KEY POINTS

- Ethereum is predicted to be the next trillion-dollar cryptocurrency. It benefits from a growing dApp and DeFi ecosystem.

- While Ethereum will likely not overtake Bitcoin it is still an excellent investment opportunity. Ethereum has much larger goals than Bitcoin, it is a different kind of investment.

- It isn’t too late to buy Ethereum. Ethereum is predicted to rise exponentially in price, and so it is still early to invest.

>>>Buy Ethereum Now<<<

Why Ethereum Is a No-Brainer Crypto To Buy Right Now

If you are new to the world of Ethereum investing, you might be wondering if Ethereum is a good investment, or should I invest in ETH? Well, the easiest answers to those two questions is yes – Ethereum is likely a good investment and investing in Ethereum could pay off big time.

One of the biggest reasons to invest in Ethereum is Ethereum 2.0, an upgrade of Ethereum’s algorithm that will transition it from proof of work to proof of stake. If the transition is successful, it may increase the price of Ethereum immensely. But that’s just one of many reasons why investing in Ethereum could be profitable.

Ethereum has increased significantly since the start of last year, and it shows no sign of slowing down. Experts believe the ETH coin has plenty of growth ahead and that investing in Ethereum is a smart financial decision for the long-term. Therefore, it could be a good time to invest in Ethereum ETH while the coin is performing very well.

In this article, we’ll break all Ethereum-related myths circulating online and help you come to your own conclusion on if you should consider investing in Ethereum.

>>>Buy Ethereum Now<<<

So, What Is Ethereum? A Simple Explanation

Ethereum is the most popular open-source platform that employs blockchain technology in the world.

In fact, Ethereum is the second-largest crypto platform by market cap after Bitcoin. Ethereum uses its own token, ether (ETH), to power transactions on the Ethereum blockchain.

But Ethereum also supports different tokens, such as ERC-20 tokens (Binance Coin and Tron both started out on the Ethereum blockchain!).

That said, Ethereum has numerous applications beyond peer-to-peer digital transactions.

Ethereum can be used to create smart contracts, digital agreements written in code that can help users make agreements and payments directly with each other without a third party.

But that’s not all (we’ve barely scratched the surface!). Perhaps, more importantly, is decentralized applications or ‘dApps’, which are distributed in a decentralized manner and built on top of the Ethereum blockchain.

dApps have also fuelled the rise of DeFi (decentralized finance), providing lending, borrowing, trading (though DEXs – decentralized exchanges) and insurance services among a vast number of other things.

All of this activity has created an exciting ecosystem where Ether flows effortlessly.

It’s really not surprising that Palm Beach Confidential editor Teeka Tiwari believes that Ethereum may soon be the next trillion-dollar crypto, and others believe that it may even one day overtake Bitcoin!

