The primary way governments in modern economies get the money they spend is through taxes.

Often considered a ‘necessary evil’ tax can be defined as “the compulsory exaction of money by a taxing authority, usually a government, for public purposes.”

In Section 8 of the first article of the Constitution, the United States Congress is afforded the right to lay and collect Taxes.

How the US Tax System Is Structured

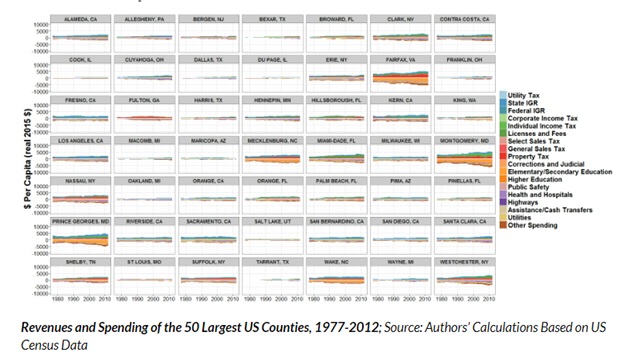

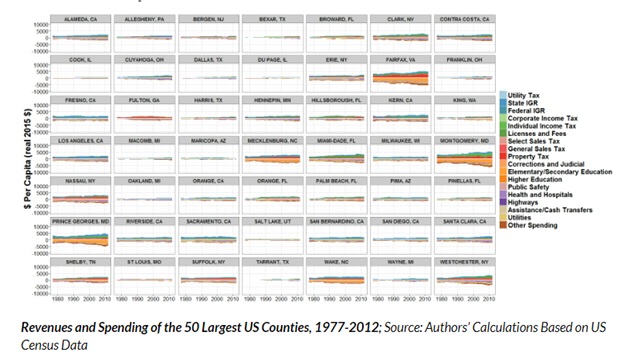

The US tax system is set up at federal (national), state, and local government (county) levels.

Taxes are levied on income, payroll, sales, dividends, capital gains, property, estates and gifts.

Taxes may be imposed on individuals, business entities, trusts, estates, or other forms of organization.

Federal, state, and county taxes are separate, each with its own authority to charge taxes. The federal government has no right to interfere with state or county taxation.

Every state has its own tax system that’s separate from the other states.

Within the state, there may be several jurisdictions that also charge taxes. For instance, counties or towns may set their own school, property and utility taxes in addition to state taxes.

There are 3,144 counties in the United States. Counties deliver human capital-intensive services like public health, elections, and regional transit systems.

All counties in Indiana and Maryland levy a local income tax.

Tax Administration

Efficient tax administration can help encourage individuals and businesses to pay their fair share, thereby expanding the tax base and growing tax revenues.

Several tax authorities administer taxes in the United States.

There are three tax administrations at the federal level:

- Most domestic federal taxes are administered by the IRS – Internal Revenue Service, which is part of the Department of the Treasury. The Internal Revenue Code is codified as Title 26 of the United States Code (26 USC).

- Alcohol, tobacco, and firearms taxes are administered by the TTB – Alcohol and Tobacco Tax and Trade Bureau.

- Taxes on imports (customs duties) are administered by CBP – US Customs and Border Protection.

The organization of state and local tax administrations varies extensively. Each state maintains a tax administration. Some states administer some local taxes in whole or part.

Most localities also maintain a tax administration or share one with neighboring localities.

What Are the Biggest Federal Revenue Sources?

