Inflation is a nightmare scenario for many countries since the financial game of justice is currently locked in the entire globe and still seeking to increase. Is there a war on money? I’m still looking into the cause and origin of the current financial globalization catastrophe. In the opinion of many players, the game is open but not actually open.

I believe that when something is widely accepted, it becomes a free market for everyone. Could it be that the dominant banking system rejected a certain system? We are all aware of the topic of the rising European gas prices and gas hikes in several European countries. The global financial war affects all nations, including those in Asia, America, Europe, Africa, and Australia. Inflation may have a number of factors, including increasing aggregate demand, rising salaries, and growth in the money supply, according to economists. The U.S. and global inflation rates in 2022 reached their greatest levels since the early 1980s.

This article is based on the ongoing financial conflict, not a statistical analysis of the situation. All economic theories and regulations will result in an unresolved economic crisis, thus if all economists came together to brainstorm solutions to the world’s financial issues, I doubt there would be any areas of agreement among them.

We all learn to contribute to the human race, which will greatly enhance the world economy and increase the number of individuals who have the opportunity to find employment. But the world system sectors have worth now and in the future, and a sizable population is creating and adding enormous value to the financial system. Why is inflation a global issue on foreign TV channels when all of these are present in the system?

What is Inflation? What is an easy way to define inflation?

The rate at which prices increase over a specific time period is known as inflation. Inflation is often measured in broad terms, such as the general rise in prices or the rise in a nation’s cost of living. However, the current state of the global market, including the definition of inflation and media coverage of the market, indicates that the previous financial is at risk. Win, lose or draw.

Could the bitcoin community be to blame for the problems with the world’s finances?

Alcoholic beverage companies never utilize inebriated people in their advertisements; instead, they always feature individuals of integrity. Because people are embarrassed to use inebriates, the product is not worth the money. These examples are important to discuss. In the global market system, both Bitcoin and the cryptocurrency community are genuine. Some economists believe that the cryptocurrency community is the biggest financial issue driving or contributing to global inflation. Okay, let’s face it: The cryptocurrency community is not the problem with the world market; rather, the so-called centralized exchange is what is fueling financial inflation in that industry. How?, Do you believe that phony bitcoin is sold on centralized exchanges? Another global financial issue that no one has ever examined is this one. I believe the price of bitcoin would have reached $200,000 by now if the centralized functioning exchanges had accepted native bitcoin.

Could the 2022 invasion of Ukraine by Russia be related to the global financial crisis?

