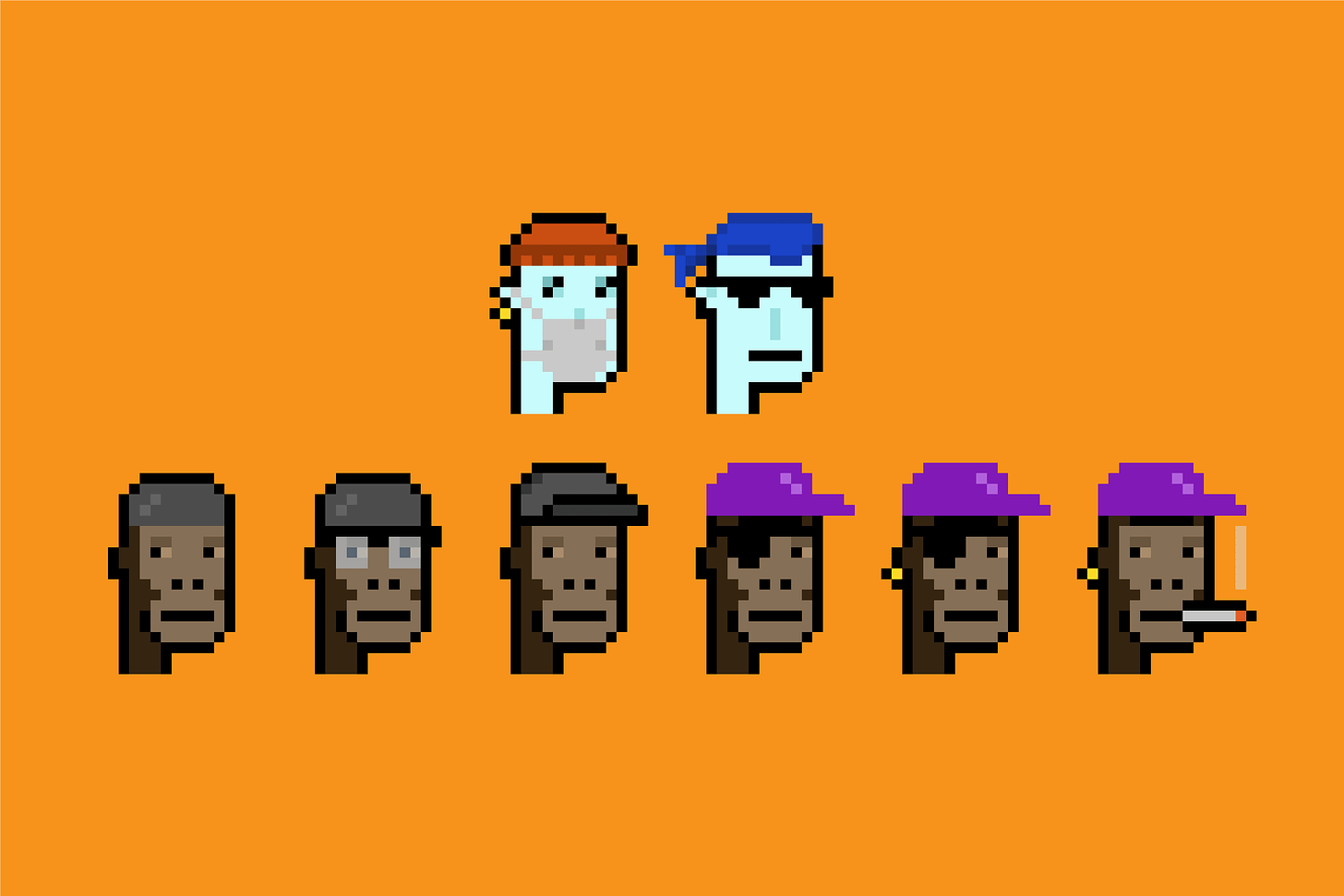

Lately there has been buzz on the Ordinals Bitcoin NFTs. Rodarmor, a prolific blockchain developer created the ‘Ordinals’ on Satoshi script a week ago on the Bitcoin network, presumably many believed Bitcoin is meant for processing payments and not as fungible tokens but through this new discovery, NFTS can now be inscribed on the chain with many notable derivatives such the original CryptoPunks and Bored Apes launching on the Ordinals protocol with high trading volumes, floor and bidding price.

The average price of a floor CryptoPunks NFT on the Ethereum mainnet is around 60 Eth or $90,000 but it is way more expensive on the Bitcoin chain, with Bitcoin Punks trading around six figures as most trades are executed on Spreadsheet via OTC trading.

Interestingly, Leonidas an NFT Historian wrote an extensive Twitter thread explaining why he ventured into the Bitcoin NFTs narrative and what prompted him in spending 3.2 BTC (45 ETH) or $73,600 on Bitcoin Jpegs.

To put it simply, I’ve fallen in love with the ordinals protocol. It’s elegant, opinionated, and strives to bring digital objects to Bitcoin in a way that honors its ethos and values. I got to meet the founder back in September and am so proud of him. For those who don’t know, every Bitcoin can be subdivided into 100,000,000 satoshis.

Recently, Rodarmor found a way to associate a unique number with every satoshi so that they can be individually tracked and transferred. Then he took it a step further by developing a method for inscribing arbitrary data onto a satoshi. When you put all of this together it means that you can store any content that you want directly on Bitcoin and then transfer it to others. Want your art on Bitcoin? Just inscribe the JPEG. What about a song? Just inscribe the MP3. A website? Just inscribe the HTML. A video game? No problem, somebody already inscribed a fully functional game of Doom which you can play.

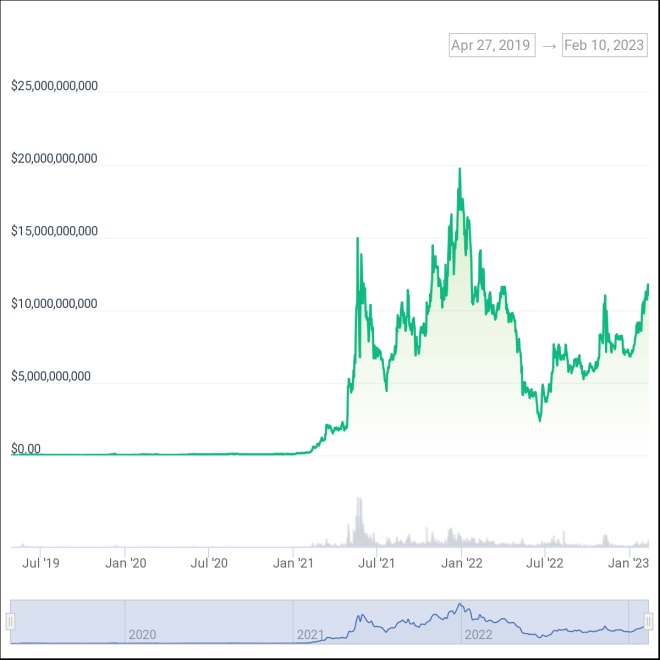

So far there are ~38,000 inscriptions and this number has been roughly doubling every day for the past week. However, interacting with the ordinals protocol is currently cumbersome as you need to run a full Bitcoin node and have minor technical skills.

But this is changing quickly, which is part of the reason why I’m so excited about the future of ordinals. An organic ecosystem is forming and IMO it is inevitable that the infrastructure needed to onboard several orders of magnitude more people will get built out. Explorers, collections, inscription tools, wallets with a GUI (currently only has a CLI), and trustless marketplaces with a GUI (currently all trades are OTC) are all actively being developed.

This brings me to the Bitcoin Punks. As a Historical NFT collector, my thesis is that value will accrue asymmetrically to the collections that are early. I’m not interested because they are punks (they could be anything) rather I care because they are low number inscriptions. Bitcoin Punks are 10,000 of the first 34,400 ordinal inscriptions. As a collector, this narrative resonates strongly with me.

My theory is that the more successful the ordinals protocol becomes, the more inscriptions there will be and thus the more rare and desirable the earliest inscribed collections will become. I think some people are missing the point by paying attention to the art/collection. In the future, quality will matter a lot more, just like it does for Ethereum, however, the ordinals market is currently predicated on low inscriptions having long-term collectible value. I believe that collectors will value the permanence of having art backed up forever to the Bitcoin blockchain, and think the high-end cryptoart market will eventually come to value what the Bitcoin brand adds to a collection but for now it’s all about low inscription numbers.

However, Davis KOL an ardent Bitcoin and Crypto Experimentalist at BasedKarbon, is not really happy with the Bitcoin NFT meta currently buzzing Twitter, he noted Bitcoin NFTs priced in eth, based on eth NFTs, and being wrapped in emblem vaults to sell on opensea has to be the stupidest nft meta we’ve had so far;

Priced in eth and emblem wrapped wouldn’t be that dumb if the projects were original. I’d understand the need to make the experience accessible and familiar. But copies of punks, a ripoff of a failed punk derivative, moonbird, Clones kinda clear which group is doing these gifts.

Bitcoinooooors have spent the last years alternately mocking NFTs and trying to get ETH regulated out of existence ex-post facto as a security, and now they want all the ETH NFT folks to basically seed them on their development of a Bitcoin NFT architecture.