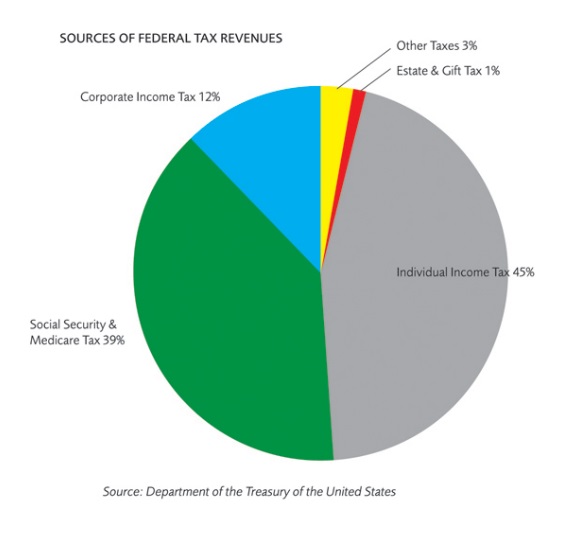

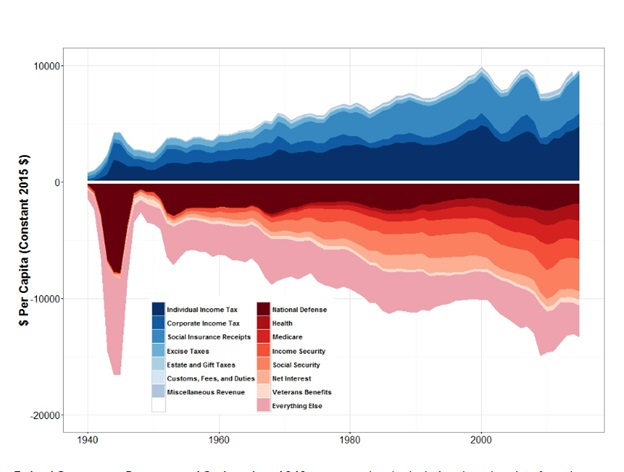

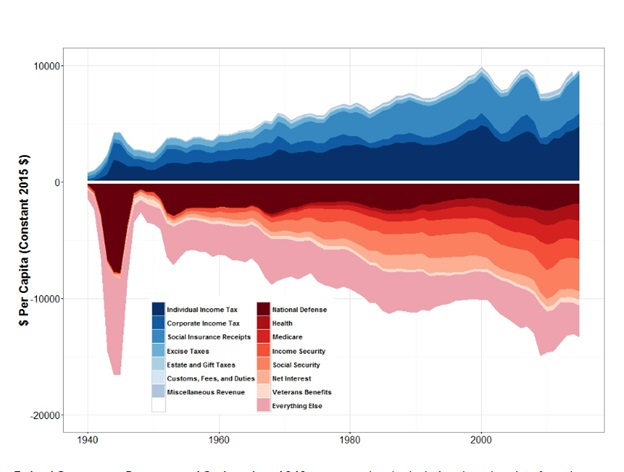

According to the US Treasury, the 3 primary sources of federal revenue are:

- Income taxes paid by individuals

- Corporate income taxes paid by businesses

- Payroll taxes paid by both workers and employers

There are also a handful of other types of taxes, such as customs duties and excise taxes, but these make up very small portions of federal revenue.

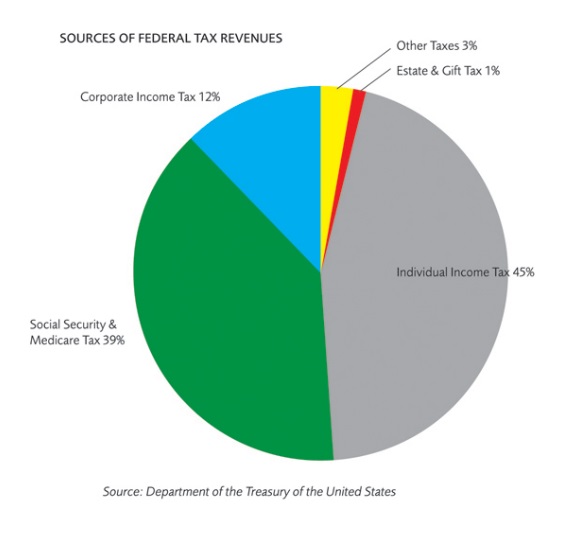

The above figure shows the relative sizes of sources of federal govt tax revenues.

- 45 percent of federal tax revenue comes from individuals’ personal income taxes.

- 39 percent comes from Social Security and Medicare withholdings.