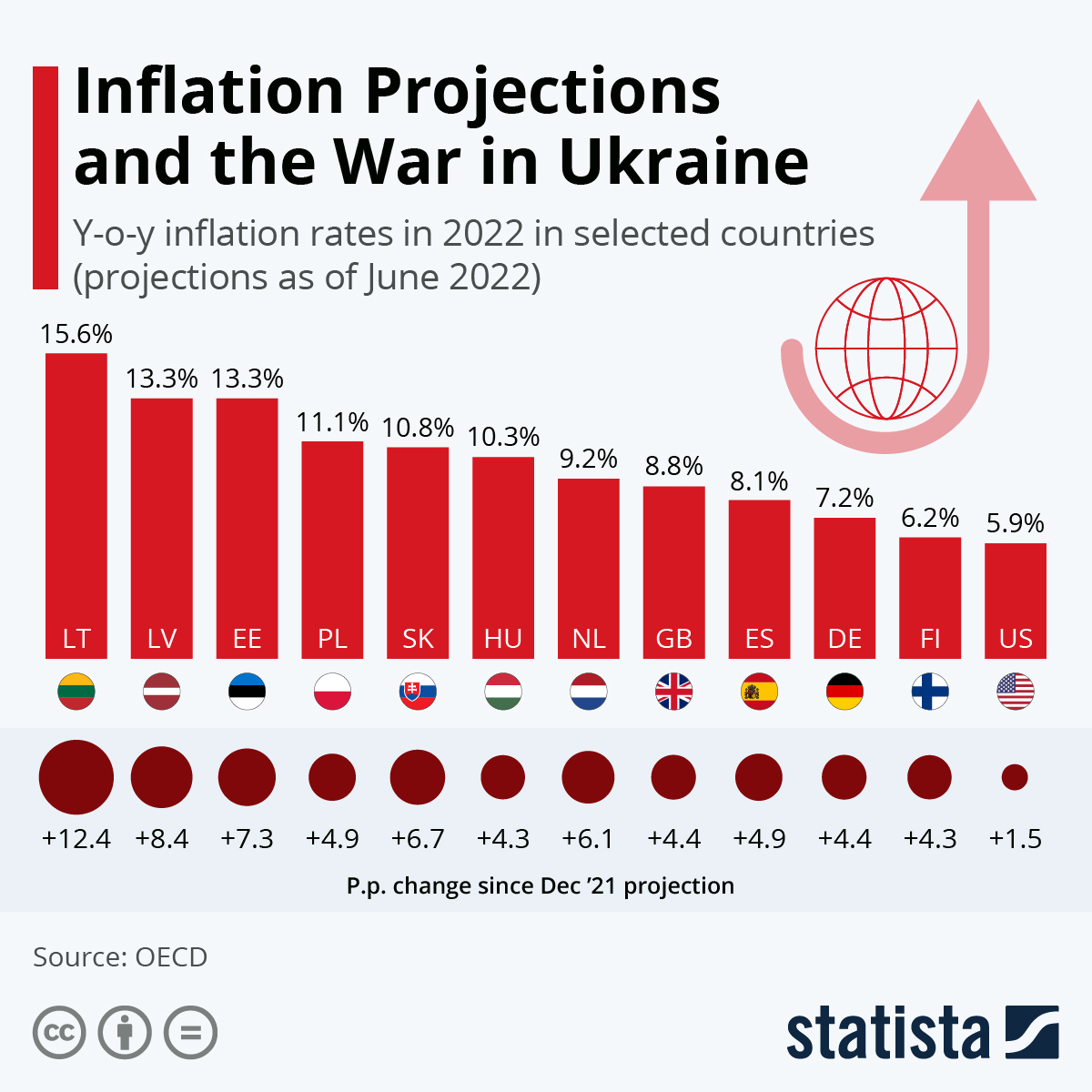

European CFO Survey — Spring 2022 According to CFOs, the greatest danger to their companies since the survey’s inception in 2015 is the war in Ukraine and its effects on a European economy already dealing with high inflation and supply issues.

In-depth summary

The invasion of Ukraine has dealt a harsh jolt to corporate mood, which had been rebounding as lockdown measures from the COVID-19 outbreak were lifted, according to the Deloitte European Chief Financial Officers Survey. A record amount of risk, brought on by geopolitics and inflation, is now being reported by CFOs. The data was gathered two weeks after Russia invaded Ukraine, which would have made CFOs’ expressed anxiety more apparent. Energy prices in Europe are significantly impacted by this invasion. War is a sibling of inflation, and we already know that inflation stunts economic expansion. Some have argued that the global rise of inflation means that many countries — including the U.S. — overstimulated their economies and generated excess aggregate demand. These demonstrate that the Russian invasion of Ukraine is to blame for the current rate of inflation in Europe.

Why do businesses in the information and technology sectors dismiss their staff members?

Global development as a whole, as opposed to the modern development we see, is still evolving. Employees are being laid off by businesses right now. What may be the problem? Is it based on new technologies or the status of the financial industry today? It’s likely that the layoffs at these major firms were caused by new technology. The point I’m making is by no means not referring to Twitter. Facebook is currently laying off about 12,000 workers. Then, thousands more workers, including those at Amazon and Twitter, are let go. We take our time repairing this inflated chamber. As big problems for Big Tech companies such as global headwinds and declining ad expenditures arise, Meta Platforms is implementing “hidden layoffs” at Facebook to shrink its workforce.

The parent firm of Facebook reportedly intends to fire more than 12000 ineffective workers from all teams. characteristics of rapid market inflation.

In conclusion, the problem of inflation is just too big to be solved, but one wonderful strategy to combat it is to simply use the past and subsequent solutions to the current issue. Let love reign supreme between Russians and Ukrainians.