>>>Buy Ethereum Now<<<

Ethereum Investing: Getting Started

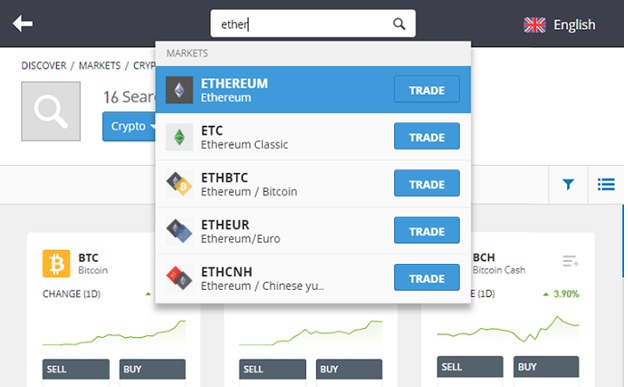

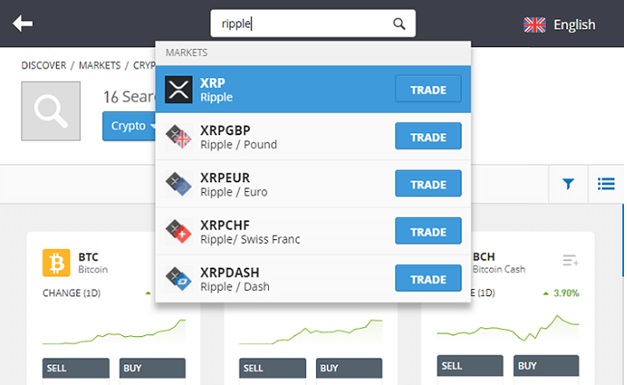

To start investing in Ethereum you first need to register online with an exchange that will allow you to buy and invest in Ethereum.

An exchange broker is an online platform that enables you to buy and sell Ethereum as well as any other cryptocurrency that they have listed.

There are a few simple reasons why investors should consider buying this Crypto right now.

As Ethereum is the second-largest blockchain platform, many crypto experts believe that Ethereum is a good investment compared to other cryptos. Despite all the ups and downs in Ethereum’s history, analysts believe that Ethereum’s price could grow further in the long-term.

One of the factors that will influence investing in ETH is Ethereum 2.0, the second iteration of Ethereum. Ethereum 2.0 will focus on energy efficiency and staking instead of mining. Note that proof of stake involves the active transaction validation and network support by holding funds in a crypto wallet to ensure safety.

Another reason to consider investing in Ethereum is the increasing use of blockchain technology, which attracts more and more successful crypto traders. Such technology can facilitate online payments, loan distribution, and commodities trading.

Why Should I Consider Investing in Ethereum? Well, Ethereum is an innovative technology that can change the whole world. To be more precise, Ethereum has introduced dApps and smart contracts that allow users to make transactions without a middleman. Thanks to the introduction of smart contracts, Ethereum can revolutionize computer programming and digital ownership as a whole.

People will be able to buy different assets from all over the world without dealing with banks and bureaucracy. Ethereum also allows the tokenization of artwork, patents, mortgages, person-to-person transactions, and even voting.

No surprise that according to data provided by the World Economic Forum, up to 10% of the global Gross Domestic Product globally will be facilitated via blockchain technology by 2025.

Ethereum can support not only individuals but businesses around the world by providing improved interconnectivity. This technology can foster innovations, such as crypto-collectables (such as NFTs – non-fungible tokens), blockchain-based healthcare records, sustainable energy sharing, and so on and on.

Because Ethereum is decentralized, it’s believed Ethereum can also help people target censorship and run uncensorable dApps to keep societies informed.

On top of that, Ethereum’s cryptocurrency ETH is one of the cryptocurrencies rising in popularity. The great news is that, unlike Bitcoin, Ethereum is uncapped. There are around 120 million ETH in circulation at the time of writing and this number is increasing.

Here we should note that programmers are also compensated in Ether coins to run the protocol on their computers and help the network remain safe and effective.

Last but not least, diversification matters in the world of trading, which is enough of a reason to invest in Ethereum.

After all, Ethereum is not only a cryptocurrency but an innovative platform for smart contracts, tokens, and decentralized apps.

>>>Buy Ethereum Now<<<

Will Ethereum Ever Overtake Bitcoin?

Ethereum is the second-largest digital currency after Bitcoin, and as explained above, there are many reasons to invest in Ethereum instead of Bitcoin. Though both Ethereum and Bitcoin use distributed ledgers and tokens, Ethereum has some advantages over Bitcoin, which attracts traders from all over the globe.

As mentioned above, there are more tokens in circulation than Bitcoin, and it’s easier to obtain ether at a shorter block time. To be more precise, it takes up to 15 seconds to receive ether in a transaction, compared to Bitcoin transactions that can take between 10 minutes and a day.

Because Ethereum has its own programming language, Solidity, it is used not only as a currency and transactions but as a way to run decentralized applications, monetise work, and delegate ownership.

Its unique structure to run smart contracts is actually one of the most important aspects that make Ethereum a good investment option.

A clear example of the importance of Ethereum is the innovative Ethereum Blockchain as a Service, presented by Microsoft Azure and ConsenSys. It allows for financial services customers and developers to have a flexible and safe cloud-based blockchain environment.

Interestingly enough, many crypto games are also based on Ethereum, which makes them an attractive investment option. One of the most popular games is CryptoKitties that allows gamers to breed and trade digital cats.

Will Ethereum get as high as Bitcoin?

Probably not in the foreseeable future, but it could one day be possible. Ethereum and Bitcoin are the two most popular cryptocurrencies. Together they dominate the crypto market. But still, Bitcoin is far ahead of Ethereum. According to TradingView, Bitcoin makes up approximately 42.22% of the total cryptocurrency market’s market cap. Meanwhile, coming second is Ethereum at approximately 19.25%. The gap between the two is enormous.

Looking at CoinMarketCap we can see more clearly how much more Ethereum would likely have to grow in terms of market capitalization to reach a similar valuation.

At the time of writing, Ethereum has a market capitalisation of $408 billion, while Bitcoin is at $894 billion. For Ethereum to reach Bitcoin’s prices, it would have to more than double in value, which will not happen overnight! A big change in people’s perception of cryptocurrency would have to take place for Ethereum to reach Bitcoin.

While Ethereum has been called the next trillion-dollar cryptocurrency and offers a wide range of features not available to Bitcoin, Bitcoin is far simpler to understand. Bitcoin solely aims to become digital money. Ethereum’s goals are much larger and get lost on less technical people.

Further to that, we need to recognise that most crypto traders are not really interested in dApps and smart contracts. What likely interests them is profit, and predictions that suggest Bitcoin can overtake the market cap of gold will keep them hooked on Bitcoin for the foreseeable future.

Bitcoin is more feasible to understand. It’s harder to explain to people why we need Ethereum in comparison to Bitcoin. Therefore, while Ethereum will likely continue to climb in value, expecting it to reach BTC levels might be too much for the time being.

>>>Buy Ethereum Now<<<

How Much Could Ethereum Be Worth?

Given that Ether’s main purpose is not to become an alternative to global currencies but to facilitate smart contracts and applications, many experts see a huge potential in Ethereum. Some analysts predict that an ETH token may reach $10,000 and over a trillion-dollar market cap. However, when such predictions could materialize is difficult to say.

Though making crypto predictions is hard, the demand for decentralized finance makes experts believe that Ethereum might rise again. Based on price projections and Fibonacci extensions, Ethereum experts claim it may reach extreme highs in the next five years.

For instance, some predictions suggest that between 2023 and 2025 Ethereum’s potential high might be $25,000, while its potential low might be $3,500. As a result, many crypto traders may take advantage of such price swings.

Price predictions for Ethereum in 2023 are positive. WalletInvestor is very bullish, believing that in 2023 Ethereum could reach $5,149. But Digitalcoin forecasts that Ethereum could reach $4,778 in 2023.

There are Trading Beasts who are conservative with the prediction methods. They predict that Ethereum will be worth $3,879 at the highest in 2023, which feels as if it could be the most reasonable forecast.

And finally, there is The Economy Forecast Agency, which sees Ethereum ending 2023 at a price of $4,701.

The further we get from today’s date, the harder it becomes to find reasonable predictions for how much Ethereum could be worth in 2025. Again, however, 2025 predictions are generally very bullish.

Digitalcoin’s Ethereum forecast for 2025 is a bold $7,476, a big increase from its price today!

The Economy Forecast Agency are predicting a high of $13,899 in April 2025. And last but not least, WalletInvestor’s 5-year forecast – which would technically be for 2027 – predicts Ethereum to reach $14,696.

The lowest prediction for Ethereum is by Anisa Batabyal of Coinswitch who believes it could reach $5,000 by 2030. On the other end of the spectrum, we have the Coin Price Forecast, which predicts that by 2030, Ethereum may be worth between $17,411 and $18,282.

