What really is ‘Financial Inclusion’ ?

Most dictionaries, or AI summaries, will define ‘Financial Inclusion’ as making financial products and services accessible and affordable to all individuals and businesses, regardless of their personal net worth or company size.

They will claim it aims to remove barriers that exclude people from participating in the financial sector and using these services to improve their lives.

Access to a transaction account can be a first step towards broader financial inclusion.

In 2021, 30% of women in Latin America had no checking accounts, credit cards, or savings, compared to 23% of unbanked men. Boosting financial inclusion requires digital tools and training to help connect women with financial services that meet their needs, aiming to close the gender gap in financial access and foster equitable economic growth around the Caribbean.

Financial inclusion is seen as a key enabler to reducing poverty and boosting prosperity.

Though ‘Financial Inclusion’ can be interpreted differently. Is it just about the access to services, or equity of opportunity among citizenry to generate personal wealth?

The two things are not the same, and there is a moment of inertia that sits at a base level below even the most basic strata of financial tools – below the first rung on the ladder.

Last year, Nigeria overtook India in the list of countries in the world with the largest % of the population living below the poverty line. Even among the employed, it is not uncommon to find people doing jobs that barely cover their commuting expenses.

The component of the Nigerian populous that are unbanked is more acute in the north of the country, where many of the states operate under Shariah Law.

Religious compliance in Shariah states create obstacles to retail banking in the North. Newer ‘Shariah compliant’ services do exist, but leaders aren’t doing enough in Northern Nigeria to educate the masses on difference.

For 10 years+, affordable ‘PoS’ terminals in ‘kiosks’ abound in even small villages in Nigeria, giving the unbanked means of sending money remotely, or paying bills, also Microfinance banks.

I assisted at submission compliance level with the formation of a Microfinance bank in Ikeja, Lagos, almost 15 years ago.

Stand alone rechargeable payment cards also exist. These work similarly to a retail bank debit card. They however do not have the extended services of a retail bank account appended to them. Operators simply have a ‘ledger’ integrated with settlement systems, and cash deposits can be made to the card at any shop or retail outlet acting as the operators agent.

Blockchain and Financial Inclusion in Nigeria.

Every once in a while, someone comes along with a new article about what ‘Blockchain’ can bring to Nigeria regarding ‘Financial Inclusion’.

It is important to understand Blockchains on their own, only offer better security but do not make the availability of many services easier. In the ‘Closed Naira’ market, blockchain cannot offer a ‘game changer’ over the ‘ease of movement’ of funds INSIDE Federal Nigeria, already been served by a mix of PoS outlets, Microfinance Banks, payment cards, and other free-market non-blockchain digital services.

