Many comments from our LinkedIn community members on my post on how gubernatorial elections in Nigeria are increasingly being decided by judges instead of voters. Like in Imo State where the justices committed a blunder, the Osun State case is another example where justices just invent new legal fudge factors to balance electoral equations:

What is wrong with Nigeria with this tradition that most gubernatorial elections must end with judges. This is repulsive and extremely offensive that at the end, few special men and women, wearing big clothes and well designed white rugs (I come in peace), make these calls. The National Assembly must fix whatever that has made this become a pattern next week. Osun State needs to get back to business over another pause! Mutiu Iyanda, mMBA, ASM shares his perspectives here

As I wrote when INEC called it for PDP in Imo State in 2019, that even INEC was not interpreting the law well; Ihedioha (PDP) scored the highest votes but he did not meet the spread requirement, according to the law. Technically, he ought not to have been declared the winner. Also, during litigation, justices did not consider the absurdity where the new “winner” (Uzodinma, APC) came after total votes became larger than the voting participants.

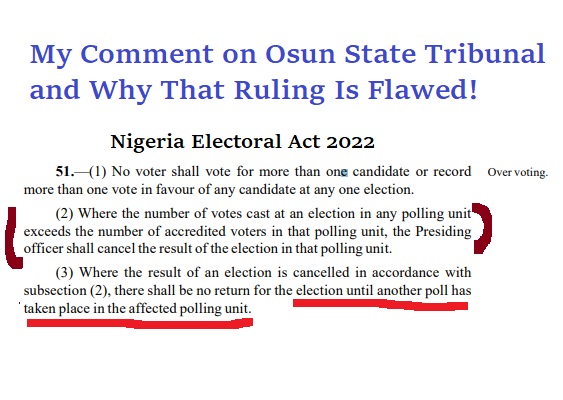

Then Nigeria improved to fix those issues in the Electoral Act, 2022 section 51 (Over-Voting):

51.—(1) No voter shall vote for more than one candidate or record more than one vote in favour of any candidate at any one election.

(2) Where the number of votes cast at an election in any polling unit exceeds the number of accredited voters in that polling unit, the Presiding officer shall cancel the result of the election in that polling unit.

(3) Where the result of an election is cancelled in accordance with subsection (2), there shall be no return for the election until another poll has taken place in the affected polling unit.

My position is that if the judges canceled all the over-votes in Osun based on #2, the law is clear “there shall be no return for the election until another poll has taken place in the affected polling unit.“ As a lay man, what that means is clear: no one is allowed to add and subtract, but rather, ask INEC to do a re-run in those polling units. The judges did not do that.

(INEC possibly had a technical problem which made it impossible to pick an over-voting in the polling units due to inability to reconcile its local and central data, as it argued (believable or not). But irrespective of the decision on the polling unit, once it is established that an over-voting occurred, the remedy is a rerun, and nothing more. You do not cancel, injuring legal votes with no remedy.)

They simply used their calculators to come with new numbers, repeating the mistakes in Imo State by injuring legal votes with no remedy. If we follow this ruling, politicians can push over-voting in opposition strong areas to make sure those units are canceled to give them victories. The law was smart, understanding that politicians could do that, and insisted on reruns. Simple: you cannot just cancel and have new winners.

Finally, I have no interest in who governs Osun State. My position is my unalloyed interest that Nigeria emerges as a better nation by having a predictable legal system on election matters.

That I am an engineer does not mean I cannot read Acts. So, I will not just yield that only judgets have exclusivity on interpreting these Acts.

Premature call

The difference in the post-Tribunal votes was 24,655 (314,921 vs 290,266), after canceling all the over-voting polling units, but the total accredited voters in the affected polling units was 171,386 voters. That should have triggered a re-run in the affected areas since the 171,386 is well above the 24,655 difference. (Download the rulings here and here)

There was large deployment of security operatives across strategic points in Osogbo, Osun State capital, on Friday, as the Election Petitions Tribunal set to deliver its judgement.

Armed police operatives were observed at the Osun State secretariat of the PDP and that of the APC, as well as the state office of the APC presidential campaign in Osogbo.

The road leading to the premises of the Osun State High Court, where the panel would deliver the judgement was blocked to traffic, thus students, workers and others with business along the route had to trek long distances to their destinations.

Delivering the judgement, the Tribunal annulled the result of the July 16 Osun governorship poll.

Justice Tetsea Kume, while delivering a majority decision, declared that INEC did not comply substantially with the constitution and the provisions of the Electoral Act.

He subsequently deducted the over-voting observed from the votes scored by the candidates and declared that Oyetola won the election, having polled 314, 921, while Adeleke’s score came down to 290, 266.

We give credit to some of these judges when day and night, many continue to make calls which confuse common sense. I do not care who becomes the governor of Osun State but I do have interests that Nigeria’s judiciary improves on our electoral matters.

Comment on Feed

Comment 1: Let’s leave judicial matters for the legal luminaries

My Response: “Let’s leave judicial matters for the legal luminaries ” – that is the greatest mistake of any generation. Until ALL judges can rule 100% the same way, we cannot ignore. Because they do not rule alike 100%, they do not have exclusivity of the law. Judges do not write the law, they only interpret and that means, they are not infallible.

Comment 2: Ndubuisi Ekekwe This why why we have Appeal Court and Supreme Court.If a judge in the Tribunal misinterprets the law,all judges up to the Supreme Court will not misinterpret the law.The judiciary should be left to do its duty.

If the judgement had been the other way round the judiciary would have been praised even if there was a misinterpretation of the law.

All humans are biased and all humans are fallible.

My Response: Your assumption is that I care who becomes the governor of Osun. I said for Imo, it was wrong to call PDP the winner. Months later, I also wrote, it was wrong to call APC the winner. I do not care who becomes the governor; I just think we must try to follow the system. Your argument is that we should keep mute where the Tribunal rules Left, Appeal rules Right and Supreme Court rules Center. You think that is normal? I do not agree. This mess has to be fixed and Judiciary needs help because it does not write the law. Why not fix this confusion?