Is Shiba Inu losing its once titan grip on the cute meme crypto market? Toon.Finance is the new coin on the block and one that has exploded in popularity. A once semi-joke form of cryptocurrency launched to topple the big names like Bitcoin and Ethereum turned into one of the most popular coins of all time.

Let’s look at what makes Shiba Inu attractive, some of its ATHs, and more.

Shiba Inu Coin Price Prediction

Ryoshi, a group or single person, created SHIB in 2020 to answer the DOGE coin. While it was launched as a parody of the DOGE, it gained incredible popularity and exploded.

More meme-inspired coins are hitting the crypto market than ever before. Not only are they fun, but they are a bit of an antidote to the ‘stuffy’ appearance of some of the other coins. What makes meme coins so interesting is that while they don’t seem to take themselves too seriously, they are more popular and a better investment than many old and original cryptocurrencies.

Meme coins have been on the rise for the last few years – what started as a way to poke fun at some of the traditional coins has now become some people’s preferred way of investing in bitcoin.

For many age groups, we have grown up with the meme culture. Looking specifically at Imgur and Reddit, a large number of people can enjoy a single meme, and it can have a meaning and back story of its own. Not too dissimilar to the cryptocurrency meme-coins.

Billy Markus and Jackson Palmer created DOGE as a parody of bitcoin (BTC) that offered the general public a welcoming entry point into the realm of cryptocurrencies. Given the historical ambiguity and mistrust surrounding cryptocurrencies in general, it worked well to demonstrate to the general public that they don’t have to be taken seriously.

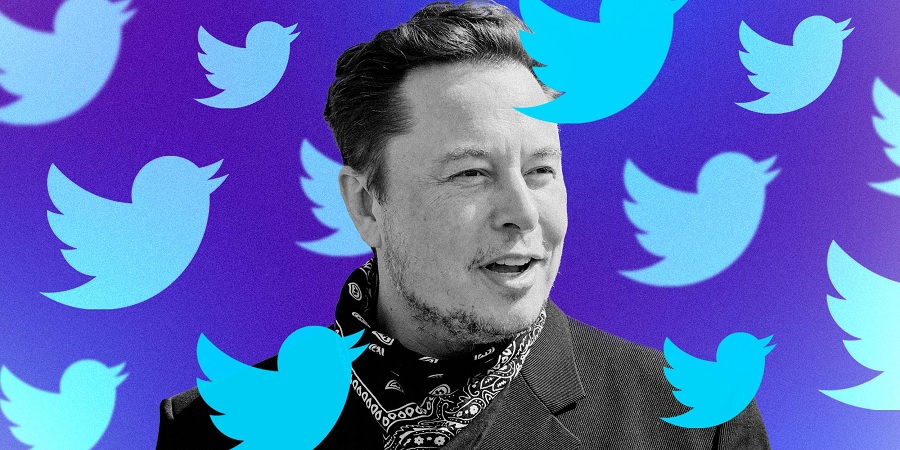

Although DOGE was started as a bit of a joke, in the end, it had the backing of people like Elon Musk and Snoop Dogg – driving its notoriety further in huge leaps. Eventually, seeing a rise in value that exceeded 14,000%!

Where does Shiba Inu come into this?

DOGE opened the door for many different takes on crypto, including Mona Coin, Tiger King, SafeMoon, and Shiba Inu.

$CAT is one of the most interesting to look at face value because it was created after the huge smash hit Netflix series and the TikTok Carole Baskin parody songs. It was Carole Baskin herself that launched the $CAT. Unlike others, you can’t buy this currency, but you can use it to buy online experiences and merchandise – but it’s not for investing in.

MONA is another interesting case; while it was launched in 2013, it isn’t as popular as Shiba Inu at all – however, it is predominantly used in Japan and has a huge $134 million market value. MONA is even more special because it was approved by Japan’s Financial Services Agency and is accepted as a payment in-store, land-based, and on the internet.

It creates blocks in 1.5 minutes, which is much faster than bitcoin’s 10-minute creation time.

Shiba Inu is potentially the most successful breakout. The Shiba Inu as a dog was doing serious rounds on the internet, increasing in popularity ten-fold. Shiba Inu has been labeled as the Dogecoin killer, and while you wouldn’t want to see the coin tank, it makes it more interesting for investors looking for something new.

When it comes to crypto, it is typical for the creators to be anonymous so Ryoshi being a pseudonym has no negative impact on the explosive popularity.

Its market cap is around $7 billion (£4.9 billion), and there are close to 400 trillion coins in circulation. It was designed after DOGE. It has also been referred to as the “Dogecoin killer,” but analysts doubt its price will rise significantly.

For example, according to Digital Coin Price, SHIB will only increase to $0.00004607 by the end of 2025. In addition, despite SHIB’s rapid recent development, many analysts think it will be a while before it hits the $1 threshold.

Toon Finance #1 ICO

In just the first week itself, Toon Finance Coins sold out over 3 million dollars worth of TFT Coins.

Just like Shiba Inu revolutionized the meme-coin, TFT is disrupting the market again. And it has been predicted to surpass the explosive runaway success of Shiba Inu with relative ease. Since TFT offers a unique combination of gaming, huge NFT drops, and is only on its second round of presales, the capability is huge.

Most investors want something interesting, unique, and a strong projection. The success of both DOGE and Shiba Inu means the market is primed for something else. Toon Finance is unquestionably a fantastic choice for those searching for an early investment opportunity while the coin is still in the presale period. Additionally, TFT is hosting an airdrop giveaway for their members that will feature 10,000 adorable cuddly NFTs.

One thing that makes presale so interesting is that it offers a low-risk way for people to purchase crypto. Early investors shape the project’s future and give a key indicator of the success that can be expected when the coin goes live.

With the project finally ending its presale after several months of preparation to ensure the project and beta testing came out flawlessly, cryptocurrency experts have referred to Toon Finance as the most well-known and successful ICO to date.

The popular coin is Toon Finance Coin, which takes inspiration from adorable, cuddly cartoon creatures. A group of industry experts and blockchain engineers created this DEX application platform to address the externality surrounding the need for P2E gaming by securing a P2E metaverse with SHA256 encryption protection.

It just started its initial coin offering, which pre-sold more than half of the total coins. In total, there are more than 1 billion Toon Finance Coins.

The ICO saw frenzied subscriptions from traders, investors, gamers, and fans.

Media coverage is ramping up, and TFT is set to be the runaway success of 2022 and leave Shiba Inu in the dust by December.

Toon Finance / TFT Twitter / Toon Finance Telegram / Toon Finance Presale