Solana (SOL) is gaining momentum as significant breakthroughs in the cryptocurrency space occur. While gaining momentum, Little Pepe (LILPEPE) aims to enter the top 20 by market size. SOL is on track for $300, and LILPEPE is a meme coin to watch in 2025 due to strong pushes on both sides.

Solana’s Bright Future: $300 Price Goal Amid ETF Hopes and Big Changes

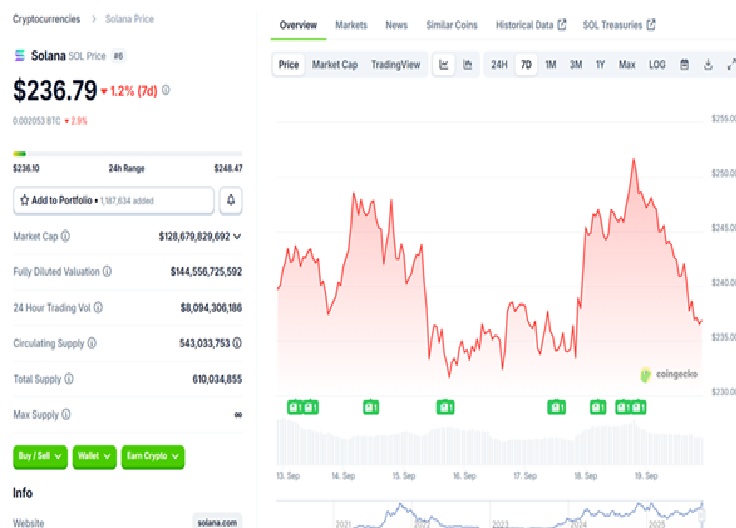

Solana (SOL) has been performing exceptionally well, remaining in the top 10 cryptocurrencies by market capitalization. With several good things coming up, Solana is set to climb higher. Experts believe SOL could reach $300, thanks to key market developments.

SEC clearance of Grayscale’s multi-crypto fund, which contains Solana, is critical for Solana. This is acceptable because it adheres to crypto ETF guidelines and enables large investors to purchase Solana, potentially boosting its price. Solana, in a huge investment fund, may attract more significant players, strengthening it. Additionally, Solmate has launched a $300 million Solana fund in the UAE, backed by Ark Invest. This fund plans to establish a staking setup and expand Solana’s presence in the Middle East, demonstrating that major investors are increasingly confident in Solana. This strategic move is expected to help spread Solana globally and boost its value. Finally, Forward Industries filed a $4 billion stock program to build its Solana fund. This suggests that significant investors are betting on Solana’s future, which is expected to raise the price. With all these factors in play, Solana is well-positioned to reach $300 soon, particularly with rising interest from major investors and network growth driving it forward.

Little Pepe (LILPEPE): Building Speed for a Top 20 Market Cap

While Solana continues to experience rapid growth from major investors, Little Pepe (LILPEPE) is forging its own path to success. This new meme coin is gaining attention for its strong presale results, with $25.9 million raised and 15.9 billion tokens sold to date. Although it’s relatively new, LILPEPE is poised for significant success in the years ahead. A highlight of Little Pepe is its team. LILPEPE has about 41,000 holdings and 30,000 Telegram users. Community-driven projects generally succeed, and the LILPEPE community is keen to grow the coin. Meme coins need this support to generate demand and value. LILPEPE’s token scarcity makes it an appealing investment. Buyers rush for LILPEPE presale tokens due to huge demand. After the presale, the token’s limited quantity will raise its price on open markets. Incredible giveaways have also boosted LILPEPE’s popularity. The $777,000 giveaway awards 10 winners with $77,000 in tokens, ensuring everyone participates. These gifts make people have fun and keep them interested, accelerating coin circulation. Due to its limited supply and demand, strong community support, and large giveaways, LILPEPE is expected to soon burst into the top 20 market cap. Its rapid growth could surpass XRP in 2025, making it a coin to monitor. ? Get your tokens now at littlepepe.com

Solana and Little Pepe: The Future of Crypto?

Both Solana (SOL) and Little Pepe (LILPEPE) have demonstrated impressive speed in the market, but each is taking a distinct growth path. Here’s how each coin shines: Significant investor support, network enhancements, and the introduction of ETF products power Solana’s road. The future looks promising for SOL, with the CME Group launching futures options and major players backing the coin. The ongoing work in the Middle East and the U.S. set Solana up for more growth, with a $300 goal in sight. Little Pepe, on the other hand, is still early on, but its presale wins, growing group, and short-supply demand make it a formidable player for the future. If it continues to build on its speed, LILPEPE could reach the top 20 market cap, offering huge upside for early buyers.

Conclusion: Solana and Little Pepe—Two Coins to Watch

As Solana (SOL) aims for a $300 price goal, driven by ETF hopes and significant investor adoption, Little Pepe (LILPEPE) is quickly gaining momentum, making it one of the hottest meme coins for 2025. With its strong team, short supply demand, and massive giveaways, LILPEPE is poised to soon shake up the top 20 market cap. XRP is a good long-term investment, but Solana and Little Pepe are expected to surpass it by 2030. In the future, Solana and Little Pepe are worth watching for their impressive scalability and rapid expansion, respectively.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken