Crypto markets in 2025 are shaping up to be more dynamic than ever, with investors turning toward projects that offer both innovation and long-term potential. Amid the noise of meme coins and speculative tokens, three standout names—Ozak AI, Solana, and Ethereum—have captured market attention for their strong fundamentals, cutting-edge use cases, and impressive growth outlooks.

Ozak AI (OZ)

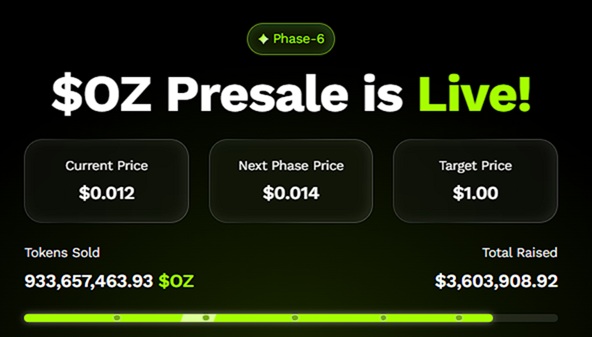

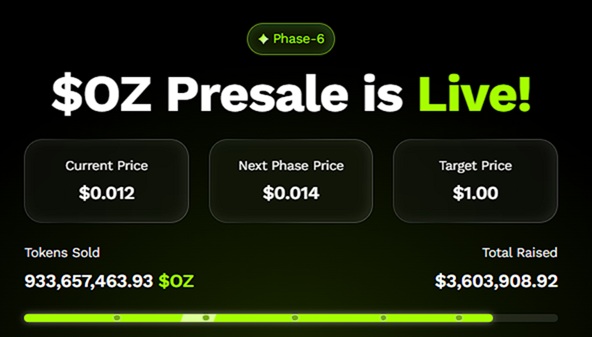

Ozak AI is quickly emerging as one of the most promising tokens in the AI-driven blockchain segment. Currently priced at $0.012 in its 6th presale stage, Ozak AI has already raised over $3.5 million, with more than 930 million tokens sold—a clear indicator of strong investor confidence. What sets Ozak AI apart is its seamless integration of artificial intelligence with blockchain infrastructure.

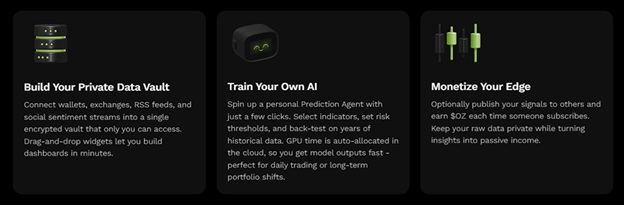

The project’s partnerships with major tech networks like Perceptron Network and SINT highlight its deep-rooted vision for AI autonomy and real-world utility. Through Perceptron’s 700,000+ active nodes, Ozak AI aims to power decentralized prediction agents capable of delivering real-time market insights and trust-based AI decisions. Its partnership with SINT, which provides AI agents, SDK tools, and voice interfaces, further expands Ozak AI’s ecosystem into voice-activated data interactions and multi-chain communication.

Ozak AI’s roadmap is equally ambitious. By 2029, the project targets 100 million users, supported by its growing community and integrations with HIVE’s blockchain data API for 30ms market signal updates. With listings already on CoinGecko and CoinMarketCap, and a CertiK audit completed, Ozak AI is showing both transparency and credibility—rare traits in the early stages of crypto ventures.

Price-wise, analysts project that once Ozak AI transitions from OZ presale to public trading, the token could witness a substantial surge, potentially reaching $0.50 to $1 within its first major bullish cycle. If AI adoption in crypto continues to accelerate, Ozak AI could become one of 2025’s biggest breakout stories.

Solana (SOL)

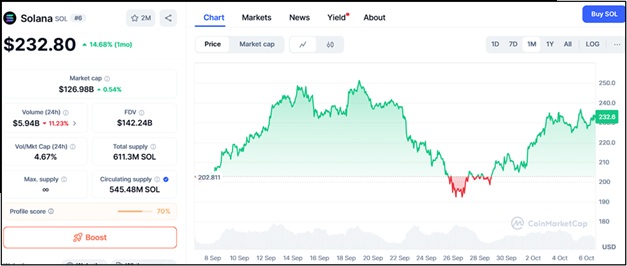

After the network challenges in preceding years, Solana (SOL) has re-emerged as a top performer in 2025’s altcoin cycle. Its community improvements have extensively improved scalability and uptime, making Solana one of the fastest blockchains with minimal transaction costs. SOL’s environment continues to develop unexpectedly, hosting thousands of dApps, NFTs, and DeFi protocols that pressure strong community activity.

At present trading stages near $180, Solana faces resistance at $240, $260, and $280, at the same time as support holds around $160, $145, and $120. Analysts accept as true with that a breakout above the $240 area could set the level for a rally toward $300, aligning with bullish momentum visible throughout the market.

Solana’s long-term increase is likewise being supported via institutional interest and cross-chain adoption. Its energy-efficient Proof-of-History mechanism and seamless developer equipment have made it the desired platform for next-gen blockchain applications—from GameFi initiatives to on-chain AI models. As 2025 progresses, Solana’s mixture of speed, scalability, and active development could make it one of the year’s top-performing Layer 1 property.

Ethereum (ETH)

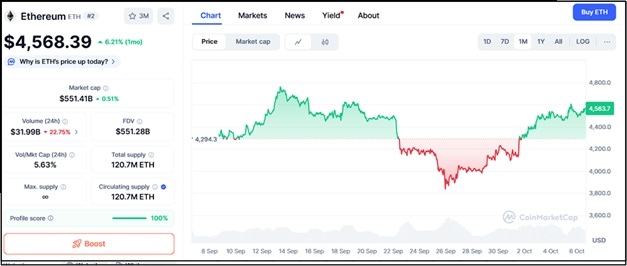

No listing of main cryptocurrencies would be complete without Ethereum (ETH), the backbone of the decentralized net. Ethereum continues to evolve post-merge, transferring in the direction of an extremely efficient proof-of-stake model at the same time as it specializes in scalability through Layer 2 networks consisting of Arbitrum, Optimism, and Base.

ETH currently trades near $3,200, going through resistance at $3,500, $3,850, and $4,200, with support levels at $2,950, $2,700, and $2,400. Market analysts are expecting that Ethereum could reach as high as $6,000 to $8,000 inside the next bull run if institutional adoption continues and DeFi 2.0 protocols increase their on-chain liquidity.

Moreover, Ethereum’s ecosystem remains unrivaled in terms of innovation. From tokenized real-global assets to business enterprise-grade smart contracts, ETH continues to anchor the Web3 revolution. Its deep liquidity, developer community, and dominance in decentralized finance make it no longer just a safe wager but an essential pillar of crypto’s long-term destiny.

While Solana and Ethereum retain their proof of dominance with speed and scalability, Ozak AI often is the revolutionary wildcard that might reshape how AI and crypto engage. Each of those 3 initiatives brings something particular to the table: Ethereum gives stability and a sizable environment, Solana gives efficiency and performance, and Ozak AI introduces intelligence and autonomy to blockchain structures. As 2025 unfolds, these three cryptos constitute not simply funding possibilities but glimpses into the evolving structure of the following digital generation.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi