In secondary school economics, they taught us the doctrine of specialization and core competencies. The wisdom was simple: find what you do well, sharpen it, and dominate your niche. But in today’s digital age, that mantra is being redefined. Technology has altered the cost structures of industries. The barriers to entering new markets are thinner, and firms are no longer confined to narrow lanes.

They taught us in the economics class that companies have to specialize and build core competencies. They need to do things really well and be the best possible in their chosen domains. But today, especially in native tech companies, we think that does not overly make sense as technology has changed the cost of entering into new domains.

For technology companies, everyone is doing everything, even at top-level. Alphabet, Google parent company, is a car company, a search company, a medical company, an advertising juggernaut, fintech, etc. Amazon.com is an e-commerce firm, a publisher, a movie producer, a drone maker, and pharmacy chain.

Native technology companies embody this redesign—Google’s Alphabet is simultaneously a car company, an advertising titan, a health player, and a fintech. Amazon, from humble bookseller, is now a publisher, a studio, a logistics empire, and even a pharmacy. The new orthodoxy is this: in the digital economy, boundaries blur.

Indeed, when you examine IBM, the question is not what it does, but what it does not do. With Watson branching into finance, health, real estate, and beyond, “core competency” looks more like an expansive ecosystem of adjacencies. Yes, the economics of scope, and not just the economics of scale, is the playbook.

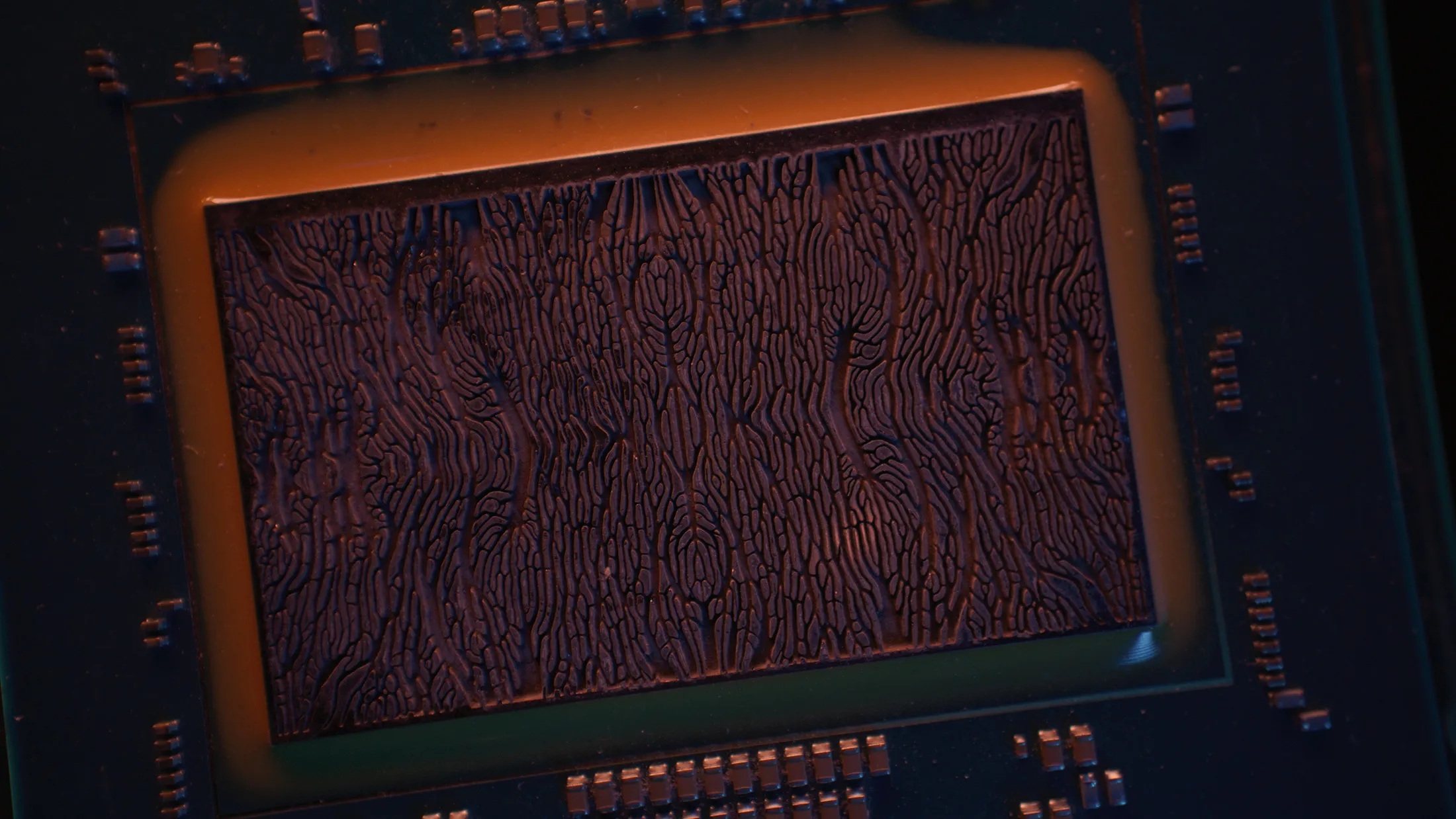

It is within this construct that Microsoft is pioneering new possibilities—solving problems not just in software but in the physics of silicon itself. AI workloads are colliding with the thermodynamic limits of chips, and the challenge of heat is real. Microsoft’s introduction of in-chip microfluidic cooling—tiny etched channels bringing coolant directly to the source—demonstrates how firms are redesigning not just markets, but nature’s constraints.

The implications are profound. By cooling chips more efficiently, Microsoft unlocks the promise of denser datacenters, cheaper computation, and new architectures like 3D chip stacking. This is more than engineering; it is strategic advantage in the age of AI.

And as Microsoft signals openness—inviting the world to adopt microfluidics—the lesson deepens: success in modern business is no longer about standing guard over a fortress of one competency. It is about orchestrating systems, shaping ecosystems, and reimagining boundaries. In this era of frenemies and convergence, the most innovative companies are not defined by what they do best, but by what new possibilities they can make feasible. And that connects back to the One Oasis which exists in all great firms

Microsoft Unveils Breakthrough in Chip Cooling to Power the Next Wave of AI