Tech giant Google began to introduce Twitter-like blue check marks next to select senders’ names on Gmail to verify that they are identified and to also help users identify messages from legitimate senders.

The tech giant via a blog post announced on Wednesday that the new blue check marks will appear next to companies that have adopted Gmail’s existing Brand Indicators for Message Identification (BIMI) feature.

The blog post which is titled “Expanding upon Gmail security with BIMI” reads,

“In 2021, we introduced Brand Indicators for Message Identification (BIMI) in Gmail, a feature that requires senders to use strong authentication and verify their brand logo in order to display a brand logo as an avatar in emails. Building upon that feature, users will now see a checkmark icon for senders that have adopted BIMI. This will help users identify messages from legitimate senders versus impersonators”.

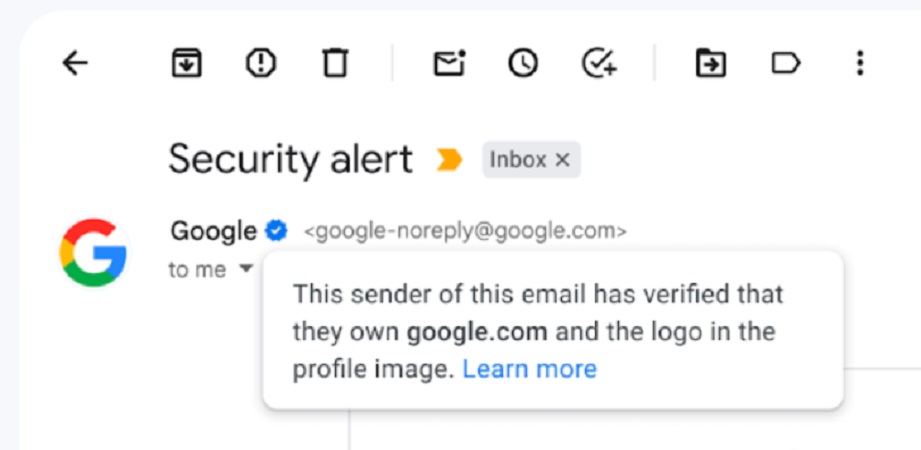

Google via Twitter advised users to look out for the blue checkmark next to a company’s name in their emails to make sure they’re the real deal before they respond. It is worth noting that once users hover over the blue checkmark next to a sender’s name, they will see a blurb that says “the sender of this email has verified” that they own the domain and logo in the profile image.

The tech giant revealed that this strong email authentication feature was rolled out to help users and email security systems identify and stop spam, and also enables senders to leverage their brand trust. The company also disclosed that this will increase confidence in email sources and give readers an immersive experience, creating a better email ecosystem for everyone.

This feature which has started rolling out is available to all Google Workspace customers, as well as legacy G Suite Basic and Business customers. It is also available to users with personal Google accounts. Google’s introduction of Blue Checkmarks for Gmail accounts is coming at an interesting time, with the rise of ubiquitous Email scams especially in the wake of ChatGPT, which can pose a serious threat to online safety.

These scams are often hard to trick people into revealing sensitive financial information by responding to messages or clicking on links, which leads to loss of money. Now with the introduction of blue check marks, users will be very of divulging vital information to accounts without it.

Google joins the like of Twitter, YouTube, and Pinterest, which are using Blue Checkmarks to authenticate users. Recall that in March this year, Meta also launched paid verification check marks as well as LinkedIn with the introduction of verification badges. It wouldn’t come as a surprise if more companies jump on the trend of verification checkmarks to ensure the highest level of trust is maintained with customers.