Update: This is an update

Original Article

In December last year, an Abuja Federal High Court stopped the attempt by the Department of State Services (DSS), to effect the arrest of central bank governor, Godwin Emefiele.

The DSS had moved for Emefiele’s arrest based on allegations that he’s financing terrorism and that he’d committed other economic crimes, creating a cloud of controversy and a potential threat to Nigeria’s economy.

The move came along with allegations that the central bank governor masterminded the heist that saw N89 trillion stamp duty fund disappear from the government coffers. The allegations triggered a demonstration by a group of protesters who last week demanded the resignation of Emefiele.

Ever since those developments hit the news, the central bank governor has been notably scarce in the public. Emefiele was part of President Muhammadu’s entourage to the US-Africa Summit held in Washington in December, but failed to return to Nigeria after the event.

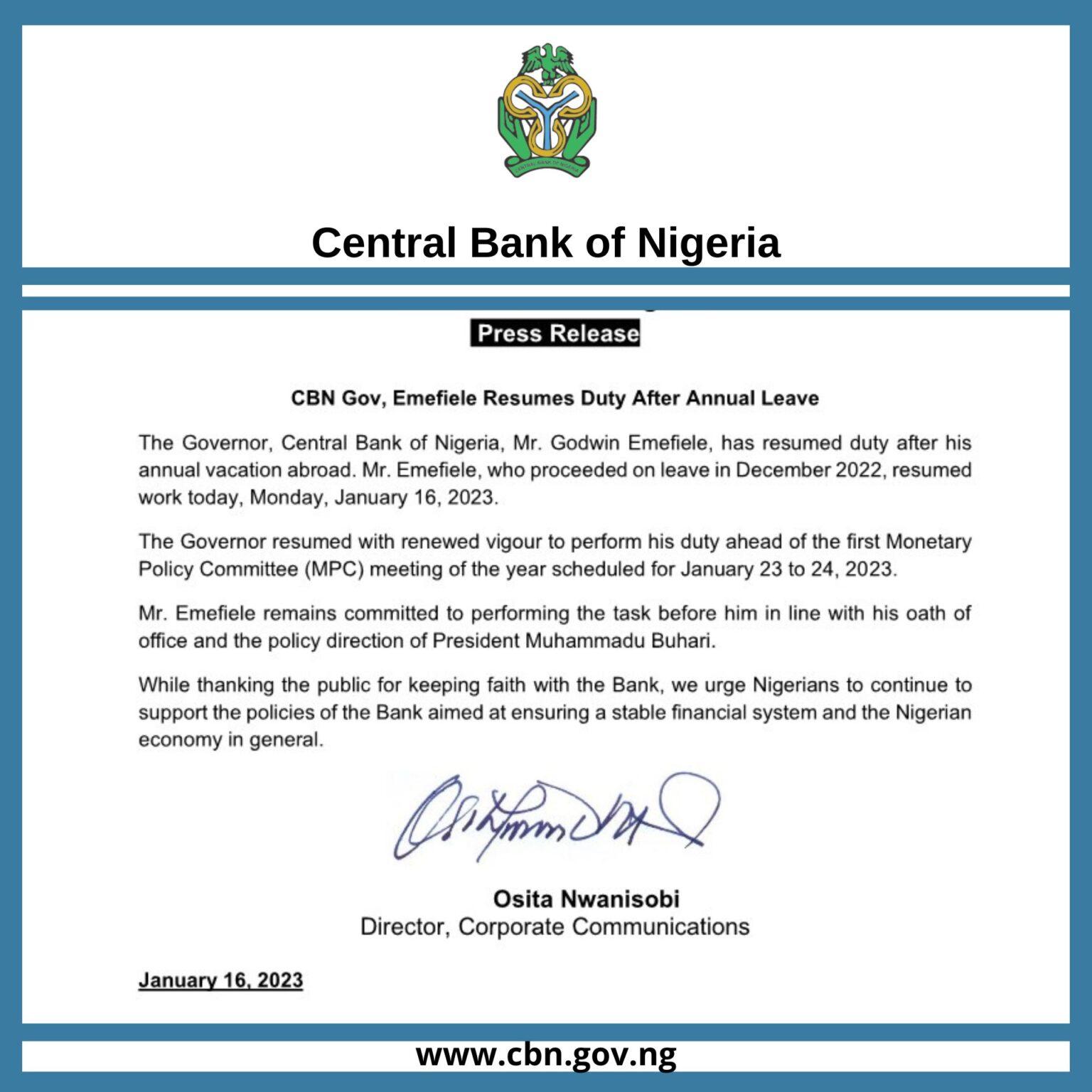

Although there are claims that his disappearance has nothing to do with DSS’ attempt to arrest him, that he’s on his annual leave, Emefiele is due to return to Nigeria to resume work as the head of the Central Bank of Nigeria (CBN). But that has not happened.

On December 24, People’s Gazette reported that the DSS had established a surveillance operation to arrest Emefiele on sight despite the High Court’s order, restraining them from arresting him.

“We have different teams of at least two each monitoring those places. We don’t know if they have more people deployed to even more places, but we did not see any signal from the DG’s office to suggest his involvement at this point,” a DSS source told Peoples Gazette.

Yesterday, the whereabouts of Emefiele was discussed on ChannelsTV’s Sunday Politics, which had rights activist, Femi Falana as a guest. The Senior Advocate of Nigeria (SAN) was generous with words when answering question on Emefiele’s whereabouts. Mr. Falana reechoed what several others have been saying.

“I can say without any fear of contradiction that Mr Godwin Emefiele is not in Nigeria; he hasn’t returned to the country because he has been declared wanted by the state security services,” he said.

But while the DSS has maintained that it is acting based on evidence, a section of Nigerians believe the move to arrest Emefiele is buoyed by the recent CBN policies – the redesign of the naira and the introduction of a new withdrawal limit. These, they believed, have irked state and non-state actors who were counting on the old rules to influence the outcome of the coming election through vote-buying.

