If you are new to cryptocurrencies, an altcoin is any of the cryptocurrencies that came after Bitcoin. They are all altcoins, from large-cap ones like Ethereum to the smallest ones out there.

The challenge with choosing the best altcoin to invest in 2023 is that too many of them exist. The crypto market has close to 20k altcoins, and many of them are either weak on fundamentals or just outright scams.

If you have been dealing with this challenge, you are in luck. We have taken the time to compile a list of 10 of the best altcoins to invest in 2023. Each of the altcoins in this list has a high potential for value appreciation in 2023.

In the list, you will find everything from large-cap altcoins to new cryptocurrencies that hold significant growth potential as investors get to know about them.

>>>Buy Altcoins Now<<<

10 Best Altcoins to Invest in 2023

- Terra Classic – Lowly priced altcoin with a strong community

- Shiba Inu – In-demand meme altcoin that is expanding its use case.

- Cardano – One of the best Proof-of-Stake networks in the market.

- Sandbox – Metaverse altcoin that is quickly gaining in adoption.

- Uniswap – Most adopted Decentralized Exchange with lots of growth potential.

- Decentraland – Metaverse cryptocurrency taking virtual real estate to the next level.

- Yearn.Finance – Top altcoin that is among the most adopted DeFi cryptos

- Chainlink – Decentralized oracle altcoin that has already gained market dominance.

- Ethereum – Large-cap altcoin that recently had a major upgrade

- Cosmos – Fast growing that is focused on interoperability for Web 3.0

>>>Buy Cryptos Now<<<

An In-Depth Look at the Best Altcoins to Invest in 2023

With thousands of altcoins in the market today, choosing the best ones to invest in can be challenging. Besides selecting the best altcoins, you also need to find the best altcoin exchange that is both secure, investor-friendly, and has competitive charges.

To ensure that you only choose high-potential altcoins, go for those with solid fundamentals, and their historical price has shown strong potential for growth.

1. Terra Classic – Lowly priced altcoin with a strong community

Top on the list of the best altcoins to invest in 2023 is Terra Classic. Terra Classic is a cryptocurrency community that has shown tremendous resilience and determination in the face of adversity. Just look at what happened in mid-2022 when there was an epic crash in the LUNA/UST market. Despite losing billions of dollars in value overnight, the Terra Classic community never gave up. They rallied together and devised creative solutions to reduce market volatility and build long-term value.

Most recently, they introduced a token burn that is geared towards helping remove excess liquidity from the market and reinvigorate investor confidence. This bold move appears to be paying off, as we are now seeing signs of renewed growth in this dynamic community. With its strong track record of endurance and innovation, it’s safe to say that Terra Classic is hands down the most resilient crypto community out there today.

Besides the show of strength after the LUNA/UST collapse, Terra Classic also remains one of the best layer-1 chains out there. Not only does it boast a robust layer-1 structure that is both flexible and scalable, but it also has a growing number of Dapps building on top of it. This means that not only can Terra Classic handle large amounts of data and high-volume transactions, but it also provides a foundation for innovative new projects to be built on. What’s more, this diverse ecosystem ensures that Terra Classic remains one of the most exciting chains to watch in the coming years.

All these factors mean that once the bulls retake the market, Terra Classic could be among those that see the most positive price action. That’s why I believe it is one of the best altcoins to invest in 2023, and even for many years to come.

>>>Buy Terra Classic Now<<<

2. Shiba Inu – An in-demand meme coin that is expanding its use cases

Shiba Inu launched in August 2020, but by November of that year, few people had even heard about it. At the time, it was just another meme coin in a crowded market, with little indication that it would stand out from the rest. But soon, its price action quickly proved that it was something special. Over the next two years, Shiba Inu saw massive gains, skyrocketing to over 40 million percent at its peak. By the end of 2021, it had made many small investors rich beyond their wildest dreams and cemented its place in crypto history as one of the best-performing altcoins ever.

As the popularity of the Shiba Inu meme continues to rise, so too do its fundamentals. Not only has the team released a groundbreaking layer-2 scaling solution, but they have also introduced a new virtual reality platform that is sure to revolutionize digital media.

Additionally, Shiba Inu offers a novel pay-to-burn feature that, over time, will gradually reduce the total number of tokens in circulation. With these and other exciting developments, it is clear that Shiba Inu is more than just a meme coin – it is an investment with real potential for growth.

The Shiba Inu community is rapidly growing, and that means there is a high potential for hype in the next bull run. This is because the more they talk about Shiba Inu on social media, the newer investors learn about it and become interested in buying SHIB tokens. With this increased exposure there will be an influx of new capital into the market, driving up demand and pushing up prices across the board. As a result, those who are in early on this trend stand to reap huge financial rewards as the value of SHIB continues to soar.

With all these factors at play, there is no doubt that Shiba Inu is one of the best altcoins to invest in 2022. Compared to a lot of other altcoins in the market today, the odds for exponential value growth are in its favor.

>>>Buy Shiba Inu Now<<<

3. Cardano – One of the best Proof-of-Stake networks in the market.

Cardano is undoubtedly one of the best altcoins to invest in 2023. Unlike most other cryptocurrencies, Cardano was built from the ground up using a unique Proof-of-Stake protocol called Ouroboros. This innovative technology is highly secure, highly scalable, and completely decentralized, making it an excellent choice for those looking to invest in cryptocurrencies for the long haul. Additionally, Cardano receives regular updates and improvements from its large community of developers, ensuring that it always maintains its edge over competing cryptos.

Cardano now also has smart contracts, and it’s exciting from a long-term perspective. Smart contracts are a key component of the modern technological landscape, enabling complex interactions to take place securely and quickly on the internet. Now, Cardano has also embraced this technology, with Dapps already beginning to build on top of it.

Cardano’s unique architecture gives it several advantages over other platforms for building smart contracts and Dapps, including increased scalability, security, and privacy. These features make Cardano ideal for any application that requires high levels of resilience or efficiency, from decentralized exchanges to prediction markets to gaming platforms. With its cutting-edge functionality and ease of use, it’s only a matter of time before Cardano becomes the go-to platform for building innovative new applications.

Not only is Cardano lauded for its theoretical and innovative approach to blockchain, but it also offers lower barriers to entry than many other popular cryptocurrencies. Because there are no minimum requirements for staking with Cardano, small investors from all over the world can get involved in the project and earn a passive income through its Proof-of-Stake algorithm. By acting as validators for transactions on the network, these investors help secure the blockchain and ensure that everything runs smoothly. In addition, investing in Cardano typically provides greater returns than simply buying and holding traditional currencies like US dollars or Euros.

All these and the fact that Cardano is led by one of the most elite teams in crypto make it one of the best altcoins to invest in 2023. For context, Charles Hoskinson, the Cardano founder, is one of the people that understand the technical aspects of blockchain technology pretty well. He was one of the founding members of Ethereum, one of the largest and most successful cryptocurrencies ever created. With such brains, Cardano inspires investor confidence and that’s good for its long-term value growth.

>>>Buy Cardano Now<<<

4. Sandbox – Metaverse cryptocurrency that is quickly gaining in adoption.

Another cryptocurrency that holds significant potential for growth in 2023 is Sandbox. At the heart of the Sandbox Metaverse lies a unique and thriving ecosystem where players can communicate and network with each other while enjoying an immersive gaming experience. Inside the Sandbox virtual world, users can create custom characters and then participate in a range of challenging play modules as they strive to earn the in-game currency – SAND.

What sets Sandbox apart from other gaming platforms is its extensive selection of NFTs. These digital assets represent a diverse range of items, props, collectibles, and more that can be used to enhance gameplay on the platform. With thousands of NFTs available at any given time, there is always something new and exciting for players to discover within the Sandbox Metaverse.

