A few days ago the CEO of P2P platform Paxful, Ray Youssef, announced the suspension of the platform for an indefinite period. The exact reason for the closure is unknown, but the CEO cited an unfavorable regulatory climate in the United States and the departure of several key employees.

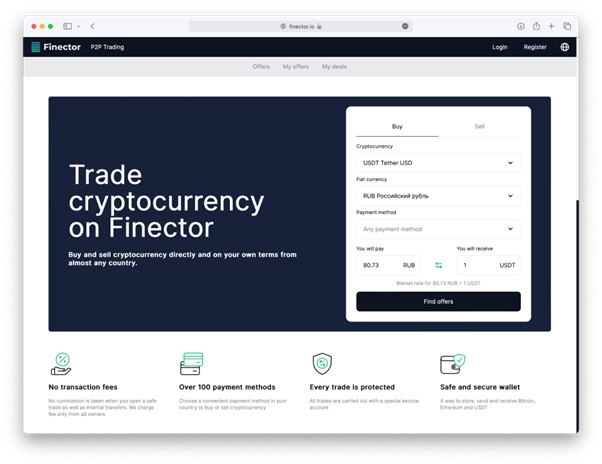

Finector, an international P2P marketplace registered in the global cryptohub, Dubai, was launched not too long ago, in full compliance with local laws.

Finector is developing rapidly and in addition to the already available regions: UAE, Russia, Kazakhstan, Turkey, Georgia, etc., the company begins to provide services in the African region in such countries as Nigeria, Ghana, Kenya, South Africa, Cameroon and Ethiopia.

What does Finector offer?

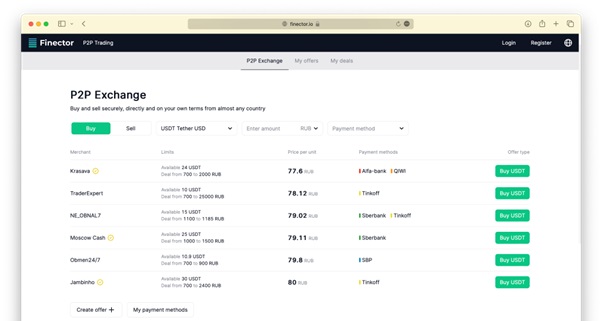

To buy cryptocurrency on the platform, you need to register on Finector and choose the best offer from all the available offers. Then, you need to make a payment to the seller using the method of your choice. After completing the fiat transaction and confirming the payment on the platform, the buyer receives a cryptocurrency transfer from the seller.

Key features of Finector P2P:

- No commissions. The platform has no commissions for both buyers and sellers on existing listings. For merchants it is 0.5%.

- More than 100 payment methods. Users can choose the most convenient payment format depending on location and available options. The payment through payment systems, bank transfers and cash is supported.

The platform works with the major popular global payment systems, as well as Nigeria (NGN), Kenya (KES), South Africa (ZAR), Cameroon (XAF), Ethiopia (ETB) payment methods.

- Notifications. You can connect Telegram and email in your profile and receive notifications of deals. This is very convenient because you do not need to sit in front of the monitor all the time and wait for the deal.

- Secure trades. The platform has implemented an escrow system – at the time of placing an offer, the amount of cryptocurrency specified in the offer is automatically reserved on the seller’s P2P wallet. If the merchant fails to transfer the cryptocurrency purchased by the buyer, the support staff will send the reserved cryptocurrency to the customer’s wallet themselves. This system prevents theft and fraud.

- P2P Wallet. On the platform you can store, send and receive cryptocurrency through an internal wallet. Cryptocurrency bought on the platform is credited to the wallet, from where it can be withdrawn to third-party addresses. To sell cryptocurrency, the seller must also first transfer it to a wallet before placing an order.

Selling cryptocurrencies and terms for merchants

Finector provides a platform for secure transactions between buyers and sellers (merchants) – offers to sell cryptocurrency on the platform are posted by other users.

The platform has a user-friendly interface and many ways to pay for the transaction, which creates a stable flow of customers for exchange transactions.

The security of the platform is of great importance for Finector: regular third-party security audits are conducted and a rewards program for finding vulnerabilities is implemented.

Finector invites merchants to register in advance to get an advantage over other merchants.

The main terms of cooperation for merchants on Finector P2P:

- Merchant fee – 0.5%;

- Number of offers – unlimited;

- Money transfers without any limits;

- Availability of referral program;

- Support 24/7.

To become a merchant on Finector P2P, register on the platform and fill in the application to add a merchant to the platform.