Dear Senator Ademola Adeleke,

I believe that today will go down in history as one of the best days of your life, your family’s life, and the history of your city. It will be a memorable day in your life because not everyone wants you to be proclaimed the sixth governor of Osun State. It will stick with you whenever you think back on how you fought the battle between 2018 and 2022. Every member of your family will remember today in the history of Osun politics because your emergence has reaffirmed your family’s place in the statewide political game. You made history by matching your late father’s and brother’s political achievements. People in your home country (Ede) will remember this day because you are the second citizen who will govern the state from the city.

Mr. Governor, the purpose of writing this letter extends beyond recounting today’s happy event. Celebrations should be kept to a minimum. This is necessary because you must reflect on how you fought and won the battle. I and other colleagues conducted several studies on your personality and political party in relation to the nature and patterns of Osun politics between July 2018 and November 26, 2022. Throughout these years, you and your team have specifically deployed defensive and offensive warfare strategies in political campaigns and other personal engagements with the public with the goal of being pronounced governor and sworn in on a day like this.

Mr. Governor. I can say that, like other Nigerian politicians and political parties, your defensive warfare strategy entailed a lot of counterattack, intimidation, deterrence, skillful retreat, and lying low when under aggressive attack. You and your team also used offensive warfare strategy by establishing an overall goal, devising methods to achieve it, and meticulously planning the entire plan. You and your team also looked at enemies and discovered their secrets. Overall, you completed your campaign successfully and were proclaimed as the new governor of Osun State.

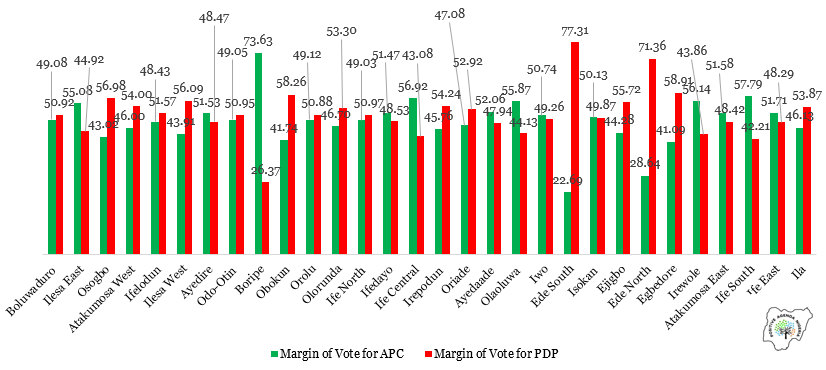

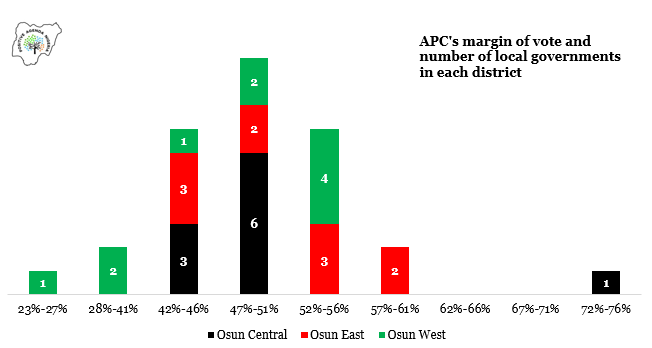

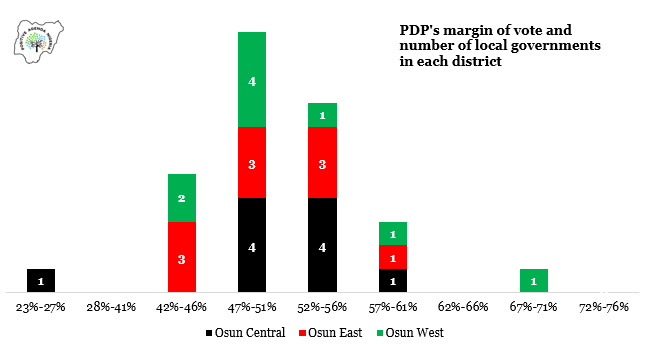

Mr. Governor, you can see from the Exhibits in this letter that your strategies paid off across the state. However, you can see that there are some areas where you and your main opponent, the immediate past governor, are tied. This indicates that the race was close. This does not surprise me because people were not normally opposed to the former governor’s personality. They voted against him and his party, in my opinion, because they felt certain socioeconomic policies and programs were failing to deliver desired public goods.

