Monty Python Logic

I heard a very bizarre argument recently, about why a Toyota Camry is bad for the environment. It was in a wider debate about different kinds of vehicles and how best to being able to minimize the impact of vehicle use on the environment. The argument made absolutely no sense at all.

It went like this…

Mining Lithium is bad for the environment. The sponsor of this ‘thesis’ evidenced a Lithium mine in Zimbabwe. He began talking about a Hyundai Crawler Excavator in use on one of the sites.

He diverged for some time, choosing to talk about Hyundai excavator manufacture in India (for no clear reason).

He then summed up that since the use of the Hyundai Crawler Excavator in Lithium mining is bad for the environment, then the Hyundai Crawler Excavator is complicit. Feeling energized by making this broad leap, he felt he would not go a leap further.

Since a Hyundai Crawler Excavator is a vehicle, and a Toyota Camry is also a vehicle, then by association, Toyota Camry must be bad for the environment.

This is an argument of ‘Monty Python Logic’

The ‘witch’ scene from Monty Python and the Holy Grail – ‘Monty Python Logic’ at work. We can’t be using Monty Python logic to justify ‘stuff’ as Web 3. Web 3 isn’t a witch hunt. It is not about ducks or pieces of wood or whether things float.

When I think about Web 3, I don’t think about Projects, Products, Companies, or even Blockchain Tokenization. – I think of people.

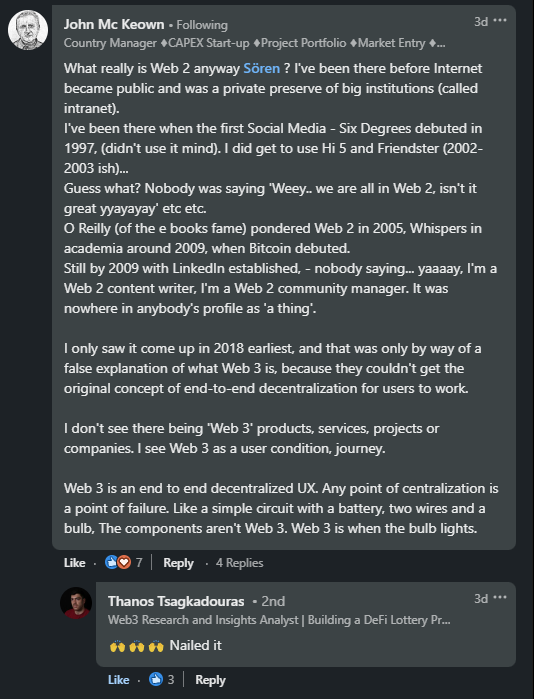

Real Web 3 is a user state, a journey, it is about the live state of people action.

Web 3 is an end-to-end decentralized UX.

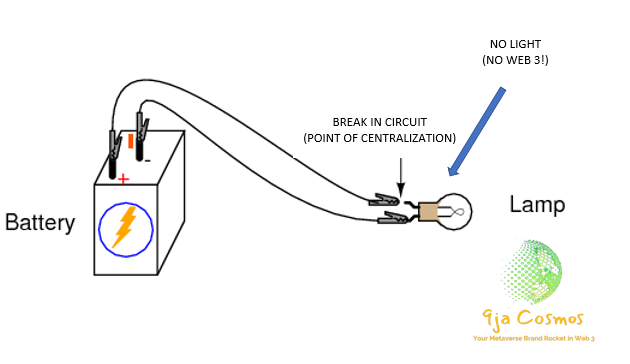

Consider the simple circuit of a battery, two pieces of wire and a bulb.

Imagine it as an ecosystem in which Web 3 may or may not happen.

The magic of Web 3 is when the light is on.

So there are two things that can cause the circuit to not work and for the light to not come on.

- Nobody switches the light on. Since Web 3 is a DECENTRALIZED UX end to end, the ecosystem of products waiting to use them is ‘Web 3 ready; but nobody has come to party. The magic isn’t happening. Its in a passive state of readiness.

- There is a break in the circuit somewhere, something has become centralized somewhere as part of the UX journey so decentralization hasn’t happened end to end, and the bulb fails to light.

The Wire isn’t Web 3. The Battery isn’t Web 3, the bulb or its holder aren’t Web 3. Web 3 is only the state of the light being on. Meaning. Regardless of how many blockchain products or activities are out there… tokenized digital art markets, cryptocurrency markets, immersive services, blockchain gaming….

Absolutely NONE of it is Web 3 if there is no end-to-end DECENTRALIZED UX happening. No amount of Web 3 Delight events is going to change this reality.

Can you have Web 3 happening without blockchain?

I was recently asked this question in a 1-2-1 Zoom session and my immediate impulse was to answer no, but then I began to think about it. The development of blockchain can certainly be categorized as a STEM (Science, Technology, Engineering, Mathematics) evolution. Once upon a time, we had the law of conservation of matter. ’Matter cannot be created or destroyed, it can only change its form’.

We knew of two ways we could get energy from matter.

Firstly, physical change – the three states of matter – solid, liquid and gas. The first being the lowest energy state, with the last being the highest energy state. Kinetic energy is released when a substance changes from gas to liquid, or from liquid to solid.

Secondly, chemical change – there are higher energy and lower energy elements and compounds. Under the conditions that support a chemical reaction, some reactions are endothermic (need an input of kinetic energy to happen), while others are exothermic (give out kinetic energy when they happen).