Among the most famous NFTs on Sandbox are those that represent the virtual real estate. At its core, The Sandbox is a blockchain-based platform that allows users to buy land and build on it virtually. Plots of land are bought and sold using SAND tokens, also used to purchase virtual items on The Sandbox marketplace. And just in case you were wondering if these virtual pieces of real estate are worth anything, consider the recent example of one user who sold virtual islands for over $4.2 million in SAND. With tools like these at our disposal, the sky is the limit regarding what we can achieve online. By extension, it means that the potential value growth for SAND tokens is limitless, too.

SAND’s price action is also one of a cryptocurrency that holds a lot of potential going into the future. Launched in mid-2020, the SAND token started at a price of just $0.05. By late 2021, SAND had reached an all-time high of over $8.40, signalling its meteoric rise to success in the crypto world. Despite experiencing some ups and downs along the way, SAND has continued to show incredible promise throughout its relatively short history as an established altcoin.

With many investors eagerly watching and waiting to see what further growth might be in store for SAND, this coin is clearly a force to be reckoned with in today’s competitive crypto market. Whether you’re new to trading or an experienced crypto veteran, now may be the perfect time to take a closer look at this outstanding performer. It is trading at a considerable discount from its most recent all-time highs.

Besides its strong technical capabilities, one of the key factors that makes SAND a highly undervalued cryptocurrency to invest in 2023 is the growing rate of adoption. Unlike most Metaverse cryptocurrencies, Sandbox has already caught the eye of large corporations. One of the big names that have already adopted Sandbox is Warner Music, which wants to hold virtual concerts on the Sandbox Metaverse.

With all these factors at play, there is no doubt that SAND is one of the most promising altcoins to invest in 2023.

>>>Buy SAND Now<<<

5. Uniswap – Most adopted Decentralized Exchange with lots of growth potential.

Another top DeFi cryptocurrency that makes it to the list of the best altcoins to buy in 2023 is Uniswap. Uniswap was one of the pioneers of decentralized trading, quickly making it a favorite among crypto enthusiasts. At its core, decentralized trading gives people more control over their money.

Traditionally, buying and selling altcoins meant going through a centralized exchange, which meant entrusting your funds to a third party. But with decentralized trading, you no longer need to rely on anyone else to manage your assets. Instead, you can buy and sell directly from other users or via smart contracts that automatically execute trades based on predefined rules. Uniswap enabled millions of people to take back control of their money, cementing its place as one of the most influential crypto pioneers of 2018. And with the continued popularity of blockchain technology and crypto assets today, it seems likely that more people will turn to this innovative exchange in the years ahead.

Unlike traditional trading platforms, which rely on complex order books to create liquidity and facilitate trade, Uniswap uses an automated market maker model called the AMM. This unique approach allows traders access to fast and fair trades with increased levels of liquidity. Furthermore, Uniswap also offers several additional features, such as built-in risk management tools, real-time auditing, and transparent pricing algorithms.

With all these powerful features, there is no doubt that Uniswap is massively undervalued at current prices since it is trading at more than 70% off its most recent all-time highs.

>>>Buy Uniswap Now<<<

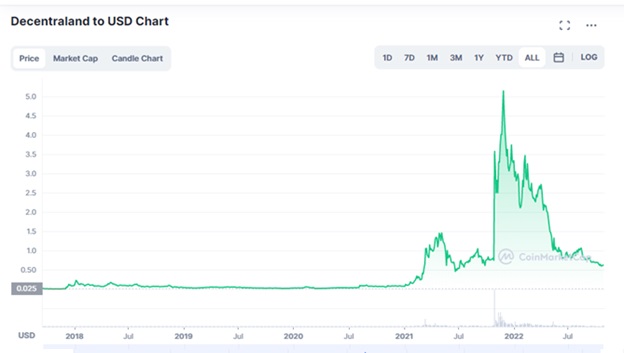

6. Decentraland – Metaverse crypto that take virtual real estate to the next level.

The Metaverse is gaining traction, and Metaverse tokens are among the hot cryptocurrencies to buy now. That’s why Decentraland is on the list of the 10 best altcoins to invest in 2023 alongside SAND.

Launched in 2017, Decentraland has quickly become one of the world’s most popular and widely used virtual reality platforms. With thousands of users interacting with this Metaverse daily, it is clear that Decentraland has established a strong and vibrant community.

What’s more, this community continues to grow and expand, as evidenced by the daily number of transactions conducted on the Decentraland platform. In 2021 there were countless record-breaking real estate trades on Decentraland, signalling its continued success and dominance in this space. Whether you’re looking to invest in some digital land or enjoy exploring what Decentraland offers, it’s a good time to get involved with this popular Metaverse cryptocurrency.

One such high-value sale is Fashion Street Estate, a stunning collection of high-end fashion boutiques that went for $2.4 million in December 2021. With its sleek storefronts and stylish retail spaces, Fashion Street Estate quickly became one of the most popular destinations in Decentraland – and remains a prime example of what is possible when talented developers meet rising demand from an engaged community.

Even as the popularity of the Decentraland Metaverse continues to grow, its native token, MANA, has taken a hit in 2021. Currently, MANA is trading at more than 70% off its most recent all-time high. This indicates that MANA is massively undervalued and is one of the best altcoins to invest in 2023.

>>>Buy MANA Now<<<

7. Yearn.Finance – Top altcoin that is among the most adopted DeFi cryptos

Yearn.Finance can’t miss among the ten best altcoins to invest in 2023, thanks to its strong use case in the crypto market. Yearn Finance comprises smart contracts that combine to make yield farming more efficient. Each component works to streamline the process and ensure you get the most out of your investment.

The first component, APY, handles the aggregation of annual percentage yields from lending protocols across Ethereum’s vast network of decentralized applications. By leveraging this data, APY makes it easy to find the best interest rates at any given time.

The second component, Earn, helps users to further sort through potential investment opportunities based on their ranking. By aggregating and analyzing data from multiple sources and providing a target objective for each yield opportunity, earn is able to deliver only the highest-quality options for your portfolio. With Yearn Finance, so much of the hard work has already been done for you, allowing you to focus on maximizing your ROI and enjoying better returns in less time.

Besides its strong fundamentals, Yearn.Finance price action also points to an altcoin worth buying in 2023. This high-flying Decentralized Financial (DeFi) coin has garnered much attention in recent years thanks to its steady growth and impressive performance. In fact, Yearn. finance has even outperformed Bitcoin in market value, with its price reaching an all-time high of $90,000 in the cryptocurrency bull run 2021.

It is also noteworthy that Yearn.Finance has taken a significant hit in the crypto bear market of 2022. At the moment, YFI tokens are trading at a discount of over 80%. This, in an environment of improving fundamentals, means it is highly undervalued. That’s why it stands out as one of the best DeFi altcoins to invest in 2023.

>>>Buy Crypto Now<<<

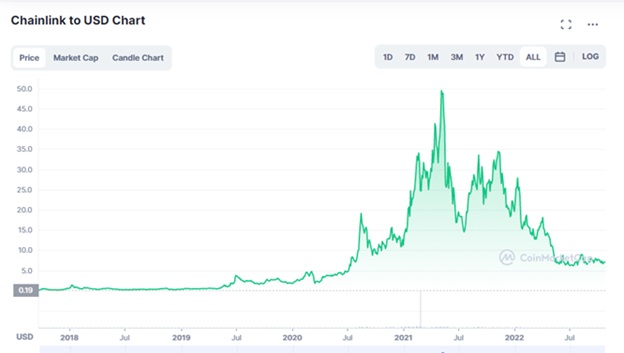

8. Chainlink – Decentralized oracle cryptocurrency that has already gained market dominance.

Chainlink is the most dominant decentralized oracle cryptocurrency, and as such, it can’t miss in the list of the best altcoins to invest in 2023. As a rising star in the world of cryptocurrency and blockchain technology, Chainlink has captured the attention of businesses and traders around the globe.

This innovative platform uses cutting-edge technology to provide seamless connections between data sources and smart contracts, enabling enterprises to interact with blockchain solutions securely. Whether you’re a small start-up or a large enterprise, Chainlink provides all the tools necessary to tap into the power of blockchain. With rock-solid security, powerful data feeds, and flexible pricing options, Chainlink is the ultimate solution for connecting to blockchain technologies.

While it is easily one of the most fundamentally strong cryptocurrencies, Chainlink’s price has been depressed for months. LINK is currently trading at $6.94, a significant drop from its most recent high of $50. As adoption continues to grow, LINK has the potential to push through its most recent all-time highs easily. It’s one of the most underrated altcoins in the market today.

>>>Buy Cryptos Now<<<

9. Ethereum – Large-cap altcoin that recently had a major upgrade

When it comes to cryptocurrencies, there is no doubt that Ethereum is one of the most popular and well-established platforms out there. Thanks to its decentralized consensus mechanism and support for smart contracts, Ethereum has become a leader in the blockchain world, with countless applications built on top of the platform.

But what really sets Ethereum apart is its recent upgrade, which makes the platform more scalable and energy efficient than ever before. With these improvements, Ethereum looks set to dominate the crypto space well into the future, making it one of the best altcoins to invest in 2023 and beyond. Whether you are an early adopter or just hopping on board now, Ethereum is sure to be a valuable asset for years to come.

The biggest aspect of the merge though is that it has made Ethereum deflationary. Unlike other cryptocurrencies that experience regular inflation, Ethereum will actually see demand outstrip supply over time. This is great news from both a short-term and long-term perspective, as it means that these new protocols will continue to gain value over time and give investors an attractive avenue for earning returns on their capital.

Ethereum is also attracting a lot of institutional investors. When it comes to investing, individuals and institutions typically have very different preferences. While individual investors are often motivated by the prospect of high returns and big profits, institutional investors tend to be more cautious and strategic in their approach. That’s why it is a plus to note that over the past couple of years, Ethereum has emerged as a key focus for many institutional investors.

This is largely due to two main factors. First, Ethereum boasts a number of key advantages over its competitors, making it an ideal platform for a wide range of use cases. And second, this emerging technology has attracted interest from some major industry players, who see great potential in Ethereum’s potential to disrupt existing business models. Overall, it seems clear that Ethereum is poised to become a leading player in the world of institutional investing in the years ahead.

By extension, this makes Ethereum quite an easy pick for anyone looking for the best altcoin to invest in 2023.

>>>Buy Ethereum Now<<<

10. Cosmos – Fast growing that is focused on interoperability for Web 3.0

With Web 3.0 gaining traction fast, Cosmos can’t miss among the best altcoins to invest in 2023. Interoperability is critical for the continued growth and development of the cryptocurrency industry. Since different blockchain networks use unique software and protocols, they cannot communicate or share data with each other. This makes it difficult for businesses in the crypto space to integrate, as well as hinders interoperability between public and private networks.

To address these challenges, developers are exploring innovative solutions that will enable greater interoperability between different blockchains. Some possible approaches include creating cross-chain smart contracts, exploring decentralized exchanges, and leveraging artificial intelligence for data analysis and exchange purposes. Ultimately, any viable solution must account for security and scalability issues to be truly effective. But given the immense potential of blockchain technology to reshape the way we do business, tackling these challenges is a crucial step toward a more connected, interconnected future.

Cosmos is one of the cryptocurrencies that have built a reputation for helping create blockchain interoperability. Cosmos stands out as one of the best providers of blockchain interoperability solutions. Cosmos’s underlying technology makes it possible for cryptocurrencies such as Bitcoin and Ethereum to collect and share data across platforms easily.

This opens up a wealth of exciting possibilities for the future of blockchain technology, as Ethereum-based smart contracts can now be leveraged to make crucial decisions based on transactions taking place on various other blockchains, for instance. Ultimately, Cosmos has established itself as a key player in the growing field of blockchain interoperability, providing the technologies necessary for truly interconnected systems to flourish in the years ahead.

Cosmos price action also points to a cryptocurrency with a lot of potential for growth going into the future. When ATOM first hit the market in early 2019, it was already generating a lot of buzz due to its unique features and innovative technology. While the coin initially started at a relatively low price point of just $7.50 per token, it quickly shot up over the year as investors flocked to get in on the action.

By early 2022, ATOM had not only surpassed its initial price point but was trading at more than $43 per token, cementing its spot as one of the most popular cryptocurrency coins on the market. Despite major fluctuations IN 2022, there is no doubt that ATOM has shown incredible growth and resilience as an investment. This makes it highly undervalued at current prices and easily one of the best altcoins to invest in 2023.

>>>Buy Cosmos Now<<<

Is it worth investing in altcoins?

If you have been considering investing in altcoins but are still unsure whether to buy, you have come to the right place for information.

In the section below, we will look at some of the reasons why altcoins could make for smart investments.

Altcoins have the potential for parabolic gains

When it comes to investing, savvy investors understand the importance of looking beyond the top projects in the market. These large-cap coins often have a low potential for growth due to their already significant size and popularity. In contrast, smaller altcoins offer huge upside potential because they are still relatively unknown and less saturated with investors and traders. And while this lack of interest can make it difficult to find accurate data on some of these altcoins, it also means that smart investors can often get in before the hype takes off and drives up their value.

With this in mind, savvy investors know that the best way to increase their portfolio returns is to seek out emerging altcoins with high upside potential. Whether through careful research, technical analysis tools, or just good old-fashioned intuition, paying attention to these projects can help you capture more value than you would otherwise. After all, as every seasoned trader knows, investment success is all about taking smart risks at just the right time.

For instance, not many people knew about when Shiba Inu launched in August 2020. All eyes were on Bitcoin and the top altcoins. This gave savvy investors to load up on SHIB at a low price, and the risk was worth it when it took off. SHIB ended up being one of the best-performing altcoins ever made.

If you want to maximize your earning potential in the crypto world, look beyond top coins and explore some of these lesser-known gems instead. You never know where a great opportunity might be lurking.

Altcoins represent the future of innovation

New altcoins are usually made to reflect emerging needs in the tech world. This means most of them are at the cutting edge of technology. Bitcoin is a revolutionary technology, enabling fast l transactions with unparalleled security and low fees. However, the inherent limitations of the Bitcoin network mean that it can only facilitate payments, and many altcoins outperform it on this front, too.

Fortunately, many new altcoins offer even more exciting innovations, giving them a more significant potential for growth than Bitcoin itself. These altcoins represent the future of payments and financial tech, ushering in new capabilities and opening up a world of possibilities. With these innovative new platforms on the rise, it’s clear that investing in altcoins represents the best path toward greater profits and gains. After all, who wouldn’t want to be at the forefront of the next great digital revolution?

Altcoins usually outperform Bitcoin

While most people associate investing with Bitcoin or other well-known major cryptocurrencies, several lesser-known altcoins have generated equally impressive returns since their launch. For example, some of the top performers in recent years include coins like Solana, Dogecoin, and Shiba Inu – all of which have given investors life-changing returns within just a few short years. And it’s not only niche altcoins that have seen substantial gains either. Even the best-established tokens like Ethereum and Litecoin enjoyed multi-hundred percent price jumps over the past few years.

It is important to remember that when Bitcoin first launched nearly 10 years ago, its value was negligible compared to what it is worth today. This astronomical price appreciation means that many early BTC investors are now sitting on significant capital gains. With Bitcoin now valued at over $300 billion, and even topping a trillion dollars in the last bull rally, the odds are that BTC’s potential upside is small.

In essence, it makes sense to scout for low-cap altcoins with a significant growth potential compared to BTC.

You can use altcoins to diversify your crypto portfolio

When investing or trading in cryptocurrencies, diversification is one of the most important things to consider. Having a diverse portfolio of altcoins can help mitigate the risk of losses and increase the chances of gaining significant returns. After all, while some altcoins tend to perform well when Bitcoin does well, others can fluctuate dramatically depending on broader market conditions.

