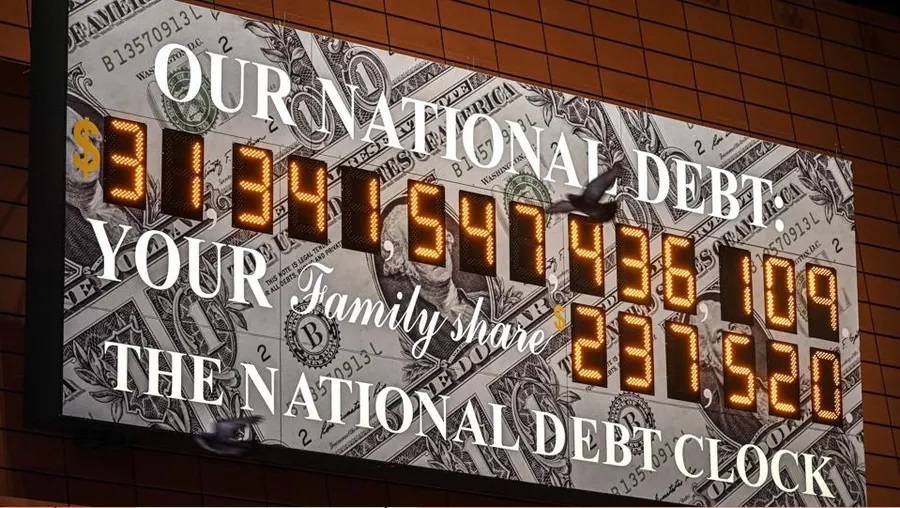

Good People, some of our learners in the Tekedia Investment and Portfolio Management program have asked me how the paralysis on the US debt ceiling could affect some of their investments. Our subject matter experts will examine this in our June edition, but as a former banker, I will offer some perspectives here. If the United States does not resolve this quickly, here are things you should expect.

- For currency traders, the US dollar will fall.

- US stocks will fall with negatives for most indices.

- Bond yields will spike. The implication is that bond prices will go down.

- Many will lose their jobs as growth will stall.

- More so, if this should happen, it could cause severe economic pains across the globe since the US dollar is the leading currency for global trade.

That said, I do not believe that the US will not break this ceiling; it has always been doing that for generations. That the US will default is academic because it will not happen. They will play politics and then get serious just hours to any default.

That said, if you are investing in the US, we posit that you create a US entity and use that entity to invest if you are unable to work directly under a US entity. We have looked at recent recoveries/settlements and observed that settlements are first extended to US persons and entities before international persons and entities.

In other words, US persons and entities are being prioritized during recoveries and settlements: “Meanwhile, the new FTX CEO John Ray, who replaced Bankman-Fried to guide FTX’s restructuring, is trying to rescue funds that were lost by the crypto company’s depositors when the firm spiraled into bankruptcy in November last year….John Ray III, while testifying to the U.S house committee, disclosed that U.S. customers are more likely than other customers to get their money back.”