOs Should Follow Elon Musk’s Playbook — Even as Silicon Valley Divides Over His Management Model

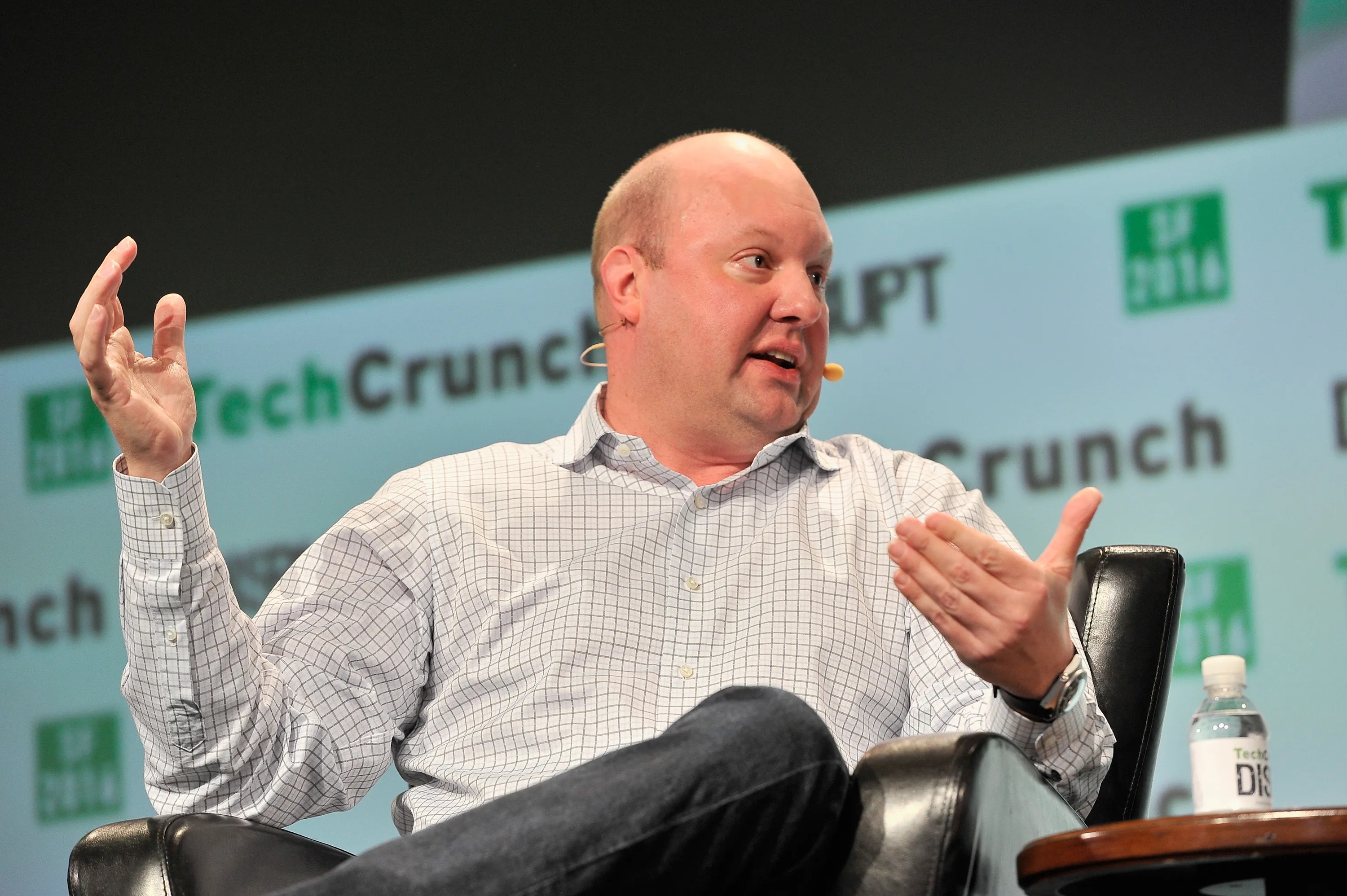

Billionaire venture capitalist Marc Andreessen is urging today’s corporate leaders to rethink what modern leadership looks like — and to take cues from Elon Musk, whose mix of engineering obsession, personal branding, and confrontational style he says defines the new age of executive management.

Speaking on “A Cheeky Pint,” a podcast hosted by Stripe cofounder John Collison, the Andreessen Horowitz (A16z) cofounder said Musk’s unorthodox style has replaced the century-old leadership frameworks once taught in business schools. His argument was that Musk is the model for the new industrial class of technologists, not just a businessman but a system architect.

