Why Traditional Teaching Isn’t Enough Anymore

Let’s be honest, getting today’s college students excited about lectures is like trying to run a startup without Wi-Fi… nearly impossible.

Professors and deans are facing a new reality: students juggle jobs, family responsibilities, and digital distractions while sitting in classrooms built for another era. The result? Low engagement, dwindling motivation, and a gap between theory and the real-world business strategies they’ll actually need.

To close this gap, universities can no longer rely only on conventional education or traditional learning models. Students today expect interactive teaching methods and proven student engagement strategies that connect lessons to their lives and careers.

That’s why Malcolm Knowles’ Adult Learning Theory (Andragogy) offers such a useful lens. Unlike pedagogy, which focuses on children, andragogy recognizes that adults, yes, even today’s undergraduates, learn best when education is self-directed, relevant, and problem-centered.

This is where experiential learning and hands-on learning come in. Imagine students not just memorizing concepts, but running a startup simulator, testing decisions in a business simulation game, and managing the ups and downs of a small business. With scenarios that feel real, students suddenly lean forward, debate choices, and reflect on outcomes.

Thanks to modern online education platforms and accessible simulation software, universities can now deliver flexible, career-focused experiences that truly prepare students for entrepreneurship and leadership. The classroom becomes a digital business lab, where mistakes become lessons instead of penalties.

Pedagogy vs Andragogy: Why the Difference Matters in Higher Education

Pedagogy vs. Andragogy: The Key Difference

The key difference between pedagogy and andragogy is that pedagogy refers to teaching methods designed for children, which are teacher-centered and structured, while andragogy refers to approaches for adult learners, which are self-directed, experience-based, and problem-centered. In higher education, students increasingly align with andragogy because they value autonomy, practical application, and active learning strategies.

Knowles’ Five Assumptions of Adult Learners

- Self-Concept ? Students want control, not spoon-feeding. A senior majoring in entrepreneurship may prefer to build her own project plan instead of following a rigid outline.

- Experience ? They bring valuable real-world baggage. A student who’s worked part-time in retail can use those insights to explore customer behavior through a simulation.

- Readiness to Learn ? Motivation grows when lessons feel relevant. For instance, students prepping for internships are far more eager when case studies align with career goals.

- Orientation to Learning ? Problem-solving beats busywork. Solving a supply chain issue sparks curiosity more than memorizing definitions.

- Internal Motivation ? Grades matter, but career goals matter more. Students show up when they believe what they’re learning connects to launching a startup or contributing to entrepreneurship.

Why This Matters in Higher Education

Today’s students already act like adult learners. Many work while studying, some support families, and nearly all expect flexibility. Professors see it daily: “I can see my students scrolling TikTok during lectures, it’s not that they don’t care, it’s that the format doesn’t resonate.”

That’s why experiential learning in higher education, supported by active learning strategies and modern teaching tools, isn’t just a trend, it’s essential for student success.

The Challenges Professors and Deans Face

Being a professor or dean today isn’t easy. Higher ed is evolving fast, and the classroom is no exception.

- Limited Time ? With syllabi, grading, and committees, creative teaching often gets squeezed out. Finding time to design interactive lessons feels like a luxury, even when the need is clear.

- Theory vs. Practice Gap ? Students crave relevance. They want to know how marketing models or finance tools actually connect to real-world business strategies. If they can’t see the connection, interest fades fast.

- Disengagement ? PowerPoints alone don’t cut it anymore. Students raised on simulation games and mobile apps expect active learning techniques instead of passive learning. Without it, attention drifts to phones or laptops.

- Technology Gaps ? Some thrive on online education platforms, others struggle with access or skills, creating uneven experiences in the same classroom.

These challenges ripple out. Students feel unprepared for careers in entrepreneurship or small businesses. Institutions risk weaker retention and satisfaction, while leaders face reputation risks.