But this is still minuscule in comparison to the prediction made by Brian Schuster of Ark Capital LLC, who in 2020 stated he believes Ether could reach $100,000 in 10 years, according to Blockgeeks.

| Year |

High |

Low |

| 2023 |

$6,800 |

$2,500 |

| 2024 |

$7,650 |

$3,560 |

| 2025 |

$9,150 |

$4,250 |

| 2027 |

$12,000 |

$5,550 |

Will Ethereum go down in 2023?

There will likely be unavoidable dips in Ethereum’s price here and there throughout the year, but generally speaking, many believe the price of Ethereum will continue to go up in 2023.

Traders should also remember that just because Ethereum doesn’t always maintain new highs, doesn’t mean it will continue to go down!

You need to look at it from a more long-term perspective – from the beginning to the end of the year for example. The dips here and there will likely be insignificant in comparison to the bigger picture.

>>>Buy Ethereum Now<<<

Who Should Include Ethereum In Their Portfolios?

- Day traders: Ethereum has been known to have multiple-percentage swings in one day, making it a good option for day traders who believe they know what its short-term movements will be.

- Cryptocurrency traders: Ethereum is the second well-known cryptocurrency, and therefore, many crypto traders buy it as part of their cryptocurrency portfolio.

- Blockchain enthusiasts: Since Ethereum is the second major application of blockchain technology, those who have faith in the technology and its potential impact on the tech and financial industries, could consider buying Ethereum.

- Forex traders: The cryptocurrency market is perceived by some as a safe haven for when traditional currencies become too volatile. Since Ethererum is more separated from mainstream markets than other cryptos, it could become the new gold safe-haven for some traders.

>>>Buy Ethereum Now<<<

Is It too late to buy Ethereum?

It is not too late to buy Ethereum. Many crypto market analysts appear to be quite bullish on Ethereum and there is a general consensus that it will likely increase in value in the near future.

That said, there isn’t a clear consensus on how high Ethereum can reach.

If that is the case, then buying now could be ideal and you could even call it ‘cheap’.

Does Ethereum have a future?

Yes, Ethereum does have a future. If anything, it is still only just getting on its feet as smart contracts, dApps and DeFi services grow in popularity. There is no urgent reason to suggest that Ethereum will not last for the next 10 or so years. That said, there are technical risks that are worth mentioning. The biggest is that Ethereum has an inflationary nature as it doesn’t have a cap on the total number of tokens that can be made.

What this means is that if a large number of Ether tokens were dumped into the market, it would decrease the value of everyone’s holdings.

Another key technical risk is Ethereum’s 2.0 upgrade to proof of stake. While this would likely make Ethereum even more popular, it is a significant change and if it doesn’t work out, it could be catastrophic to Ether’s price.

And finally, we need to consider Ethereum’s rivals (check ‘Alternatives to Ethereum’ below for more!).

Ethereum was announced in 2015 and back then the idea of smart contracts and dApps was brand new.

Fast forward to today, there are a lot of new cryptos promising to topple Ethereum in what it claims to achieve.

>>>Buy Ethereum Now<<<

How safe is Ethereum?

Ethereum is largely considered safe. Like almost all cryptocurrencies, Ethereum uses blockchain technology to ensure itself against attackers.

As Ethereum’s network continues to grow, it will become more secure as having more nodes makes it harder for attackers to manipulate it. This is because the combined computing power of all the nodes on the network will be very hard for attackers to overcome.

However, we cannot avoid not talking about the creation of Ethereum Classic.

In 2016, the network was attacked, and many Ether tokens were stolen. The Ethereum team hard forked the blockchain to create another chain where the hack had not taken place.

Ethereum Classic is technically the original version of Ethereum and what we technically call Ethereum is the newer version. It is worth mentioning that not everyone wanted to migrate to the new version and that’s how we ended up with two Ethereums.

However, it is unlikely that such an event will happen again as the network is more secure now.

Note that many of the hacks where Ether has been stolen did not happen on the Ethereum blockchain, but in cryptocurrency exchanges where tokens are stored in ‘hot wallets’.

To keep your Ethereum safe, store it in your own wallet, not on a cryptocurrency exchange!

How legit is Ethereum?

Despite the promises that Ethereum shows and the support of the crypto development world, it’s not a secret there is a lot of pressure from regulators and banks regarding crypto trading.

In fact, it’s the regulatory pressure around the so-called initial coin offerings that can make any cryptocurrency drop significantly.

Another obstacle is the fact that blockchain technology may be difficult to understand for people who are not traders or developers. Some may fall victim to crypto scams as well.

That’s why proper crypto trading education is essential to help you understand what Ethereum is and how to invest in Ethereum successfully.

Alternatives to Ethereum

If all the risks have you spooked, don’t worry there are many alternatives you can also look into. Even if you’re certain you want to trade Ethereum, you should also know these alternatives well. Some of Ethereum’s biggest rivals today include Polkadot (DOT), Cardano (ADA), Binance Coin (BNB) and EOS (EOS), and Tron (TRX).

Unfortunately, while Ethereum introduced smart contracts, dApps, DeFi to the cryptocurrency community, there is always the threat that any of the above may outmaneuver Ethereum.

These coins could also make good hedges against Ethereum if you are looking to reduce your risk.

>>>Buy Ethereum Now<<<

Is Ethereum a Good Investment and Should you Invest in Ethereum?

Most investments come down to the risk vs reward factor. In other words, do the potential rewards of investing in Ethereum outweigh the possible consequences of the risks?

No surprise that thanks to its innovative technology and huge market cap, Ethereum keeps attracting big businesses. On top of that, Ethereum is more affordable than bitcoin.

In the end, though, the pros of investing in Ethereum could outweigh its cons, depending on how you measure them.

Put simply, Ethereum is an investment with lots of potential rewards, but it’s something you should do some research on before you consider adding Ethereum to your portfolio.

Though Ethereum investing can be risky – with tonnes of competitors out there – the truth is that Ethereum has revolutionized the cryptocurrency market and is a great way to diversify your portfolio.

The final decision is down to you. You are the only one to decide whether you should invest in Ethereum or not.

>>>Buy Ethereum Now<<<

Will Ethereum Be a Millionaire Maker?

Ethereum already is a millionaire maker and the value of Ethereum is likely to increase further as demand increases.

While Ethereum price predictions are speculative due to the high volatility of the cryptocurrency market, we can simply try to analyze the factors that affect Ethereum investing.

The main factors that influence cryptocurrency investing are supply and demand, and market sentiment. When it comes to Ethereum, it is often considered the number one altcoin.

Sentiment has been fuelled by growing tech innovations and projects. With millions of Ether in DeFi apps, the demand for Ethereum might also keep increasing.

At the time of writing, according to DeFiprime, there are 215 DeFi projects on the Ethereum network, making it the largest DeFi platform.

And the DeFi market, in general, has grown massively in 2021. According to Christine Kim of CoinDesk, the DeFi market grew 150% in the first quarter of 2021.

Plus, most people strongly believe that the release of Ethereum 2.0 could lead to a high increase in demand.

While we can’t turn back time and buy ETH in its token sale to make a fortune, with enough knowledge, investing in Ethereum can potentially become a profitable investment over time.

But please remember, any investment includes some risk. So, only invest what you can afford and do as much research as possible before making a final decision.

>>>Buy Ethereum Now<<<

Conclusion: Is Ethereum A Good Investment?

Investing in Ethereum is worth considering. For many, investing in Ethereum has proven to be a great decision.

In 2017, the price of one Ether token was $25, and by March 2022 it had reached $3,409. In five years, the value of ETH had gone up 100 times!

So, if you had invested $1,000 into Ethereum back in 2017, by now you would have had about $100,000 in Ethereum!