This held true until in 1916, a dude named Albert Einstein created the equation E=MC2 We then had Rutherford bombard atoms in Manchester in 1917 getting them to release sub atomic energy, and we had Cockcroft and Walton split the atom in 1932.

The original law had to be changed with the word ‘Matter’ being replaced with the word ‘Energy’.

So now, we know we are in a completely new era, the dawn of Nuclear Fission. An air of finality descended on human kind. Nowhere to go next, right? Wrong.

Then came a new branch of atomic energy called Nuclear Fusion. In Nuclear Fusion, unlike splitting atoms, atoms are forced to join together. The energy released by fusion is three to four times greater than the energy released by fission.

At the moment, we have moved the needle into the atomic level of Web. We have not found ‘Web Fusion’ yet.

Will the next evolutionary iteration of seeking to achieve an end-to-end DECENTRALIZED UX involve a solution that doesn’t need blockchains? Who knows. But with current technology, it is not possible to achieve Web 3 without leveraging blockchains.

The demise of ‘fake’ Web 3 and Cryptocurrency have an infection of Centralization as a common problem.

I won’t go into long tirades about FTX and Luna… I think most everybody else have pretty much flogged those topics to death, but simply quote from the Financial Times:

..Today’s upheaval bears all the hallmarks of precisely the failings that the (blockchain) industry’s early proponents railed against….

…many supposedly decentralised protocols turn out to be highly concentrated in terms of who actually governs and controls things. Often, it is the founder and a small number of venture capital backers that are in charge — as evidenced by the implosion of the Terra stablecoin in May. In most instances, crypto is decentralised in name only.

Second, centralised intermediaries, such as Sam Bankman-Fried’s FTX, play a pivotal role as the gateway into the crypto world from the conventional financial system. They channel the flow of new investors, which is the oxygen that keeps these speculative dynamics alive. BIS research in this area has highlighted how crypto only really works when this is happening. To the extent that recruiting new investors is key to the survival of crypto, centralised intermediaries are crucial to propping up the edifice.’

Parallel to this, in blockchain assets that are not cryptocurrency, these centralized intermediaries are replaced by things like ICANN type websites, identity mapping, carrier and mobile phone scraping front ends, and off chain data (particularly in the Ethereum ecosystem) saved in L2s, scaling solutions and EVMs.

We do not have an end-to-end decentralized UX, and we do not have Web 3. Irrespective of there being blockchain products and services in the mix or not, we have an infection of CENTRALIZATION.

Conclusion:

‘Fake Web 3’ revolves around Projects, Events, Companies, Pod Casts, Service Categories, Community Management, Products, Graphic Design, Content Writing… etc etc etc… but none of these in of themselves can be considered ‘Web 3’

Some of them can enable Web 3, or be considered Web 3 ready or…

But Real Web 3 is an end-to-end DECENTRALIZED UX

Just like the light bulb circuit, any break in decentralization is a point of (Web 3) failure. Therefore no single enabling component on the journey can be considered, in itself ‘Web 3’

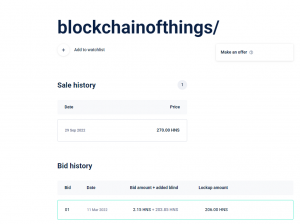

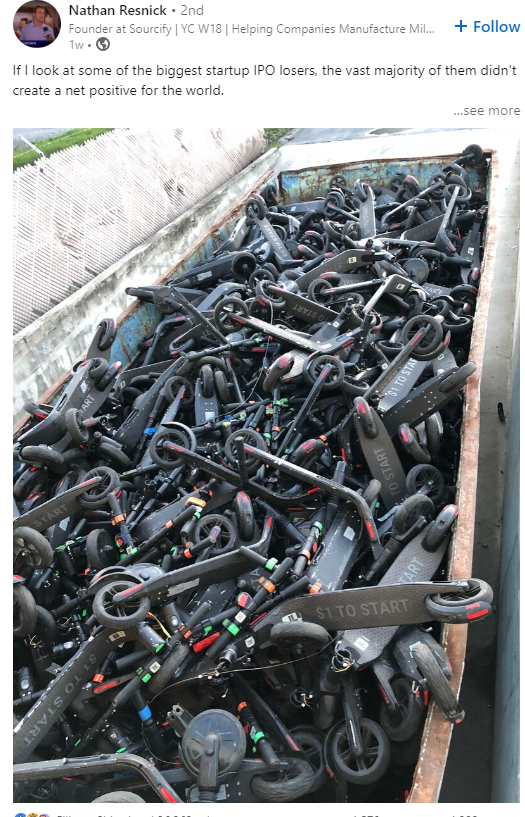

We still have time to reposition our consideration of what Web 3 really is. It is not too late. If we continue to allow centralization to masquerade as Web 3 we may end up with projects like this:

Time to shine the light!

9ja Cosmos is here… Get your .9jacom and .9javerse Web 3 domains for $2 at:

https://www.encirca.com/handshake-9jacom/

https://www.encirca.com/handshake-9javerse/

All references accessed 08-11 Jan 2023. I guarantee this article has been produced 100% Chat GPT free

ft.com/content/76234c49-cb11-4c2a-9a80-49da4f0ad7dd

cerncourier.com/a/cockcrofts-subatomic-legacy-splitting-the-atom

diffen.com/difference/Nuclear_Fission_vs_Nuclear_Fusion

LinkedIn content recognition (in order of appearance): Henry Otali Nduka Jehu Oreri Thanos Tsagkadouras Tiago Amaral Peter Holzer Nathan Resnick