But here’s the hopeful part: combining andragogy + business simulation teaching gives professors and deans a fresh playbook. Instead of fighting distractions, you meet students where they are, through interactive teaching methods, practice-based learning, and student engagement techniques that actually stick.

Business Simulations: Bringing Theory into Practice

So, what exactly are business simulations? In simple terms, a business simulation is an interactive tool where students practice decision-making in a safe, risk-free space. Rather than just reading about finance or management, they experience it by running a simulated company. The classroom becomes an arena where concepts are tested, not just recited.

Meanwhile, business simulation games add gamified elements: competition, collaboration, and instant feedback. Students enjoy it because it feels familiar, like the educational business games they already play recreationally, but this time, the skills carry into their careers.

Benefits Aligned With Knowles’ Principles

- Self-directed learning ? Students take the wheel, deciding pricing, staffing, and strategies, then experiencing the outcomes.

- Problem solving ? Learners wrestle with dilemmas like launching products, managing budgets, or facing new competitors.

- Hands-on learning ? Instead of only studying financial reports, they manage them in real time.

- Relevance ? Every scenario connects directly to startups and small businesses, so students see why it matters.

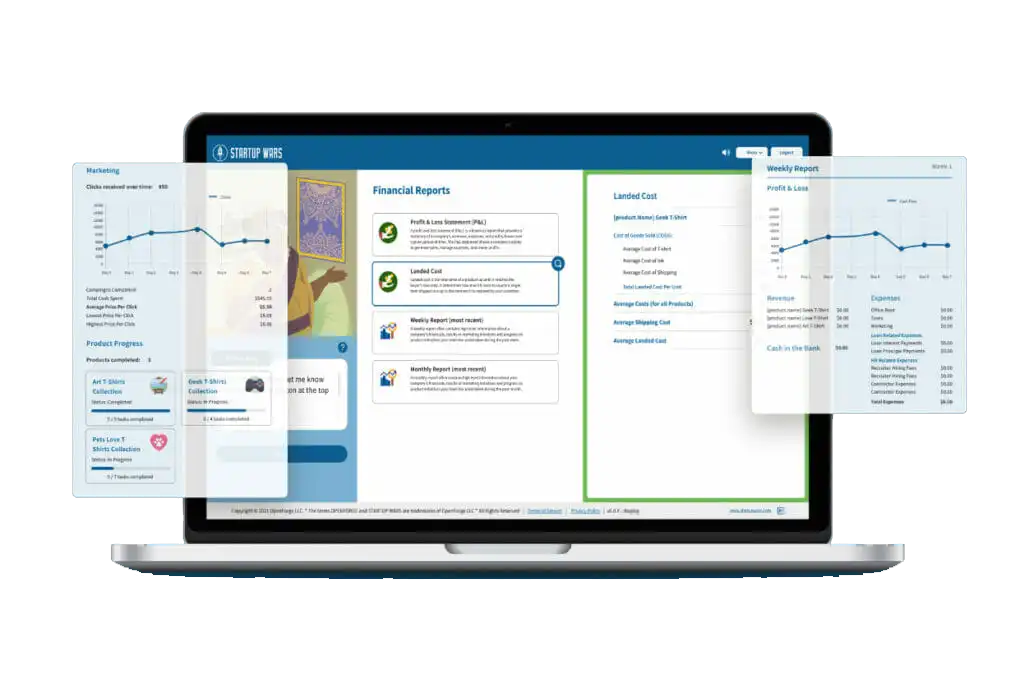

Case in Point: Startup Wars Simulator

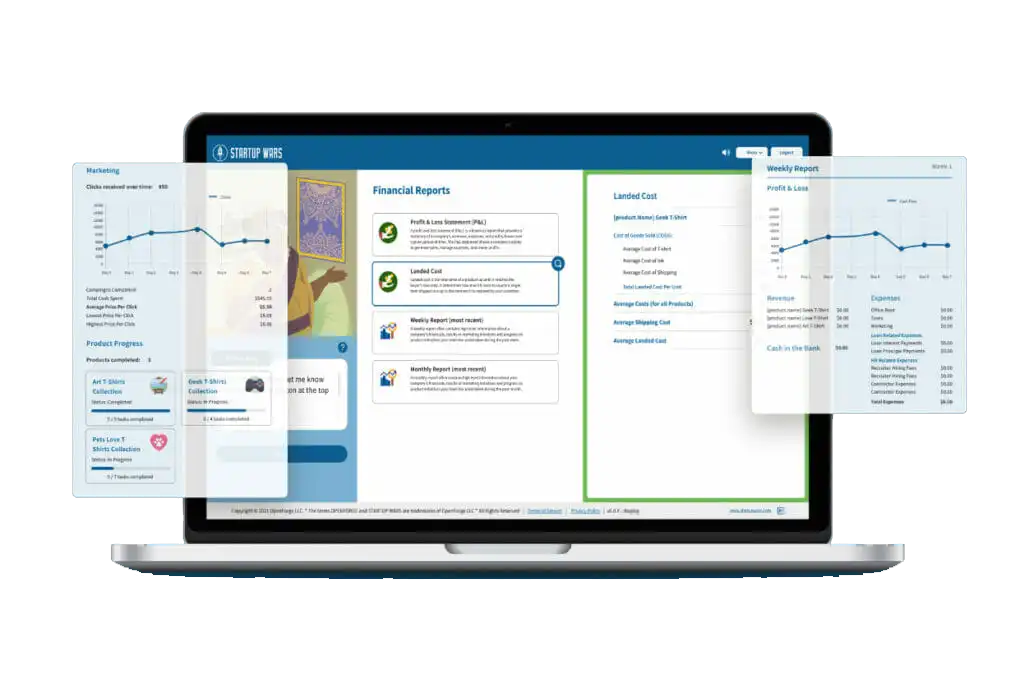

Startup Wars is a next-gen simulation software designed for business & entrepreneurship education. It lets students run a virtual startup simulator, where they pitch, plan, and manage ventures from start to finish. They practice entrepreneurship, sharpen business strategies, and develop resilience as their simulated company navigates market ups and downs.