- 12 percent of taxes come to the government from corporations’ incomes

- Estate and gift taxes account for only 1 percent of federal tax revenues. These are imposed on the transfer of property inheritance either by will or lifetime donation.

NB: Since half of Social Security and Medicare taxes come directly from people’s paychecks, about 65 percent of taxes the federal government collects come from individuals.

Now let us look at each of the 3 main sources of federal taxes in detail:

When people think of tax, it’s most often income tax that immediately springs to mind.

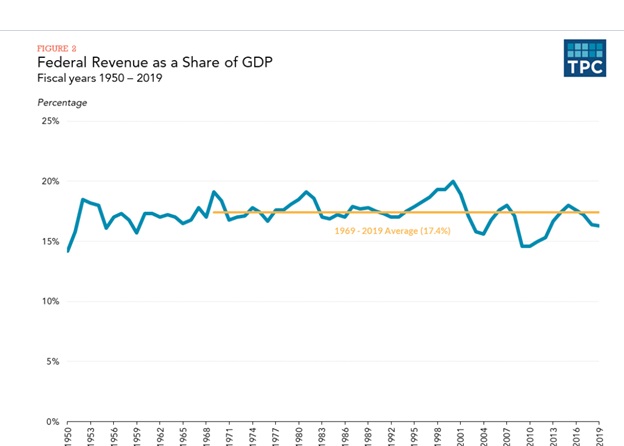

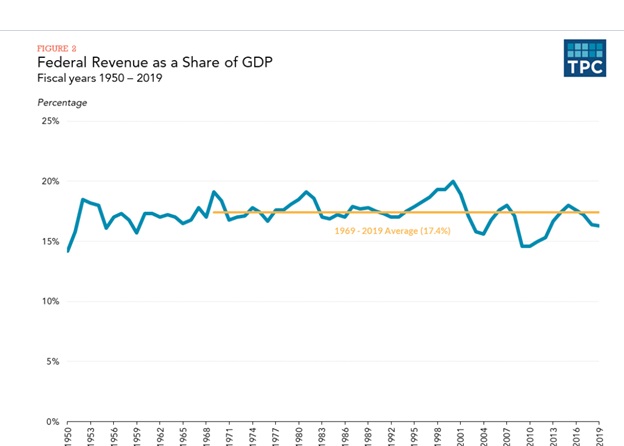

As one of the most well-known forms of taxation, income tax has been the federal government’s single largest revenue source since 1950.

If you earn income in the United States, you’ll see the deductions on your paycheck.

The income tax system is designed to be progressive, meaning that the wealthy are intended to pay a bigger percentage of their earnings than low- or middle-income earners. A progressive tax embodies the concept that individuals with high incomes should pay more of their income in taxes due to their greater ability to pay with minimal sacrifices.

But because of the complexity of the tax code, this isn’t always the way it works out. In most cases, wealthy folks end up paying a smaller portion of their income as taxes than the people who work for them.

Every state also has its own form of income tax that employers also withhold from your paycheck.

Most of the 50 states impose some personal income tax, with the exception of Washington, Texas, Nevada, Florida, Alaska, Wyoming, and South Dakota, which have no state income tax.

If you earn over a certain amount ($12,550 for single Americans, $14,250 for married folks), you must file both federal and state taxes before April 15th of each year. You can use an updated tax calculator to ensure accuracy.

NB: The United States is one of the only two countries in the world that taxes its non-resident citizens on international income in the same way and rates as residents. You may, however, be entitled to a foreign-earned income exclusion that reduces taxable income. For 2023, the maximum exclusion is $120k per taxpayer.

A corporation created or organized in the US under United States law or under the law of any state is considered to any extent a domestic corporation, regardless of whether it does no business or owns no property in the US.

Corporations in the United States are separate legal entities and are subject to corporate tax on taxable income. Federal corporate income tax is applied with a flat rate of 21 percent to the effectively connected income (ECI). State and local governments may also impose income taxes (generally ranging between 1-12 percent). Thus, the effective tax rate (the rate a corporation actually pays in taxes) differs in each state.

