My nickname in the office is “The Investor”. There are many reasons for this; none of which includes me having a US$20 million fund in my name to dole out capital to startups from (or at least not yet).

For the inquisitive, I literally started calling myself “investor” and everyone (my team members specifically) just literally took it up and it became the norm.

Warren Buffet is a great investor and one of the few global figures I look up to. I got interested in Buffet the day I realized that a share at Berkshire Hathaway (his holdings company) was worth hundreds of thousands of dollars (presently worth US$454,280). While you need to be rich to own 1% of most companies and sit on their board, you need to be rich to own one share of Berkshire Hathaway.

Occasionally, when I have the time, I try to listen to his annual briefings, not because I own a share in his business (we are getting there), but primarily to listen to snarky, witty, and outright savage responses from his partner Charlie Munger.

Warren Buffet has many rules for investing, one key one is to never invest in what you don’t understand, and this is where crypto comes in.

I like to start by saying I do not trade cryptocurrencies (or at least not yet). While I understand how blockchains work, the principle behind consensus protocols, SHA 256, etc. I don’t necessarily think I’m knowledgeable enough to put real money into cryptocurrencies and be able to predict its outcome. The fact that a single tweet from Elon Musk can shoot up the price of Dogecoin with no fundamental analysis backing its meteoric rise except the fact that the influential founder of an electric car company can change his name on Twitter to the “The Doge Father” and use a Dogecoin emblem as his profile image is pretty disturbing to me.

However, my cautiousness towards crypto hasn’t always been beneficiary. A former flat-mate of mine shared with me how he had about US$200,000 in Shiba Inu during the impeccable 2021 crypto market bull run before the market depressed and he had to off-ramp at US$70,000. He still feels hurt that he could have gotten more money out than he eventually did. The last time we talked he was sharing with me how he planned to buy a Mercedes Benz E350, while I’m planning to buy a N450,000 (US$1,000) Oculus Quest 2 VR headset amongst other things. Moral of the story: cautiousness doesn’t always pay :(

CRYPTO, TECH AND 2022

2022 has been an interesting year for African tech so far. This was the year of reckoning for startups raising money without a working business model, product-market fit, and/or even product solution fit. Global macro economical and geopolitical issues meant that investors held their purses tighter and were more than willing to drag founders who wanted to play games with them. It also meant companies without a path to profitability and sustainability had to either find one in time, furlough staff, or go out of business.

A couple of normal expected things also happened; digital payments volume (NIP) so far is up 49% YoY from November 2021 to November 2022, and those who believed MoMo PSB would “destroy all the fintechs in Nigeria” (whatever that was supposed to mean), were shocked that didn’t occur, and would probably be surprised to know that as of September 2022, MTN MoMo had about N1.745 billion (US$3.9m) in customer deposits and 1.8 million active MoMo wallets in Nigeria indicating an average user account balance value of N969 (US$2.18). For context purposes, Fidelity Bank, a licensed Tier 2 DMB in Nigeria had an average user account balance value of N277,700 (US$623).

While Crypto still remained a touch-not by commercial banks in Nigeria, and those who tried to test the school teacher (CBN) got beaten with a big stick, crypto transactions have continued to grow especially via P2P channels where the regulator has little or no visibility into.

The CBN launched its CBDC (the eNaira) in October of 2021, and shared at its one-year anniversary launch that it had processed more than N8 billion (US$17.9million) in its first year of existence, fintechs like Remita and Flutterwave have already started building propositions around the eNaira, with Remita being the leading fintech in that space making it possible for merchants to receive payments in eNaira and be settled in fiat, onboard eNaira wallets for transactions on the Remita Mobile App, fund eNaira wallets and even process outbound fund transfers to beneficiaries and have them settled in fiat.

However, while the Central Bank has been clear and unflinching on its belligerent perspective towards private cryptocurrencies, there are many reasons to believe that 2023 may be a good year for cryptocurrencies.

REGULATORY SIGNALS FROM POLICYMAKERS

The first real indicator of a change of heart this year was the Finance Bill the Minister of Finance, Budget and National Planning shared with the FEC (Federal Executive Council) in December of 2022. Amongst the plethora of proposed changes was the proposal to tax digital currencies. The eNaira is a Central Bank Digital Currency and has no speculative value, so there is no “taxable potential” there. The only taxable cryptocurrencies are the speculative ones i.e Bitcoin, Ether, Shiba Inu, etc. and the only way to tax them is to make them legal.