In support of that belief, many said that the court had denied the DSS an ex parte order on Emefiele because the service failed to provide any evidence to back up its claims. Falana said if there was evidence, the DSS doesn’t need a court order to effect an arrest on any Nigerian who is not protected by immunity.

“If you have the evidence that he has committed the offence alleged, you don’t need a court order to arrest him and that is the law. And by the way, no court in Nigeria or anyway has the power to confer immunity on any citizen… If you are not one of the 74 people who are entitled to immunity in Nigeria; that is the President, the Vice President, the governors, and deputy governors, no other person can enjoy immunity,” he said.

However, while the burden of proof rests on the DSS, the CBN governor, who is seen to have over time created for himself an imbroglio reputation by indulging in illegalities, has not utter a word on the matter. Emefiele openly moved to run for president last year, and has over the last five years, printed more than N22 trillion in Ways and Means loan to the federal government. All in violation of existing laws, which consequently created an image of someone who is capable of committing serious crimes for the governor.

Read also: Emefiele: The Baffling Audacity of A Partisan Central Bank Governor

Against this backdrop, Nigerians are divided on what to believe as the DSS has also been caught several times overstepping its bounds working for vested interests.

However, Emefiele’s refusal to return to Nigeria has been given different interpretations. While many believe it is because he has a case to answer, others say he is trying to avoid being humiliated by a possible arrest given his position as the central bank governor.

BusinessDay quoted a well-connected government source as saying that “there is a deal that will allow the governor to return this week without arrest, but he will be presented with evidence of the allegations against him, and thereafter it is expected he will resign.”

On the other hand, Falana believed the DSS doesn’t have to wait for Emefiele’s return to file charges against him if he has committed a crime.

“So, you can’t say don’t arrest a citizen if there is reasonable suspicion that he has committed an offence. So, I expect the State Security Service to come out with the allegations, and if Mr Emefiele is not going to return to the country, file a charge in the Federal High Court so that he can get his lawyers, and prepare his defense,” he said.

Nigeria is a country where rule of law is not diligently followed. And based on the relationship between Buhari and Emefiele, which is largely believed to be hanging on quid pro quo, Nigerians appear not surprised by what is playing out. Emefiele has repeatedly said he has Buhari’s backing in major decisions he has made.