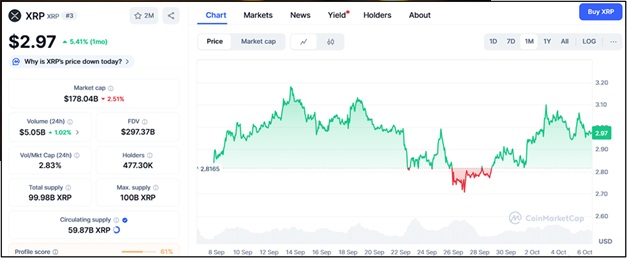

Crypto investors are watching XRP’s bullish climb closely as the token continues its steady ascent toward the long-awaited $5 mark. Renewed institutional demand, Ripple’s global payment integrations, and rising investor confidence have made XRP one of the top-performing altcoins of 2025.

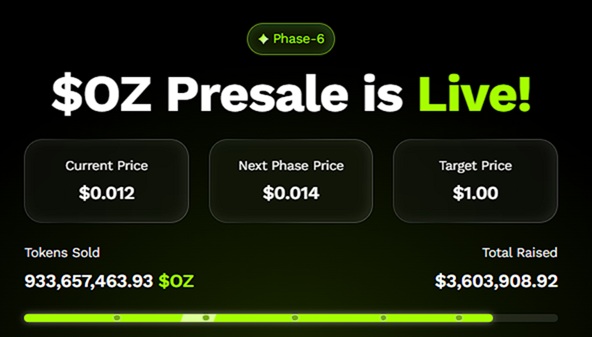

But while major holders anticipate XRP’s breakout, a growing number of savvy investors are turning to a different opportunity — Ozak AI (OZ). Priced at just $0.012 in its Stage 6 presale, Ozak AI has already raised over $3.5 million and sold more than 930 million tokens, with analysts calling it the next high-growth AI crypto capable of delivering 100x returns once listed.

XRP Surges Toward $5 on Institutional Optimism

XRP’s resurgence has been one of the most exciting stories of the year. Once burdened by regulatory uncertainty, Ripple’s legal victory and expanding network of banking partnerships have reignited enthusiasm around the token. As global remittance systems increasingly adopt blockchain solutions, XRP’s role as a bridge currency for cross-border payments continues to gain traction.

Currently trading around $3.10, XRP faces resistance at $3.50, $4.20, and $5.00, while finding support near $2.80, $2.40, and $2.00. Breaking above $4 would likely open the door to a strong rally, especially if Ripple secures more institutional liquidity partnerships.

However, even with growing real-world utility, XRP’s large market capitalization naturally limits its potential upside. Analysts expect it to 2x–3x in 2025 — impressive, but nowhere near the 100x projections that early-stage tokens like Ozak AI could deliver.

Ozak AI’s $0.012 Entry Draws Smarter Money

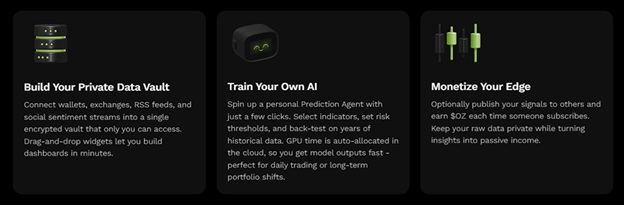

While XRP attracts institutional traders seeking stability, Ozak AI has become the go-to project for investors looking for high-risk, high-reward opportunities backed by real technology. Ozak AI merges artificial intelligence and blockchain analytics to offer predictive insights, real-time data processing, and autonomous trading through its innovative Prediction Agents.

The platform’s architecture integrates Arbitrum Orbit for scalability, EigenLayer AVS for decentralized validation, and the Ozak Stream Network (OSN) — a system designed to process vast streams of crypto data with millisecond precision. These features enable traders, institutions, and developers to analyze market conditions and forecast movements before they occur.

At its core, Ozak AI aims to democratize access to hedge fund-level intelligence, making advanced predictive analytics accessible to everyday crypto traders. This real-world utility sets Ozak AI apart from typical presales that rely solely on hype rather than tangible innovation.

$3.5M Raised and Growing Investor Confidence

Ozak AI’s presale momentum has been nothing short of remarkable. The project has already raised more than $3.5 million and sold 930 million tokens, signaling overwhelming investor confidence. Its Stage 6 OZ presale at $0.012 continues to attract both retail and institutional participants seeking early exposure before exchange listings.

Unlike many speculative tokens, Ozak AI has also undergone thorough CertiK and internal audits, ensuring transparency and smart contract security. It is officially listed on CoinMarketCap and CoinGecko, providing verified price tracking and visibility. These milestones demonstrate that Ozak AI is not just another hyped-up presale — it’s a well-structured, auditable, and fast-growing ecosystem backed by real fundamentals.

OZ’s Strategic Partnerships Accelerate Growth

Ozak AI’s rise is further supported by a growing list of partnerships. Collaborations with Dex3, Hive Intel, and SINT enhance its AI and automation capabilities, enabling seamless data flow between networks. Meanwhile, alliances with Manta Network, Coin Kami, Forum Crypto Indonesia, Block Bali Com, and Bitcoin Addict Thailand have helped expand its reach within Asia’s rapidly growing blockchain market.

The project has also gained visibility through key appearances at Coinfest Asia 2025, hosting exclusive events like Sundown Signals and The Ozak AI Roadshow, where investors, developers, and crypto enthusiasts got firsthand insight into its potential. This proactive approach has positioned Ozak AI as one of the most networked and promising AI projects in the space.

Why Ozak AI Appeals to Smarter Investors

Investors chasing the next big opportunity are beginning to view Ozak AI as a strategic long-term play rather than a short-term speculation. While XRP offers established infrastructure and adoption, Ozak AI provides exponential upside — the same kind of early-stage asymmetry that defined Solana, Polygon, and Chainlink in their infancy.

Its combination of AI-driven intelligence, blockchain validation, and verified transparency offers a balance of credibility and innovation rarely seen in presales. Moreover, as the AI narrative gains strength across the crypto landscape, Ozak AI’s positioning at the heart of predictive analytics gives it a clear advantage over competing altcoins.

As XRP surges toward $5, it continues to prove its strength as a pillar of institutional crypto adoption. Yet, for investors seeking more than incremental growth, Ozak AI’s $0.012 entry presents one of the most compelling opportunities of 2025.

With $3.5 million raised, 930 million tokens sold, strategic partnerships, and audited transparency, Ozak AI represents a rare fusion of innovation and investment potential. While XRP captures headlines, Ozak AI is quietly capturing the attention of smarter money — the kind that recognizes that the biggest winners in crypto are born before the hype, not after it.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi