Crypto Airdrop is a promotional activity typically performed by blockchain-based startups to help bootstrap a virtual currency project. ENS Probably was the first airdrop that really kicked things off in the land of NFTs. The Ethereum Name Service (ENS) is a distributed, open, and extensible naming system based on the Ethereum blockchain. ENS’s job is to map human-readable names like ‘alice. eth’ to machine-readable identifiers such as Ethereum addresses, other cryptocurrency addresses, content hashes and metadata.

A crypto airdrop is a promotional activity typically performed by blockchain-based startups to help bootstrap a virtual currency project. Its aim is to spread awareness about the cryptocurrency project and to get more people trading in it when it lists on an exchange as an initial coin offering (ICO). (investopedia)

Before the airdrop, most people thought securing a name on the blockchain was reserved for overly passionate ETH maxis, this changed on November 8th 2021. Anyone who registered an ENS domain name before the 31st of October, 2021 was able to claim ENS tokens. The airdrop was worth around six figures depending on your allocation size and exit price— there have been discussions about a second airdrop on their forum.

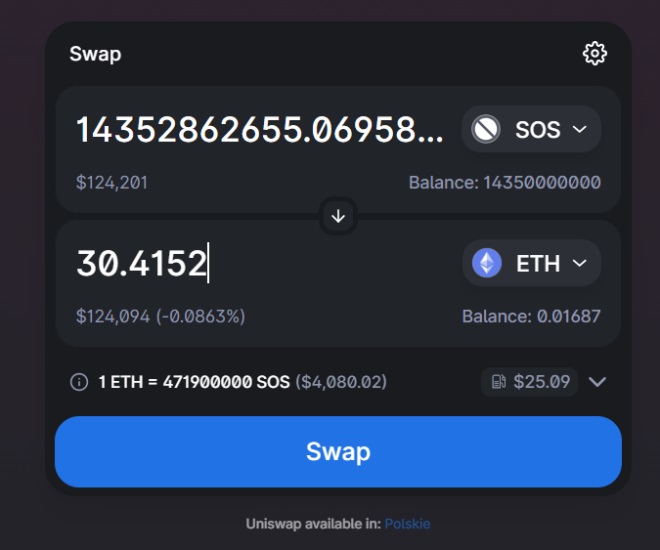

The SOS claim went live on Christmas Day, everyone was talking about it on twitter as it was a much-needed morale boost during a boring time for NFTs. The way it calculated the size of your airdrop was by looking at your Opensea activity.

It took two key metrics into account:

- i) Amount of dollars spent on Opensea

- ii) Number of Opensea transactions

As you can see, for many this was a significant amount of money.

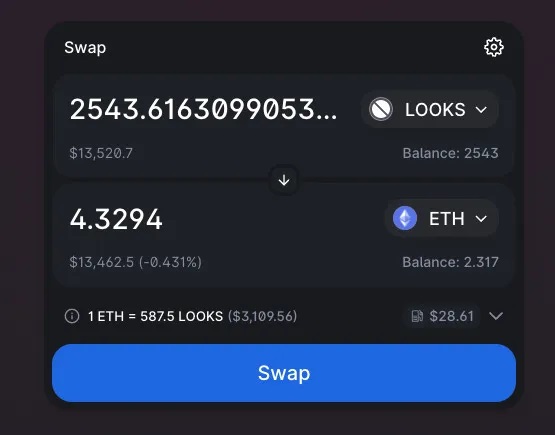

LooksRare was an attempt to take down the 500 pound gorilla in the land of NFTs, Opensea. They came onto the market Jan, 2022 blazing with new features like collection offers and lower marketplace fees.

On top of that, you could also stake your $looks to earn a portion of the platform fees. User, creator and platform incentives aligned, sounds good right. The airdrop’s value wasn’t bad either —Many people received $looks worth north of $10k.

Here’s your 3-step game plan for all future airdrops

i) Airdrops usually peak a few days after release (maybe don’t sell right away)

ii) Airdrops go to 0 long term (don’t hold long term)

iii) Profits are rotated into NFTs (buy NFTs with upcoming catalysts).

As always the most valuable thing you can gain is experience. Take the trade, test every theory and try to learn something each time. Ultimately, developing your gut instinct will be more valuable than anything you have read.