Corporate tax rates are different than personal tax rates, largely because corporate earnings are subject to double taxation. What this means is that a corporation pays taxes on its earnings and on the after-tax income it pays stockholders dividends.

The dividends must be reported on the stockholders’ personal tax form and the government taxes them at capital gains tax rates.

While 21 percent is the official tax rate for most corporations, the effective tax rate varies vastly from one corporation to the other. Some big and profitable corporations (familiar names you probably recognize) can even end up paying nothing in corporate income tax.

That variation results from the complexity of the tax code and corporations’ exploitation of “loopholes” to evade paying taxes. For instance, multinational corporations are known to send profits to overseas locations to avoid paying US taxes.

Click here to learn more about corporate tax rates.

Payroll taxes are imposed on employers and employees and on different compensation bases.

These taxes are designated as trust funds. A trust fund refers to an amount of money that’s set aside for a particular purpose and can’t be spent on anything else.

Imposed by the federal and all state governments, payroll taxes are usually set aside for Medicare and Social Security. Medicare is a federal program providing health care coverage to senior citizens and people with disabilities. Social Security, on the other hand, is meant to ensure that elderly and disabled people don’t live in poverty.

Payroll taxes are deducted from your paycheck before you get it and might appear on your paystub as SOCSEC, SS, FICA, or other names (for Social Security).

The deductions from your paycheck are, however, only half the story of payroll taxes. Your employer must match every dollar withheld from your paycheck.

There are also other trust funds, such as the Highway Trust Fund, which comes from fuel taxes.

Why Should We Pay Taxes?

Paying taxes is probably your least favorite government-related activity.

It’s often assumed that tax is a bad thing: that the government wants to deprive its citizens of their hard-earned money.

But paying taxes is a communal obligation. By design, taxes are a shared enterprise. They’re not the undertaking of one person. We can’t support the military, build bridges or battle natural disasters alone.

The same is true for taxes. A functioning society needs everyone to be a team member, obligated to take part in its civic duties and responsibilities. The government needs to be funded in a mutually agreed manner, based on the principles of fairness and the ability to pay. Taxes are a collective obligation, and their payment marks one of our civic duties.

Legislators have made laws on how you should fulfill this civic responsibility.

The money you pay in the form of taxes returns back to you in the form of infrastructure developments, healthcare and medical facilities, educational facilities, gas subsidies, etc.

The government does its best so that citizens can avail a bulk of facilities, which is their right and for which they pay taxes from their earnings.

Perceiving these duties, we have to appreciate our ruling bodies for providing these services.

If we want to achieve revenue increments that enable the government to provide valuable services, without unduly increasing the national debt and while distributing sacrifice equitably, diligently paying tax is the only way by which this objective can truly be achieved.

Besides raising revenue for the provision of public goods, other objectives of taxation include:

- Redistribution of income and wealth to address poverty and inequality

- Promoting social and economic welfare

- Police and fire protection

- Enhancing economic stability and global harmonization

Can’t the Government Just Print More Money?

Since the government oversees the printing of money, why can’t it just finance its spending? Well, here’s why.

Before 1933, the United States was on a gold standard. The amount of gold the US government had in its possession limited the amount of dollars it could print. What made the gold standard important wasn’t the gold, but rather the limit on the amount of dollars the government could print.

A “freshwater standard” or “land standard” that limited the number of dollars the government could print by the amount of freshwater or land the government owned would have accomplished the same effect.

The value of the object serving as the standard isn’t important. What’s important is that the object exists in a fixed quantity. Provided the quantity of the object is fixed and the amount of dollars is limited by the number of units of the object the government owns, the government will not be able to print as many dollars as it wishes.

That limitation on the government’s ability to print money was effectively removed in 1971 when the then-President Richard Nixon cut off the US dollar’s ties to gold.

The government started imposing an inflation tax.

You may be wondering, in what way is inflation a tax?