Additionally, some cryptocurrency tokens are better-positioned than others due to their unique technical features or use cases. For example, some projects have already experienced significant success and may be poised for even greater growth in the future. Ultimately, adding the best altcoins to your portfolio can help you reap the benefits of this volatile market while still managing risk effectively. And by using an online broker that offers both a broad selection of markets and low capital requirements, you can be confident that you are taking advantage of all your options. eToro is one of the top cryptocurrency brokers that meet this threshold.

>>>Buy Cryptos Now<<<

They have made people rich in the past

There are several reasons why it might be worth considering investing in altcoins today. Perhaps the most compelling of these is that many projects have generated life-changing returns for early investors. For example, Ethereum’S price increased from under a dollar in 2015 to $4800 in less than a decade.

Similarly, other major coins like Shiba Inu have also generated incredible returns Shiba Inu made history when it rallied by over 48,000,000% in just one year, and given the volatility and unpredictability of the crypto market, there is no telling what kinds of gains we may see in the future As such, if you’re looking to make a profit in this exciting and rapidly-evolving space, buying a selection of altcoins could be an excellent choice.

Altcoins tend to be cheap

There is no doubt that Bitcoin is a desirable investment for many people Over the past few years, the price of this cryptocurrency has skyrocketed, and it now trades at thousands of dollars per coin. While this may seem like a small amount to many investors, it means that you will only be able to buy a small portion of one coin by investing just a small amount.

This fact makes Bitcoin somewhat unattractive to most value investors. After all, those interested in minimizing risk generally prefer to put their money into more affordable and accessible assets. And while there have been some promising developments on the horizon, Bitcoin still trades at exorbitant prices.

So, while Bitcoin certainly has a lot of potential and may continue to climb even higher in value until its price drops or becomes more accessible to ordinary investors, it will likely remain off-limits for most value-oriented investors. Of course, this does not mean that highly-priced crypto assets are unsuitable investments for those looking for strong returns with limited risk – holdings like Ethereum might be worth exploring instead. In any case, as cryptocurrencies continue to evolve and mature in the years ahead, we can expect them to become increasingly attractive options for value- and growth-oriented investors alike.

One thing is sure; though, cheap altcoins will likely outperform BTC in 2023 as small investors flock in, anticipating using their little capital to improve their lives.

>>>Buy Altcoins Now<<<

Are there risks to investing in altcoins?

If you have read this article up to this point, you know the best altcoins to invest in 2023. You also know of the benefits of investing in altcoins compared to Bitcoin However, it is essential to understand that Altcoins also carry significant risks.

To make you a better investor, let’s now look at some of the risks of investing in altcoins in 2023.

A sizeable number of altcoins are scams

When it comes to investing in altcoins, one of the biggest risks to consider is that of scams and rug pulls As the name suggests, a rug pull is a type of scam project that has been specifically designed to dupe unsuspecting investors out of their hard-earned money. These projects are usually made with just one goal in mind – to manipulate the price of an altcoin for personal gain.

This is done by collecting funds from investors through an ICO, followed by artificially pumping the price of the crypto asset This results in new investors being lured into buying more tokens, causing more price volatility and further inflating its value Once the token hits a certain price, the founders will dump their entire token allocation, resulting in a sudden decline in value and leaving investors holding worthless tokens.

Therefore, you must carry out due diligence before putting any money into an altcoin project – as the risks posed by scams and rug pulls are very real. Take the time to fully understand what you’re getting into before making any major investment decisions regarding buying altcoins for your portfolio. Because there are plenty of well-intentioned projects out there – but also plenty that have been designed with deception and manipulation as their main goals. It all boils down to vigilance on the part of the investor.

Altcoins are extremely volatile – Multiple times more than Bitcoin.