The Finance Bill is a document that passes through a lot of stakeholders, and I imagine the CBN has some input in it. This is majorly speculation by the way and may have just been an oversight by an excited Youth Corper helping his boss at the Ministry of Finance draft out a document.

Another reason crypto may take a different turn in 2023 is the recently released PSV 2025 document by the CBN.

The PSV 2025 document is an 83-page policy document released by the CBN detailing the payment system vision plan for Nigeria by 2025. This document is a follow-up to the PSV 2020 plan. The PSV 2025 document lists thirteen recommendations by the CBN to bolster digital payment adoption in Nigeria. Interesting to note that of these thirteen recommendations, three were direct blockchain initiatives with the CBN indicating it would “consider the development of a regulatory framework for potential implementation of ‘Stable Coin”.

While the PSV 2025 isn’t about crypto primarily, the purpose of this piece is to highlight opportunities for crypto usage that may find expression in 2023 based on what the CBN is willing to be lenient about.

CROSS-BORDER TRANSACTIONS VIA CRYPTO

Hedging against inflation is a key reason people invest in cryptocurrencies. Another strong use case for crypto is cross-border transactions and remittances where bitcoin (or any other crypto) is used as a middle currency to facilitate the conversion between two currencies. Crypto fintech Hellicarrier (formerly BuyCoins) was a pioneer of this approach to remittances.

Cross-border trade and payments between African countries are a mess. In fact, cross-border trade generally is a friction-filled market that has loads of opportunities for disruption. Union54’s partnership with MasterCard that allows other fintech company’s issue virtual dollar cards to their customers for foreign purchases in US Dollars (albeit at black market prices) via Union54’s API has solved a significant problem in this space. VISA also has a similar proposition it extends to fintechs.

However, cross-border payments between African countries are an exceptionally friction-filled process. Here’s how it works; Assuming you want to send money to someone in Kenya from Nigeria, and you bank with Bank A in Nigeria while the beneficiary banks with say Bank B in Kenya, That process will involve Bank A debiting your dorm account to secure funds and passing it through Swift to Bank B in Kenya.

This is a friction-filled process that takes time, and the number of participants also makes it an expensive process with trade between African countries costing Africans US$5 billion in money transfer charges every year.

To solve this problem, some African countries have built regional payment systems that make it possible for these transactions to occur by placing participating banks and financial institutions on the same payment network, thereby reducing the need for a third-party currency (usually the US Dollar) for settlement.

PAPSS led by Afrieximbank is an Africa-wide initiative designed to solve this problem. With PAPSS, Central Banks and their participating banks (termed Direct Participants) are onboarded and integrated into the PAPSS platform. Direct participants are required to pre-fund an account with PAPSS to enable direct instant payment between participating banks without the need for the US Dollar for settlement.

While PAPSS is a unique and revolutionary infrastructure, there is a crypto perspective to this, where AfriEximBank can issue a stablecoin (or in better words, a Wholesale Central Bank Digital Currency) that can be used as a third currency for settlement. Imagine this wholesale CBDC is called “AfriCoin” and is hedged to the US Dollar (not pegged to the US Dollar, of which AfriEximBank would have to hold the US Dollar equivalent of its AfriCoin holding).

All participating banks will be required to pre-fund with their local currencies and be issued an equivalent amount of “AfriCoin” in their settlement accounts with AfriEximBank. When a customer of Bank A in Nigeria wants to send money to a customer of Bank B in Kenya, the first step will be to debit the customer of Bank A and immediately pass information through AfriEximBank to Bank B in Kenya that funds have been secured, Bank B in Kenya will accordingly make funds available to the beneficiary in Kenya in Kenya Shillings. At the end of the day (or at settlement time) Bank A’s position at AfriEximBank will be debited of AfriCoin to settle Bank B’s position. A simple net settlement and everyone goes home happy. In the unlikely situation of a participating bank deciding to leave the network, its AfriCoin value can be converted back to its local currency and returned to it.