Providing Public Goods

On that note, Mr. Governor, I would like to walk you through the findings of an analysis of project allocation and execution during the previous administration (most of the projects were planned by administration of Ogbeni Rauf Aregbesola).

Out of 162 projects [tangible infrastructure] I found, 104 were road projects. More than 73% of these projects are rehabilitations. Fire and safety projects are 11. All the fire and safety projects are proposed as construction. One security project proposed would be done within rehabilitation solution category.

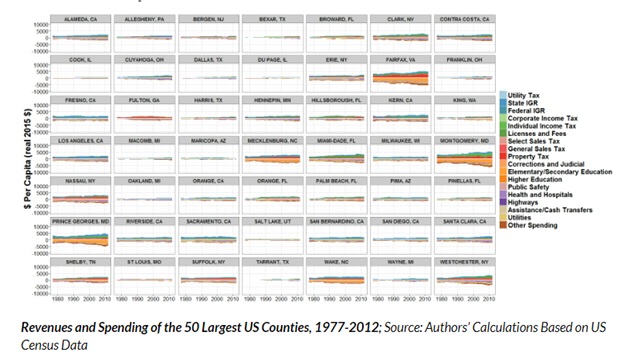

Analysis shows that Osogbo and Ilesa are the cities that have the largest share of the awarded and proposed projects for completion between 2019 and 2021. Out of 162 projects mined and analysed, 20.4% would be done in Osogbo and 11.25% in Ilesa. Analysis further shows that there are projects that lack a clear description of locations [where they would be executed].

Analysis across the category of solutions that would be executed indicates that 7.4% of 84 projects classified as rehabilitation would be executed in Ilesa while 5.6% of the projects would be done in Osogbo. Analysis also reveals that 3.7% of the projects would be carried out in Ede. Over 2% of the projects would be done in Ejigbo, Ido-Osun, Ikirun and unstated locations across the state while 1.9% are expected to be done in Iwo. Over 1% of these projects will be implemented in Gbongan, Ife, Ifon/Ilie, Ijebu-Jesa and Okuku [for each location].

Out of 22 maintenance projects, 4.9% would be implemented in Osogbo and 1.2% each in Iwo, Ilesa, Ikirun, Ife and Ede. For the 28 construction projects, Osogbo also had the largest share. Over 4% of the projects would be executed in Osogbo, 1.9% in Ilesa, 1.2% in Ikirun and 1.2% in unstated locations.

Mr. Governor, the findings indicate that your administration should consider a more strategic approach to project allocation. Your administration must also pay attention to the bottom-up approach when initiating and executing projects. I should emphasize that the analysis was completed in 2021. As a result, as of the time of writing this letter, I do not know which of these projects has been satisfactorily completed.

Mr. Governor. I know that during the campaign, you promised various public goods to individuals, groups, and communities. However, keep in mind that you are not representing a specific region of the state. As a result, you must be fair when selecting cabinet members, allocating resources, and carrying out projects. Your primary goal should be to transition Osun from conflicting governance to unified development. This thesis is proposed because there is a clear distinction between campaigning and governing. The offensive and defensive strategies you used during the campaign would not necessarily work for you when executing manifestos.

Public Engagement

Like every other administration before the immediate past governor, you need to come up with a sound proof engagement with the people. By doing this, you would have succeeded in carrying people of the state along on your programmes and policies. As a quick reminder, the first governor of the state at the beginning of this dispensation, Chief Bisi Akande introduced Labe Odan (Under the Almond Tree) as a way to involve the people in governance. Following the same step, Prince Olagunsoye Oyinlola also had a Gbagede Oro, a programme broadcast live on radio and television by the state media, it was only your predecessor that realized the need for public engagement late. He paid for it. Therefore, you are advised to communicate with the people on your programmes and policies.

Similarly, your administration should not neglect the importance of research and data in formulating and implementing your policies and programmes. As it is said, data is the new oil, it is better to use it appropriately in deciding the fate of the people of Osun. It would not only get you the needed insight, it would go a long way in making your plans fit-for-purposes.

It is also expedient to remind you that prior to the election, you enjoyed an unrivalled street credibility making the people to troop out to meet you at every of your outing. Now that you are assuming office as the governor, you need to do all so that you would not lose the earned street support. Being a candidate is different from being the elected governor. There is a high expectation that your government would deliver on all the problems facing the state. It is good you know that once you get into government, people have started reading you and your moves to give the dividends of democracy to them. Failing to do that may take the support of the people away from you. Do not forget that you would return for people’s votes again by 2026.