For professors, Startup Wars is a classroom ally. It boosts engagement, creates room for debates, and serves as an assessment tool, you can track not just participation, but the quality of decisions. The impact is broader: stronger motivation, improved retention, and graduates who step into the workforce ready for business leadership.

This isn’t just theory, it’s simulation-based learning, gamification in education, and decision-based learning rolled into one. Startup Wars shows how gamifying curriculum can transform classrooms into incubators of creativity and innovation.

In short, simulations like Startup Wars bridge the gap between traditional training methods and the unpredictable reality of entrepreneurship. That’s the kind of experiential learning activities higher education needs to stay relevant, competitive, and impactful.

The Future of Learning Starts Here

Here’s the real takeaway: students don’t just want to know, they want to do.

Knowles’ Adult Learning Theory shows us that learning sticks when it’s practical, relevant, and problem-centered. Business simulations bring that to life, turning lectures into dynamic experiences where students test ideas, make choices, and build the confidence to lead.

For professors, simulations energize classrooms and provide practical teaching tools. For deans and institutional leaders, they offer measurable improvements in student learning outcomes, motivation, and career readiness. And for students, they provide something invaluable: the chance to practice entrepreneurship in a safe, engaging environment.

That’s why platforms like Startup Wars matter. With its startup simulator, professors can spark curiosity, institutions can elevate performance, and students can leave classrooms ready to turn ideas into action.

The future of higher education isn’t about more slides or thicker textbooks. It’s about adopting modern teaching tools, student engagement strategies, and business school simulations to prepare students for tomorrow. And right now, professors and deans have the opportunity to lead that transformation, with business simulation games like Startup Wars at the center of it all.

Like this:

Like Loading...