So is Ethereum worth buying? Right now, Ethereum is definitely considered a good investment. And, if you are looking to invest in it, now would probably be a good time to do so. While no investment is risk-free, investing in Ethereum has generated more than 10,000% return over the last few years. Whether you’re new to Ethereum investing or just curious about how to make the most of your investment, understanding what to know before investing in Ethereum is critical.

In the end, the final decision comes down to you. What kind of investor do you want to be? Figure out the answer to that question, you’ll definitely know if Ethereum is a good investment!

>>>Buy Ethereum Now<<<

FAQs

Here are some of the most frequently asked questions on Ethereum. Hopefully, they’ll help you with any other questions you may still have.

How can I get free ETH?

In most cases, you will not be able to get Ether for free. In most cases where Ether is offered for free, it will likely be too much effort for too little Ether.

There are many ways advertised online where you can get Ether for free but note that many of these methods involve you having to do something, such as participate in surveys or play games (might not be as fun as it sounds!).

You can also explore the possibility of making Ether from persuading people to websites with affiliate links. But none of this is of course for ‘free’ as while you might not be paying for it, you are working for it!

Furthermore, you should also question if you trust such sites – many are likely scams.

Can Ethereum make you rich?

Ethereum could make you rich, depending on the amount you invest and your timing. If it does continue to increase in price over the coming months and years, buying and holding now for the long-term could be profitable.

Do note though that Ethereum is not a get rich scheme and you should not plan on getting rich from trading it.

Is Ethereum a pyramid scheme?

No, Ethereum is not a pyramid scheme. The Ethereum blockchain is decentralized and runs on thousands of nodes across the world. Its decentralized nature means there is no central point of control.

Ethereum is developed by the Ethereum Foundation, Hyperledger, Nethermind, OpenEthereum, and EthereumJS.

Is it better to buy Bitcoin or Ethereum?

Both Ethereum and Bitcoin are expected to tremendously increase in value, so both coins offer very high chances of providing excellent returns. Perhaps for the time being though, Bitcoin may be a slightly better investment option as it is very popular. That said, it may be even wiser to invest in both Ethereum and Bitcoin.

How long will Ethereum last?

Ethereum will last as long as people use it, theoretically. As the Ethereum network is distributed around the world, it will continue to operate until the last node logs off.

Perhaps the biggest threat to Ethereum’s existence is the rise of quantum computing. Quantum computers can perform an extraordinary number of calculations.

Is ETH mining still profitable?

According to Gareth Jenkinson writing for Cointelegraph, yes, mining Ethereum is still very profitable. In fact, because of the rise of DeFi services on the Ethereum blockchain, they may be doing even better than ever! However, Ethereum mining profitability may soon sharply decline once EIP-1559 is implemented and even more so when Ethereum finally switches to proof of stake. So, the clock is ticking for ETH miners.

How much Ethereum is left to mine?

There is no limit on the amount of Ether that can exist. Ethereum is one of few cryptocurrencies where no cap has been set. Though there has been some discussion on this, it seems unlikely at the time being that there ever will be.

When should I sell my Ethereum?

This depends on what kind of trader you want to be – a day trader or a swing trader – and what you consider a good profit.

According to CoinMarketCap, at the time of writing, the 24-hour low of Ethereum is $3,359.95 and the high is $3,435.29. Traders could aim to buy at the low point and sell at the high point, for example.

Whatever you decide to do, it is important to stick to your goals. For many trend traders, the best time to sell is when the price has peaked and appears to have started to decline. (Make sure you understand how the market runs in cycles!)

Can you cash out Ethereum?

Yes, you can always cash out your Ethereum. If you own Ether tokens in a crypto wallet, you can move them to an exchange and exchange them for your currency of choice.

Or, if you have invested in Ethereum via a broker, you can simply just sell it.

There should not be any reason why you should not be able to cash out your Ethereum.

>>>Buy Ethereum Now<<<

Like this:

Like Loading...