It is a well-known fact that cryptocurrencies are volatile. However, compared to Bitcoin, most altcoins are highly volatile, to a level that can easily lead to severe losses for investors. While the fluctuations of low-cap altcoins can be exciting to watch, they can also be extremely risky. Many of the best altcoins to invest in have experienced substantial price fluctuations, often leading to significant losses for investors. For instance, some of these cryptocurrencies initially experienced a rapid rise in value before crashing deep into negative territory.

For context on how volatile altcoins are, consider that at the moment, many of the most promising altcoins are now trading at over 80% less than their peak valuation only a few months back. While these wild swings can present great opportunities for those who play their cards right, investing in altcoins that experience severe depreciation levels carries a high risk and may not be advisable for all investors.

Nevertheless, suppose you do decide to buy altcoins with a small or medium market cap as part of your overall investment strategy. In that case, you must stay on top of your game and keep a close eye on market movements so that you don’t get caught off guard by sudden shifts in value. With careful planning and diligent research, it is possible to weather the chaotic waters associated with crypto investing – make sure that you have an exit strategy in place.

Altcoins tend to move in the same direction as Bitcoin

If you have been in the crypto market for a while, then you know that when Bitcoin goes up, altcoins go up, too. The reverse also holds true regardless of how strong altcoins fundamentals are at the time of Bitcoin’s move. For instance, since Bitcoin turned bearish in November 2021, altcoins have crashed, too.

This means that no matter how fundamentally good an altcoin is, its price is always at risk of being impacted by Bitcoin’s moves.

What’s the best platform to invest in altcoins in 2023?

When choosing an exchange where to invest in altcoins, there are several important factors that you need to put into consideration. The most important ones are as below:

- The number of altcoins listed

- Commissions they charge for trading

- The least amount you can invest

- The number of options they offer for funding your account

Based on these core considerations, we believe eToro is one of the best cryptocurrency exchanges you can use to invest in altcoins in 2023.

>>>Buy Altcoins Now<<<

eToro – Best broker to buy top altcoins in 2023

One of the reasons we believe eToro is one of the top cryptocurrency exchanges the market has to offer is its regulation. eToro is one of the leading cryptocurrency exchanges that are regulated by bodies like the SEC, FCA, CySEC, and ASIC. This means you can buy cryptocurrencies without fear of losing them and without an opportunity for recourse.

eToro also makes it easy for customers to fund their accounts. With eToro, you can fund your account with one of their many options, including e-wallets like PayPal, cards, and even wire transfers.

The best part is that eToro has a pretty low investable minimum capital. With just $10, you can start trading. This means eToro allows you to diversify your altcoin portfolio.

eToro is also one of the most affordable cryptocurrency brokers in the market today. Rather than charge a commission as most exchanges do, eToro uses a spread model that costs the trader a meager 0.75%.

For new traders looking to start in altcoins, eToro makes things easy for them, too. This is thanks to its copy trading feature; you can automatically copy the moves of successful traders and reduce the risks that most inexperienced traders face.

>>>Buy Cryptos Now<<<

How to invest in the best altcoins in 2023

- Step 1: Signup for an eToro account.

- Step 2: Send your identity documents for KYC.

- Step 3: Fund your account with as low as $10, search for the altcoin ticker and click buy.

To better understand how to invest in cryptocurrencies using eToro, read this article.

>>>Buy Altcoins Now<<<

Conclusion

Altcoins are a great way to grow your capital quickly. That’s because, in bull markets, they tend to go parabolic and outperform Bitcoin by many multiples. This article looks at 10 of the best altcoins to invest in 2023. We have also gone in-depth into the opportunities and risks of buying altcoins. Lastly, we have touched on the best cryptocurrency exchange to buy in 2023.

FAQs

What is an altcoin?

All cryptocurrencies that came after Bitcoin are altcoins, regardless of their market cap.

What’s the best way to buy altcoins?

There are many good exchanges out there where you can buy altcoins. However, we believe eToro is the best. It is regulated and has many user-friendly features.

Will altcoins go up in 2023?

No one knows for sure. However, if Bitcoin turns bullish in 2023, then growth altcoins will likely outperform it.

>>>Buy Altcoins Now<<<