As the crypto market prepares for the upcoming “uptober” rally, certain coins are showing potential for strong gains. Analysts forecast that the value of Ripple could soar to the $4.00 mark.

Meanwhile, Binance Coin is expected to rise to $1,500. Also, analysts say Digitap ($TAP), the growing presale sensation, could soar by 5x, giving early investors huge returns. This hidden crypto gem has raised almost $200k in its ongoing presale and is targeting $500k.

XRP Stays Above Key Support, Will XRP Rally or Dip?

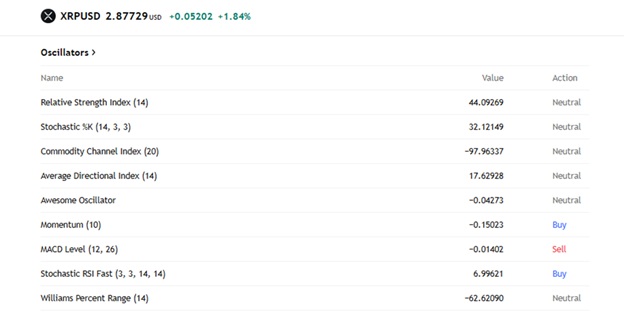

The Ripple price has been testing the $2.80 key support level in the past few days, per CoinMarketCap. However, the overall trend shows bearish momentum, as indicated by the MACD line (-0.01402) being below the signal line, confirming downward pressure.

This is supported by the Awesome Oscillator (AO) at -0.04273 which has negative bars, which means that the selling momentum is more than the buying momentum. A short-term reversal may be feasible in case the Ripple price remains above the level of 2.80.

Nonetheless, the Ripple coin will probably continue to fall if the bearish trend continues. The Ripple price could drop to $2.70 if this bearish sentiment rises.

Maxi forecasts that the Ripple coin could soar to $4.00 in the coming weeks. Another expert, Money Rules, explained on YouTube that the Ripple price pump could make people very rich. He adds that based on a price prediction from BlackRock, the price of Ripple may rally to $32.

Binance Coin (BNB) Shows Resilience: How Long Will It Last?

The Binance Coin token has reclaimed the $1,000 level after bouncing off the $975 support mark. BNB is among the top 10 crypto coins that have weathered the bearish sentiment in the market.

As CoinMarketCap shows, the Binance Coin price has increased by 6.5% on the 7D chart and 16.2% on the 30D level. The price trades above the 20-SMA ($944.06), which is a bullish sign.

On the technical charts, the Bollinger Bands indicate that the price is close to the upper band, which indicates that it may be overbought, yet it can still increase. Also, the Chaikin Money Flow (CMF) at 0.09 indicates positive buying pressure, as the value is above zero.

If BNB holds above the $1,000 mark, further upward movement is likely. ZYN forecasts that the Binance Coin price might pump to $2,000 before the end of this year. Another market watcher, Man of Bitcoin, told his followers that Binance Coin could soar to $1,500.

$BNB has reached the next upside target in wave-3. A local top could be near. pic.twitter.com/H7WLBT0KFq

— Man of Bitcoin (@Manofbitcoin) September 21, 2025

Digitap’s ($TAP) Staking and Rewards: High Returns for Crypto Investors

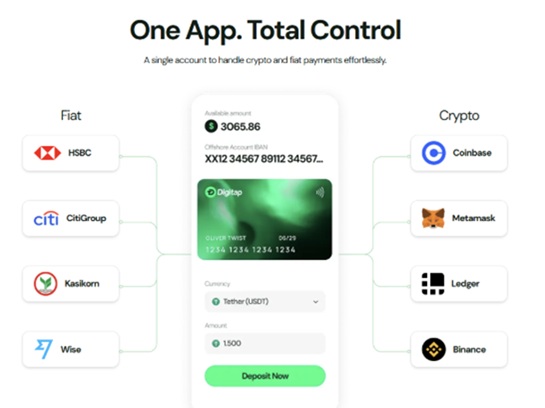

Digitap ($TAP) is the first omni-bank that seeks to make cross-border payments more efficient and cost-effective. This approach could place the project among the highest market holders in the cross-border payment sector, which is expected to hit $290 trillion by 2030.

Unlike traditional platforms, Digitap does not have a KYC procedure. This implies that investors need to enter the platform using just an email and a wallet address. In the meantime, Digitap has been making headlines with its high-yield staking rewards, with up to 124% APR to users who hold its native token, $TAP.

The staking model of DigiTap provides investors with a clear incentive to retain their tokens, which will generate passive income and may increase in value. In addition, the staking rewards are supported by a deflationary model, in which transaction fees purchase back and burn $TAP tokens, decreasing supply as time passes.

This strategy positions DigiTap for potential long-term growth, aligning with its vision of becoming a major player in the cross-border payments sector.

Can Digitap Challenge the Best Altcoins?

Digitap’s $TAP token offers a new opportunity with substantial upside potential. With its $290 trillion market at its feet, Digitap has ample room for growth when compared to Ripple or Binance Coin.

If Aster, a recent crypto that hit $2 billion in market cap within just a week, can achieve such rapid growth, Digitap, entering an even bigger market with strong early traction and a lower entry point, it could mirror similar success.

In a bullish scenario, Digitap could soar by 5x in the short term and 10x in the long run. The $TAP coin currently trades at $0.0125 with $190k in funding. As demand for decentralized, low-fee transactions continues to rise, $TAP is one of the best cryptos to buy now and a strong contender for 2025.

USE THE CODE “DIGITAP15” FOR 15% OFF FIRST-TIME PURCHASES

What Are the Best Cryptocurrencies To Invest In Before Uptober

As Uptober draws near, Ripple, Binance Coin, and Digitap have emerged among the altcoins that are expected to see huge growth. While Ripple eyes $4, Binance Coin is targeting $1,500. Analysts expect the utility-driven Digitap to see up to a 5x increase, positioning among the top 10 cryptos to buy now.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.Digitap.app

Social: https://linktr.ee/DigiTap.app

Meta Title: Ripple Price Forecast, Binance Coin Targets $1,500, DigiTap Eyes 5x ROI

Meta Description: Ripple aims for a $4.00 target. Meanwhile, Binance Coin aims for $1,500 and DigiTap targets a potential 5x ROI, drawing investor attention to high-growth opportunities.