Settlement via crypto or a wholesale CBDC is a strong proposition to empower cross-border African trade, and one that may likely see some headway in 2023 since fintechs like Zone are already towing this path, even though I feel an initiative like this may be more successful if led by a consortium of Central Banks and/or an Afrieximbank as against a fintech.

THE POTENTIAL OF ICOs

The first time I heard of a crypto rug pull was in 2018 with ICOs. For the uninitiated, ICO is short for Initial Coin Offering; a system of raising capital by issuing tokens to the public in exchange for real money or more stable cryptocurrencies like Bitcoin, Ether, or even USDC.

ICOs are like IPOs except there are unregulated and instead of getting shares you get tokens (and you can lose all your invested money and have nobody to hold).

The Ether project (Ethereum) started with an ICO that raised 31,000 BTC (US$18.3 million as at the time) in 2014 before ICOs eventually went mainstream in 2017.

A couple of Nigerian companies also hopped on the ICO bandwagon in 2018 with KoraPay reportedly raising US$12 million in an ICO in 2018, while SureRemit raised US$7 million to roll out its digital voucher system. Most ICOs ended up as scam projects. So people are generally wary of them.

Everything is agenda and competition.

Korapay raised $12million in ICO

CEO Dickson Nsofor – CU alumni https://t.co/deZ27KXYNc— Lanre X Sonde (@LanreSonde) October 16, 2020

However, the potential of ICOs even in Nigeria is phenomenal especially if the tokens issued are Utility tokens. Here is an example: Imagine a community wants to build a road but the government has refused to support the project, the community could raise an ICO with each participating investor getting a utility token for their investment. When the road is ready, a tollgate can be set up for fee collection. The only way to pass that gate will be via the utility token issued to early investors in the project. This means that investors will not only have free access due to their utility tokens, they will also be able to sell those Tokens to people interested in plying that road at a decent markup to realize their original investment in the project. This opens up a lot of investment opportunities and development opportunities for local communities and can be a revolutionary use case for ICOs.

P.S: I am not ignorant of the fact that local communities in Nigeria may not have the infrastructure required to access digital tokens, nothing stopping them from investing via an intermediary (an agent network, etc.) and receiving those tokens the same way airtime vouchers are distributed (paper slips). There can also be provisions for original utility token investors to have lifetime access depending on how such a system is designed.

CAN STABLECOINS CURB DOLLAR-INDUCED INFLATION

One of the stand-out recommendations from CBNs PSV 2025 document was to “consider the development of a regulatory framework for potential implementation of ‘Stable Coin”.

Regardless of what anyone says, a key goal of the present CBN administration is to control the exchange rate. A bunch of initiatives have been embarked upon to achieve this including banning BDC operators, incentivizing exporters via its RT200 non-export proceeds repatriation program, and even its “Naira 4 Dollar” scheme to incentivize remittances through official channels. However, demand for the US Dollar has continued to skyrocket with the US Dollar exchanging on the black market for N748 per US$1 as of the time of writing this.

The first thing to understand is that dollar scarcity is a Nigerian (and possibly African) problem, not a global problem. USDC is a stablecoin pegged 1:1 with the US dollar and may be a potential solution to this. While the US Dollar is scarce in Nigeria, this isn’t the case in other countries. A system where instead of issuing people the US Dollar, you issue them USDC that can then be converted to USD in the country the beneficiary wants to spend that money may be of high value.

Since USDC is being issued to the customer in Nigeria, there is less pressure on the real US Dollar and since demand for US Dollars in the beneficiary’s country isn’t high, the beneficiary may find it easier to convert USDC to real US dollars for spending.

While the market cap for USDC is about US$44.9 billion and may not be sufficient to solve Nigeria’s FOREX problem, considering Nigerians spent US$11.6bn in three years on education alone. it may be a step in the right direction, or at least a sector-focused proposition for a fintech to take on.