“I believe there are a lot of people who should be learning a lot more from him who cannot bring themselves to do it and to their own detriment,” Andreessen said.

Andreessen described Musk’s approach as an inversion of traditional corporate structures — one that sidelines middle management in favor of direct communication with technical staff.

“Basically, number one, it’s only engineers,” he said. “Your company, people who matter in your company are the engineers, the people who understand the technical content of what you’re doing for technology companies. And then you only ever talk to the engineers. You never ever ever talk to mid-level management.”

He admitted that few leaders could handle that level of technical oversight, noting that his A16z cofounder Ben Horowitz likens it to assuming the CEO can “hold the entirety of every engineering topic in their head at the same time.”

Still, Andreessen insisted that such talent is more common than people think. “I don’t know if it’s ten, a hundred, or a thousand,” he said. “But I tend to think we have more of those people than we think we do.”

The Cult of Personality Model

Andreessen said Musk’s influence extends beyond engineering management into how he fuses his identity with his companies.

“We’re not going to spend any money on marketing. We’re not going to put any time into IR,” he said. “What we’re going to do is we’re going to put on the show of all time. And the company, and the stocks, and the books, and the videos, and the products, and the jobs are all a function of the cult of personality.”

That approach — visible in how Musk dominates Tesla, SpaceX, and X (formerly Twitter) — has reshaped how Silicon Valley views corporate storytelling. Once centered on innovation and market data, success is now increasingly tied to the founder’s charisma and public presence.

Industry Divisions

But Andreessen’s endorsement of Musk’s management model comes amid growing division in Silicon Valley about whether Musk represents a visionary or a cautionary tale.

Some investors argue that Musk’s playbook is impossible to replicate, given his rare combination of engineering depth and risk appetite. Others warn that the “cult of personality” model is dangerous for companies whose valuation rests on one person’s behavior.

Musk’s political entanglements since the 2024 election underscore those risks. His de facto leadership of the White House DOGE office drew global protests, with Tesla showrooms targeted by demonstrators. His public feud with President Donald Trump over The Big Beautiful Bill sent Tesla’s stock tumbling earlier this year, forcing the company to issue statements reassuring investors about its long-term focus.

Despite that turbulence, Andreessen views Musk’s polarizing persona as a strategic advantage. “The thing you don’t want in any market is a lack of differentiation,” he said. “He 100% always has that.”

Legal Aggression as a Business Strategy

Andreessen also pointed to Musk’s aggressive legal posture as a defining part of his deterrence strategy.

“Anybody who goes up against us, we are going to terrorize, we are going to declare war,” Andreessen said. “And then, of course, as a consequence of declaring war, we’re not always going to win all the wars, but we’re going to establish massive deterrence. And so nobody will screw around with us.”

The comment reflects Musk’s history of combative legal tactics — from Tesla’s courtroom fights with shareholders to X’s battles over speech regulation. Andreessen suggested that even when Musk doesn’t prevail, the message of retaliation keeps competitors and regulators cautious.

Silicon Valley’s Broader Shift

Andreessen’s remarks highlight a deeper philosophical shift underway in Silicon Valley. As startups race to dominate fields like artificial intelligence, robotics, and space, investors are rewarding founders who lead with technical mastery and personality rather than managerial polish.

In recent years, leaders like OpenAI’s Sam Altman, Palantir’s Alex Karp, and Nvidia’s Jensen Huang have also blurred the line between executive authority and personal ideology — building brands around their vision as much as their products.

This mirrors a growing trend where venture capitalists favor “mission-driven” founders who cultivate an intense public following. Andreessen Horowitz, in particular, has been instrumental in backing such figures — from crypto entrepreneurs to AI pioneers — whose confidence and visibility resemble Musk’s template.

But as the market matures, critics warn of volatility tied to founder behavior. Some believe that the cult of personality can drive innovation or sink valuation, because when everything depends on one person, markets react to moods as much as milestones.

Andreessen contrasted Musk’s style with that of Alfred P. Sloan, the mid-20th-century General Motors chief whose systematic management principles became the blueprint for corporate America and inspired MIT’s Sloan School of Management.

In this new era, CEOs are expected not only to lead but to embody their companies — a dynamic Andreessen believes is critical for survival in what he calls “the attention economy.”

While it is not clear whether Musk’s model produces sustainable corporate governance or fuels crises, Andreessen believes that those who ignore his model are ignoring the direction in which leadership itself is moving.