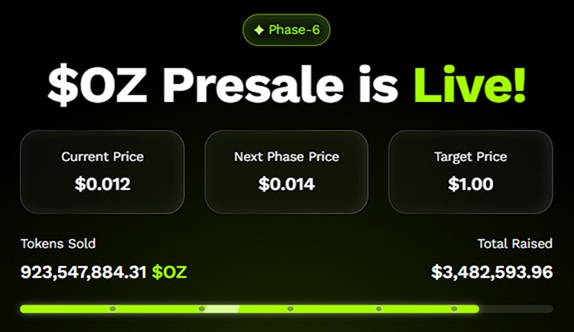

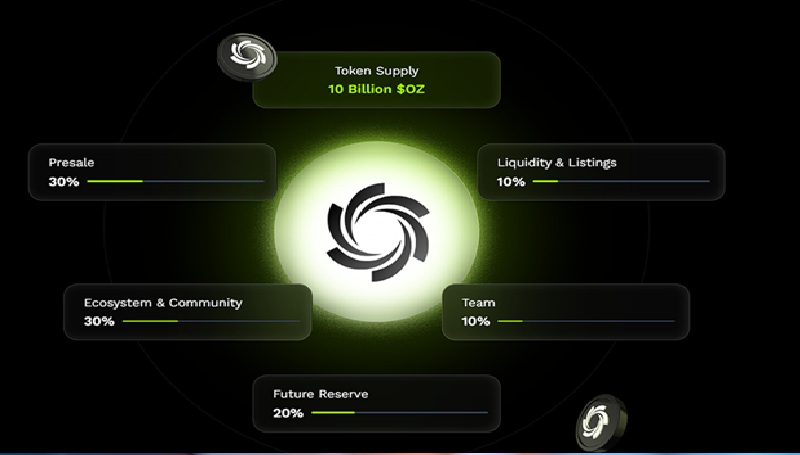

Crypto markets in 2025 are complete of opportunities, but few presales are producing as lots buzz as Ozak AI. Currently in its 6th presale level at $0.012 per token, Ozak AI has already raised greater than $3.4 million and is quickly closing in at the $3.5 million milestone. With over 920 million tokens offered to this point, the project is gaining momentum at a speedy tempo, sparking FOMO amongst each retail investors and whales.

Ozak AI Presale Gaining Unstoppable Traction

The appeal of Ozak AI lies in its perfect timing. The crypto market is already leaning closely into narratives like artificial intelligence, scalability, and cross-chain solutions, and Ozak AI sits at the intersection of all 3. By combining blockchain with AI-powered prediction marketers, the project gives investors more than just a token—it’s building equipment designed to supply real-time insights, actionable facts, and predictive analytics for crypto users and enterprises.

Stage 6 of the OZ presale has seen accelerating demand, with tokens moving quickly as investors recognize the opportunity to lock in early positions before exchange listings. FOMO has intensified in recent weeks, especially as Ozak AI continues to expand its partnerships and strengthen its ecosystem.

Why Ozak AI’s AI Twist Matters

Unlike many projects that use “AI” purely as a buzzword, Ozak AI is actively developing technology with tangible utility. Its prediction agents are designed to process massive data flows and provide instant market signals, helping users make smarter, faster, and more accurate decisions.

This practical application is backed by partnerships with some of the strongest names in the AI-crypto space. Perceptron Network, with its 700,000+ active nodes, gives Ozak AI access to a robust foundation of verified data. Collaboration with HIVE adds ultra-fast 30ms market signals, while SINT brings in cross-chain bridges, SDK development tools, and even voice-driven AI interfaces. Together, these integrations create a unique flywheel of speed, trust, and autonomy, giving Ozak AI a serious edge over other presales.

FOMO Builds on 100x Predictions

What’s driving much of the urgency is the bold prediction that Ozak AI could deliver 100x ROI by 2026. At just $0.012 per token, Ozak AI offers investors an asymmetric opportunity that established cryptos can no longer provide. Analysts suggest that if Ozak AI reaches $1 within the next two years, early investors could see life-changing gains.

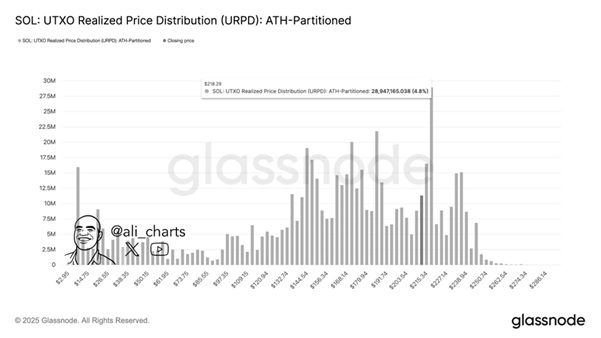

This narrative has resonated strongly, especially when compared to blue chips like Ethereum and Solana. While those coins are strong long-term plays, their upside is measured in multiples rather than exponential jumps. Ozak AI’s small market cap and unique positioning in AI-driven crypto make it a candidate for the kind of breakout run that early investors dream about.

OZ’s Building Trust and Global Recognition

Presales often struggle with credibility, but Ozak AI has worked to establish itself as a serious player. The project has undergone a CertiK audit and completed an internal audit, giving investors added peace of mind. It is also listed on CoinMarketCap and CoinGecko, two essential platforms for transparency and visibility.

On the events front, Ozak AI showcased itself at Coinfest Asia 2025 in Bali, participating in invite-only sessions and collaborating with partners like Manta Network, Coin Kami, Block Bali Com, Forum Crypto Indonesia, and Bitcoin Addict Thailand. These global appearances signal a commitment to long-term growth rather than short-term speculation.

With its presale already surpassing $3.4 million and rapidly approaching $3.5 million, Ozak AI is one of the fastest-growing stories in crypto this year. Stage 6 has unleashed a wave of FOMO as investors scramble to secure tokens at $0.012 before the next stage pushes the price higher.

Backed by strategic partnerships, audited credibility, and a vision that fuses artificial intelligence with blockchain, Ozak AI offers both utility and the potential for explosive gains. If analysts’ predictions hold true, the 100x ROI potential by 2026 could turn today’s presale buyers into the next wave of crypto success stories.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter : https://x.com/ozakagi