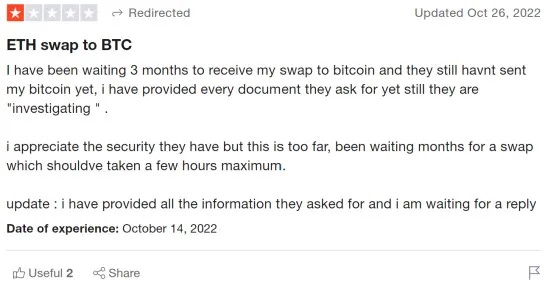

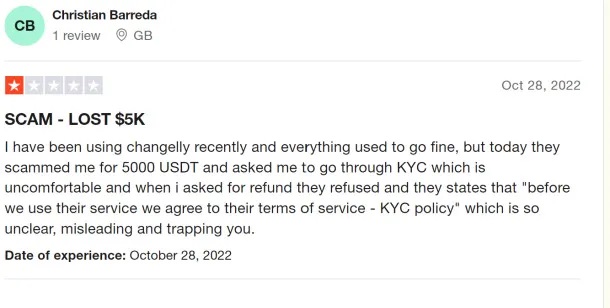

REGULATE THE EXCHANGES

The FTX debacle was a major blow in the face of all crypto supporters globally. Even Asemota acknowledged that in a tweet. Prior to the FTX debacle, the SEC was amongst the few (if not the only) Nigerian regulator with an accommodating view of crypto. They had issued a regulatory document on that wise, however, after the FTX debacle, they did an about-turn and retracted their support for “Digital Currencies” essentially denying their baby.

This is the part that is most painful. Student outreach programs. People running away from devaluation ran into bankruptcy. Imagine if @FTX_Official had been run by a Nigerian and things were in reverse? The uproar would have been unbelievable. I am just livid. https://t.co/l90BzDG82n

— Osaretin Victor Asemota (@asemota) November 11, 2022

While the FTX debacle was no doubt a shame, it is important to note that what happened with FTX and SBF (Sam Bankman-Fried) was more of a corporate governance problem than a crypto problem. SBF could have been the CEO of any company and still been fraudulent, he succeeded with a crypto company because of the presence of little or no regulatory oversight on crypto.

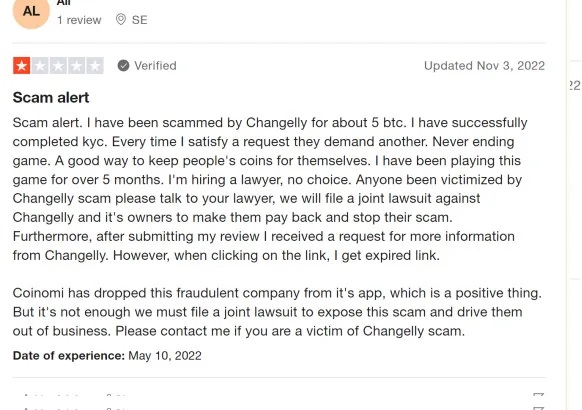

While I will not sound naïve and deny that crypto is not used by unscrupulous entities to perpetrate fraud (the easiest way to move fraud money from a foreign country to Nigeria without being detected is via crypto), crypto still has a legitimate use case that pushes people to embrace it regardless of the ban; hedging against inflation. Buying USDC as a safety net from a devaluing currency is a strong proposition that banning crypto will likely find hard to stop.

The truth is banning crypto exchanges from interacting with the banking system didn’t stop crypto trading, however, it made users revert to P2P (peer-to-peer) channels making trading more decentralized than centralized. The majority of illegal crypto activity occurs on unsupervised P2P networks, as most crypto exchanges can flag large crypto transactions as suspicious.

Regulators need crypto exchanges to be more centralized than decentralized to enable proper regulatory oversight and monitoring. Crypto transactions will continue to occur regardless of what the regulators think, the solution is to make them more centralized via stronger regulatory oversight than keeping them decentralized by allowing them to stay unregulated and banned from our centralized banking system.

2023 may be the year the CBN decides to put a more observant eye on crypto exchanges by restoring their connection to the banking system, regulating them, and putting a closer eye on their activities.

CONCLUSION

While a lot happened in 2022, 2023 may turn out to be a unique year for blockchain-based innovations. The possibility of a widely adopted blockchain-based payment solution, blockchain propositions for Identity management, regulation of crypto exchanges, and a whole lot of Distributed Ledger Technology Initiatives may begin to manifest themselves in 2023. Let’s see how the year goes.

Inspired By The Holy Spirit