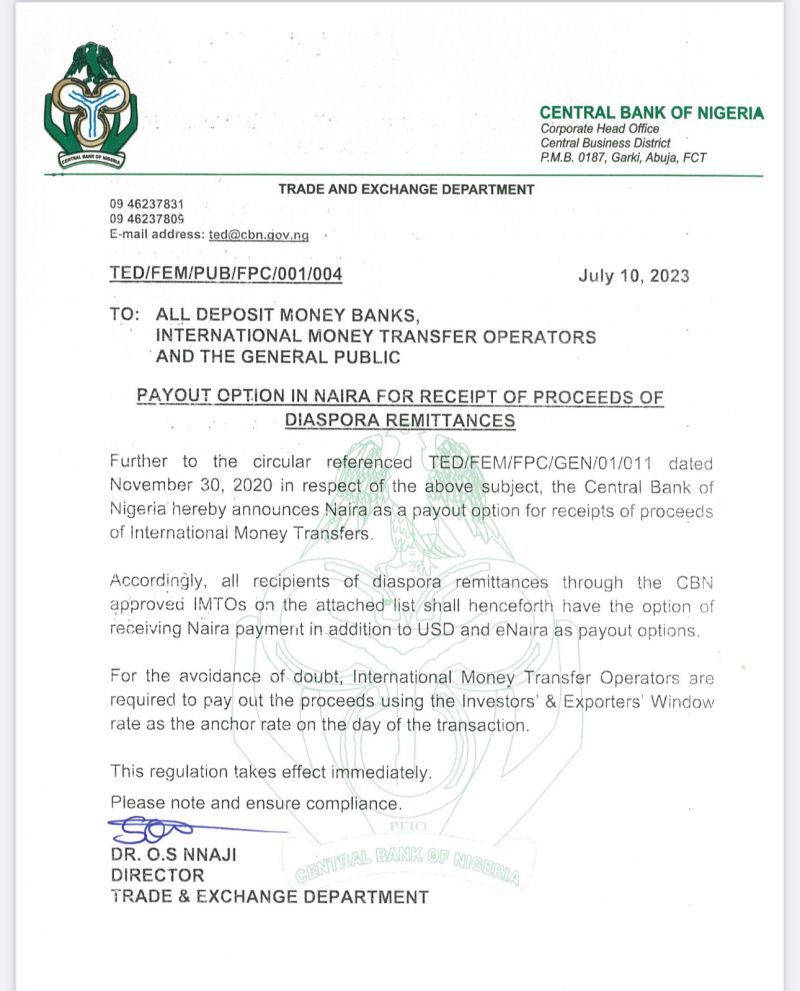

In 2021 Nigeria tightened banking regulations, deeming crypto-trading services illegal, not by saying crypto-trading is illegal per se, but by interpreting existing law to deduce that locally based CEXs are in effect, operating as a retail bank, without the licence and charter from CBN to do so. CBN then also sent circulars to existing retail banks, instructing them not to offer services to CEXs.

Hot on the trail of this, Nigeria became the second country globally (after China) to have a CBDC – (Central Bank Digital Currency).

Challenges of businesses.

Many businesses, particularly FMCG manufacturers, were FOREX starved, inhibiting their manufacturing productivity.

In a mirror of the ‘cryptoban by legal interpretation’, CBN had previously banned many raw materials that needed to be imported from abroad. This was not through an outright ban, but by declaring those materials ineligible for the issuance of FOREX. As manufacturers only earnt in Naira, the result was the same.

The ‘Tech’ instead of the Purpose and Fit.

CBDC bears many of the hallmarks of a blockchain product, but its’ important to understand the product is not in any way similar to a free-market coin or token. Nigeria’s ‘e-Naira’ is worth the same as a regular Naira and exhibited the same challenges in being exchanged for FOREX.

The popularity of Bitcoin and its ilk, was twofold –

- A hedge for liquidity against the constantly fall in value of the Naira.

- A FOREX proxy to facilitate imports of goods on CBNs’ FOREX exclusion list.

Nigerians were not ‘speculating’ on cryptocurrencies to appreciate against hard currencies like the US Dollar, because they could not get US Dollars!

CBDC could not help to do any of these things. It was the ‘tech’ but lacking the Purpose and the Fit. In the words of Ndubuisi Ekekwe – it was failing to ‘Fix the Friction’.

If we go on much of the detailed information and videos online, a world full of CDBCs is something we should not look forward to.

When did the solution arrive?

On 15 June, Nigeria ‘floated’ the Naira, which now takes its place next to the South African Rand as the only two ‘freely convertible’ currencies on the continent according to the provisions of IMF Article IV.

This ended a longstanding ‘grey market’ or ‘parallel market’ practice unofficially trading the local Naira at a discount to international currencies. This took place outside of the retail banking network being supported by those who were desperate.

This doesn’t mean there won’t be still hiccups with FOREX, as the stranglehold of decades of restricted currency dynamics unravels –

Samuel Nwite for Tekedia Institute only five days ago reported that Dangote Cement and Ethiopian Airlines swapped USD $100m of trapped revenue between Ethiopia and Nigeria. We can still expect these challenges to persist in the medium term.

Given recent meeting around the Pan African Payment and Settlement System, the development positions Nigeria extremely well for establishing itself as ‘the USD$ of Africa’, especially given Nigeria has a GDP of 1.7x and a population more than 3x the home of the only other ‘freely convertible’ currency – South Africa.

It does beg the question though – Why didn’t Nigeria just float the Naira two years ago, instead of wasting massive investment on a CBDC that nobody wanted, needed, and for the large part, do not use?

Nigeria is inching very marginally in the direction of the Financial Inclusion people can still barely dream of… but taking the step two years late, with much wasted effort and investment.

9ja Cosmos is here…

Get your .9jacom and .9javerse Web 3 domains for $2 at:

Visit 9ja Cosmos

Follow us on LinkedIn HERE

All reference sites accessed 13/07/2023

b2bpay.co/fully-convertible-currencies

cbn.gov.ng/

search.brave.com (Financial Inclusion)

nairametrics.com/2022/03/14/top-10-microfinance-banks-in-nigeria

oxfam.org/en/nigeria-extreme-inequality-numbers

en.wikipedia.org/wiki/Islamic_banking_and_finance

tekedia.com/ethiopian-airlines-dangote-cement-swap-100m-in-trapped-revenue/

trade.gov/market-intelligence/pan-african-payment-and-settlement-system