LensProtocol, the blockchain social media network of lending unit Aave Protocol, has effectively acquired NFT mobile gaming app Sonar. But specifics of Aave’s initially merger have been stored beneath wraps. LensProtocol will integrate with Sonar’s avatar method – emoji “mojis” – to develop a new identity for their metaverse.

Users can accessibility Sonar applying Lens, the ad says. Listed Sonar at this time has twenty,000 month-to-month energetic customers and 1000’s of NFT holders.

Sonar’s NFT has raised a complete of 49 ETH in trading volume considering the fact that its launch in October 2021. This assortment has just more than one, 000 owners as of press time.

As portion of the deal, Sonar executives will “go to” Aave, proceed with the Lens develop crew, and produce other mobile social applications to launch in 2023.

In early May, Aave “ported” Lens Protocol to Polygon, not too long ago unexpectedly suspending the services to handle the higher gasoline tariff challenge on this blockchain. But today’s acquisition will assistance Lens broaden into mobile apps, raising marketplace share for its social media merchandise.

Ben South, Ex-Founder Sonar stated in his tweet on microblogging platform Twitter about the acquisition that; “It became clear to us that all the building blocks to transform the way we connect online are right there on Lens. We’re excited to help figure out the configurations that are approachable and familiar to anyone”.

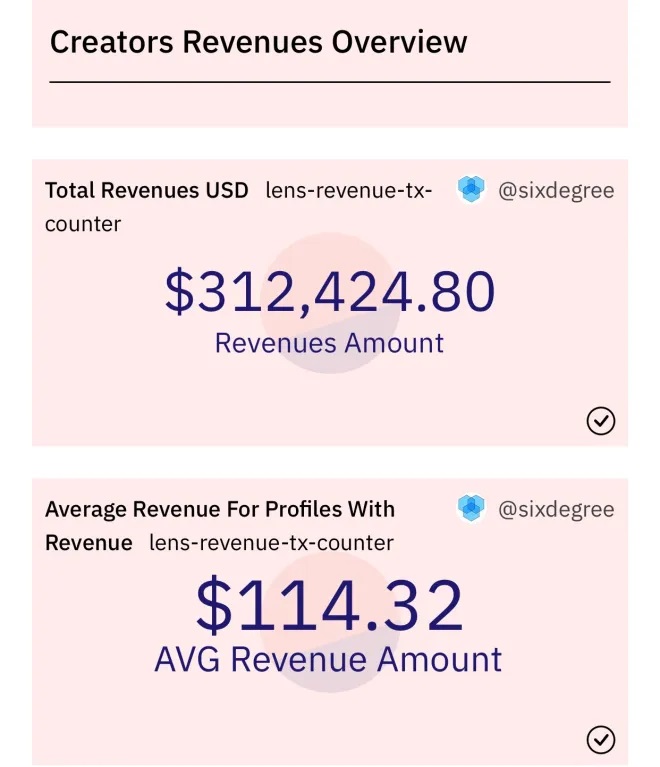

LensProtocol is annexing the Creators Economy into its bidding, Lens user earns an average of $112 through an average of three posts along with mirror and follow revenue. If you have 1k+ followers and 10k+ tweets and are still not getting paid for the cool contents you publish, then you’ll have to switch tent or make reevaluation.

Revenue generated by “Collect Mirrored” is actually shared between the original post creator and mirror user. The referral fees that the mirror user received various on different posts, LensProtocol is less about the platform more about the creator.

Perpetually, LensProtocol lets you plug into a well-connected social graph for any dapp without the need for onboarding users and filling out profiles. The same team behind AaveAave also built Lens. Their goal? To be the last social media handle you’ll ever need.

The ability to easily source a social graph can’t be understated. Users can swap from apps like Lenstubexyz to Lensterxyz and bring all their followers, friends, and posts with them. This will change how we interact with social media as a whole.

LensProtocol also has the power to bootstrap non-social media apps. Web2 apps are forced to build out a social graph. Take Venmo, Spotify, Duolingo for example. Lens can replace all this and let users import their existing social network.