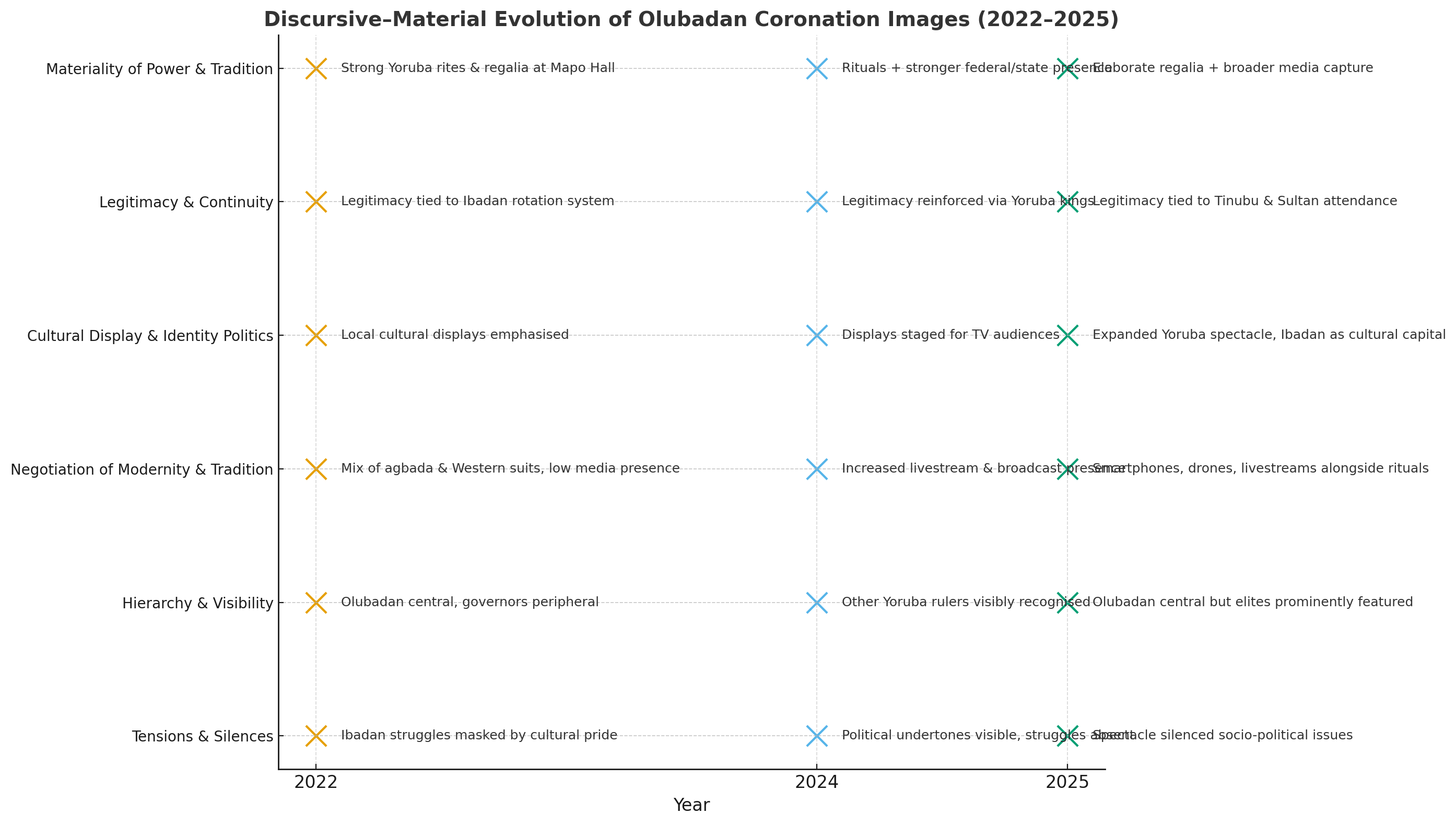

The coronation of an Olubadan is more than a cultural ceremony. It is a moment where tradition, power and identity are staged for local, regional and national audiences. Across the last three successions, the interplay of mediatisation and memorialisation has shifted in striking ways.

Tradition Anchored in 2022

The 2022 coronation of Oba Mohood Olalekan Balogun was steeped in Yoruba tradition and anchored in the symbolism of Mapo Hall. The regalia, staff, and beaded crown materialised the authority of the new Olubadan in ways that signaled continuity with centuries of Ibadan history. This coronation stood out because of its pronounced emphasis on rites that felt local and community-driven. The imagery showed governors and dignitaries in attendance, yet their presence was secondary to the spectacle of Ibadan cultural life.

Performances by drummers and masquerades dominated the memory of the event, asserting the identity of Ibadan in a broader Nigerian context. The mediatisation of the coronation was relatively limited. Coverage circulated mostly through national newspapers and television reports, and there was less evidence of livestreams and digital broadcast. In this sense, the 2022 coronation marked a moment when tradition was firmly at the centre and media served a supporting role. The memorialisation that remains from this coronation is grounded in photographs of regalia, rites and collective cultural expression.

Broader Yoruba Recognition in 2024

Two years later the 2024 coronation of Oba Owolabi Olakulehin moved beyond a local focus. This event distinguished itself through the scale of Yoruba inter-kingdom recognition. The attendance of other Yoruba monarchs, including the Alaafin and Ooni, shifted the discursive framing of the coronation from a purely Ibadan affair to a regional statement of Yoruba solidarity. The imagery was carefully staged for television audiences. Performances were more choreographed and national broadcasters gave extended coverage.

The mediatisation here was therefore stronger, with more households across Nigeria watching the rites unfold in real time. The coronation also stood out because it was a moment of re-assertion of Ibadan’s unique rotational succession system in dialogue with other Yoruba dynasties that are more hereditary. The memory of 2024 is tied to images that captured both ritual and diplomacy. These images remind observers that the Olubadan throne does not exist in isolation but is part of a wider Yoruba political and cultural landscape.

Nationalisation and Political Instrumentalisation in 2025

The 2025 coronation of Oba Rashidi Ladoja was remarkable for its scale, its visibility and its political weight. This event was not only a cultural ceremony but also a national spectacle. President Bola Tinubu attended alongside the Sultan of Sokoto and several governors. The imagery therefore placed the Olubadan within a broader Nigerian political hierarchy. Unlike 2022 or 2024, the Olubadan did not stand visually alone. Instead the coronation images showed shared visibility with national leaders. This altered the symbolic balance of power. The mediatisation of this coronation was the most extensive yet. Smartphones, drones and livestreams carried the ceremony to global audiences.

The city of Ibadan was turned into a stage that reached far beyond Nigeria. This coronation is being memorialised in high resolution images and endless clips across digital platforms. The spectacle overwhelmed ordinary struggles of the city. Poverty, unemployment and governance challenges were silenced in favour of grandeur, heritage and political capital. The event stood out because it transformed the Olubadan throne into a mediated and politicised performance that served local pride while reinforcing national political networks.