Let’s say a tank of gas costs $50; then the $50 bill in your pocket is worth a tank of gas. If the gas price rises so now a tank costs $100, then the $50 bill in your pocket is only worth half of a tank of gas. The increase in the price of gas caused the money in your pocket to lose value.

This is not only true for the money in your pocket; but also, for savings in your bank account. If the government can print money to cater to its spending and, in so doing, cause prices to rise, this causes the money you own to lose value. This means that the government has effectively taxed you to pay for its expenses.

Consider the following simple example: The money supply is $1M, the economy produces 1 million units of stuff every year, and the average price for one unit is $100. You have $500 in your wallet. With this $500 and with the price of stuff at $100 per unit, you can buy 5 units of stuff.

Suppose that the government wants to make purchases but has no money. The government prints $100,000 and uses the newly printed money to purchase some things. Since the money supply has risen 10 percent while production has remained constant, the average price of things will rise 10 percent to $110. Now, if you want to buy some things with your $500, you can only afford about 4.5 units of the things. In effect, the government has taxed you one-half of a unit of stuff to pay for the stuff it acquired.

The inflation tax is treacherous since it’s normally unseen (when inflation is moderate, you may notice it and, when you do, fail to appreciate that it is, in fact, a tax). Still, it’s impossible to avoid.

When you understand that inflation is also a tax, you’ll start to see why the only way the government can obtain money is through taxation.

Don’t Consider Paying Tax as a Burden

Many of us always try to escape situations where we’re required to pay taxes; it’s a human tendency to avoid paying taxes.

Even when tax rates are lowered, like in developing nations, there’s still a lack of desired tax culture. The general mindset of the public is stuck on the give-and-take formula leading them to ask before paying

But to echo the words of the US Supreme Court, “Taxes are the price for civilization.”

Tax evasion causes serious loss of revenue to governments. This results in an ‘unfair’ burden on honest taxpayers and the possible underfunding of public service.

In developed countries, tax evasion is frequently estimated to be at about 10-20 percent level of tax revenue. Evasion varies between occupations, with restaurants, stores and car dealers evading the most, while those in agriculture, finance, and insurance are the lowest evaders.

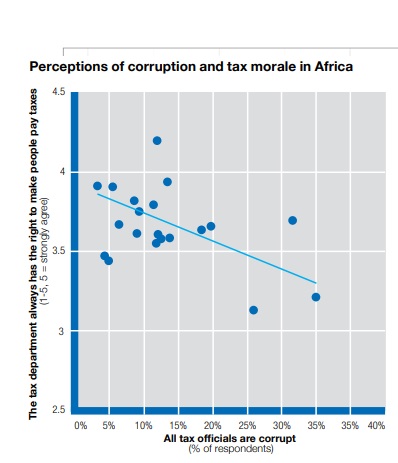

In developing countries, the problem appears worse, and in some cases, evasion exceeds 50 percent of tax revenue.

This could be a result of the following:

- Weak tax collection apparatus.

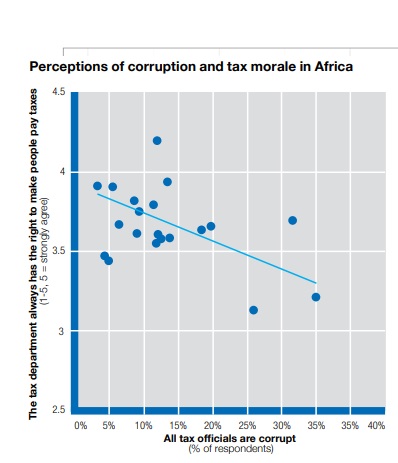

- Corruption. Tax evasion is often associated with perceptions of corruption in public institutions, especially among tax officials.

- People may evade taxes in part if they believe they’re receiving substandard government services.

In order to cut down on evasion, governments in developing countries may wish to:

- Transmit clear information on the quality of their services. There’s a need to ensure that the tax system is fair and equitable.

- Initiate strict laws against tax evasion. In the US, if you don’t file your tax returns, punishment ranges from penalties to risking jail time.

Like this:

Like Loading...