Following the growing spate of fuel scarcity in Nigeria, the Department of State Services (DSS) has given the Nigerian National Petroleum Company (NNPC) Limited and oil marketers a 48-hour ultimatum to make the product available for Nigerians or watch it activate its operation across the country.

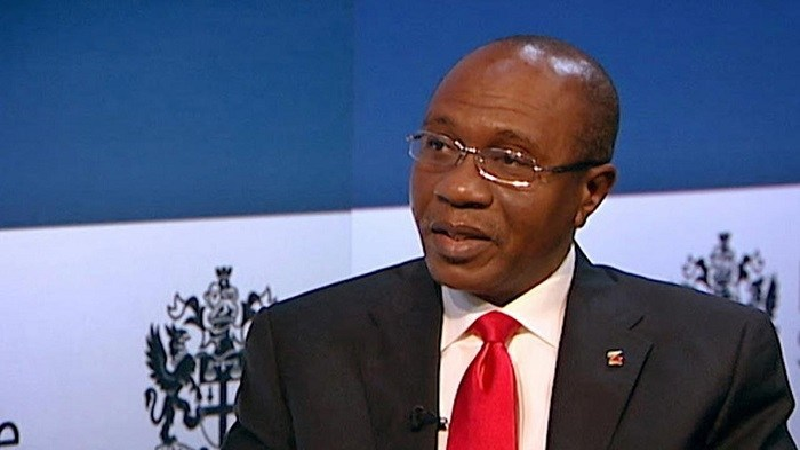

The ultimatum was announced by DSS Spokesman, Peter Afunanya after more than three hours closed-door meeting with petroleum sector stakeholders in Abuja.

Afunanya said the move has become necessary as fuel scarcity has assumed a dimension that is detrimental to the security of the country.

For weeks, long queues have marked filling stations across the country, with the pump price going as high as N260 per liter even though the NNPC had said that there is enough product to serve Nigerians during and after the Yuletide season.

Responding to the ultimatum, the operators said the depots would work for 24 hours daily until the queues are cleared.

However, the Executive Secretary, DAPPMAN, Femi Adewole, attributed the recent fuel scarcity to the challenge encountered by stakeholders in sourcing foreign exchange.

“The challenges to marketers, especially depot owners, were explained and the meeting agreed and actually noted the forex component challenge and its input into our cost, which we should in all ideal cases recover reasonably. That was agreed upon.

“We also agreed that based on the assurances of products given to marketers, provided by NNPC, we will ensure that, going forward, all depots work 24 hours, based on the security risks appraised.

“We will work 24 hours to ensure that the queues in town are reduced. Our retail outlets, spread nationwide, will also ensure that they sell 24 hours based on our security situation appraised. I want to assure Nigerians that going forward, they will be able to get fuel in filling stations without too much hitch or harassment,” he said.

Chief Executive of NMDPRA, Farouk Ahmed, had earlier assured that, based on the commitment of all parties, efficient fuel distribution will begin within 48 hours to end the shortage in fuel products resulting in the scarcity.

“We’ve heard from all the stakeholders on each of their individual commitments to ensuring adequate supply and distribution of petroleum products. And they re-emphasized that the commitment is to take effect within 48 hours.

“So we are hoping that with the efficiency in the distribution, both by marine and trucking, in the next 48 hours the commitments will really start and hopefully we will see a positive environment, away from the difficult situation we are experiencing across the nation,” he said.