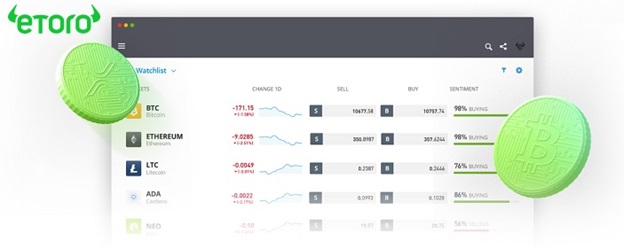

Every crypto investor is on the hunt to find the big next cryptocurrency to explode but it’s far easier said than done. Luckily, we’re here to help.Throughout this guide, we’ll be reviewing the next cryptocurrency to explode 2022 end beyond and providing a step-by-step guide detailing how to buy our top pick for a crypto that will explode. Let’s get started.

The Next Top Cryptos to Explode and Grow in 2022 and Beyond

We’ve included a brief breakdown of each of the next cryptos to explode but more comprehensive reviews can also be found in the next section.

- Cosmos

- Fantom

- Ethereum

- Decentraland

- Sandbox

- Axie Infinity

- Bitcoin

- Chainlink

- Binance coin

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Which Cryptocurrency Is Set To Explode?

Despite the market volatility, many cryptocurrency investors remain on the lookout for the next big payoff. Keep reading to learn which cryptocurrencies might explode soon.

If you’re looking to start buying cryptocurrency, you might be wondering which one will bring the biggest potential return. Although bitcoin might be the obvious choice, it’s not necessarily the best one today. Your chances of having a big payoff might be better with a new crypto to buy or a smaller coin that hasn’t already been pumped up by major investors the way bitcoin has done.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

A Closer Look at the Next Cryptos to Explode

Each of these cryptocurrencies has the potential to explode and make a huge return not just in 2022 but for many years to come. Their fundamentals are sound, and adoption could gain traction over time.

1. Cosmos (ATOM)

Cosmos is overall the best crypto to explode with massive growth potential. It has emerged as one of the most advanced blockchain protocols in the market today. That’s because it is built to help connect blockchains by allowing for the free flow of data across Dapps.

It is also one of the most advanced protocols in the market. Cosmos Tendermint is a protocol that requires only one block of validators to come together and agree on any given transaction. The algorithm has been specifically designed to be fault-tolerant. This makes Tendermints consensus more reliable than others because there’s no need for lengthy processing times or large groups attempting transactions simultaneously.

Due to its capability to help the crypto market scale, especially when it comes to Web 3.0 applications, ATOM has the potential to grow exponentially in 2022.

>>>Buy ATOM Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

2. Fantom (FTM)

Fantom is one of the cryptocurrencies perfectly suited for the fast-growing Web 3.0 economy. Fantom is designed to help developers launch Dapps in a reliable, low-cost, secure, and high-speed environment.

Fantom is increasingly growing in popularity because it is compatible with the Ethereum blockchain. This is a big deal because Ethereum is the largest Dapps platform in the market, and its dominance is not going away any time soon. In essence, allowing Ethereum Dapps developers to run their Dapps on a more efficient blockchain could drive up the value of FTM in 2022.

This coupled with the fact that key growth markets like DeFi, are gaining traction, makes FTM one of the most potential cryptocurrencies to explode and grow.

>>>Buy FTM Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

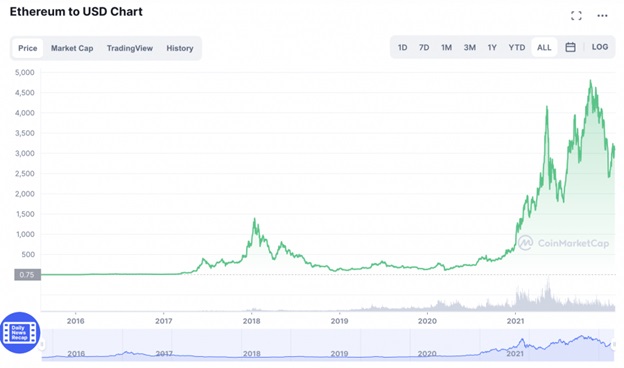

3. Ethereum (ETH)

Another crypto is set to explode in value is Ethereum. It is the number one platform blockchain in the market, and its dominance could go even higher in 2022.

That’s because a lot of the competition that was capitalizing on Ethereum scalability issues has been shown to have flaws. This has to a large extent, increased developer and investor faith in the Ethereum blockchain.

Besides, the shift to the more efficient and scalable Ethereum 2.0 is almost complete. This means most of the scaling issues that Ethereum faces today are about to end.

Ethereum 2.0 is also making Ethereum deflationary, which means the more the network is used, the more ETH is burned.

A combination of these factors makes Ethereum a top trending crypto and one of the highest potential altcoin to buy today.

>>>Buy ETH Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

4. Decentraland (MANA)

Decentraland is a Metaverse platform that has grown strongly in popularity over the past year.

In 2021, Decentraland made history when a virtual land worth $2.4 million was sold on the Decentraland platform.

Since then, a lot more land has been sold on the Decentraland platform, most of it worth upwards of $100k. Recently, Samsung built a virtual store on Decentraland, a pointer to how big the Decentraland Metaverse has become.

With the excitement around the Metaverse growing, MANA has lots of prospects going forward. It is undoubtedly a high-potential cryptocurrency in 2022.

>>>Buy MANA Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

5. Sandbox (SAND)

Sandbox was one of the best performing cryptocurrencies in 2021. Most of its gains were towards the end of the year, driven by the launch of a new play-to-earn game called Alpha.

Similar factors are likely to keep driving up the value of SAND in 2022. That’s because there are more play-to-earn games coming up on the Sandbox Metaverse in 2022. If the impact that Alpha had on Sandbox keeps repeating, then there is every reason to believe in SAND as an investment.

On top of that, there is a lot of hype around the Metaverse, and it is only likely to get stronger. This puts SAND among the top most potential cryptocurrencies to explode.

>>>Buy SAND Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

6. Bitcoin (BTC)

Bitcoin can’t miss among the most potential cryptocurrencies to explode again. That’s because it is the market leader and pretty much determines the overall cryptocurrency market direction.

Besides Bitcoin being the largest cryptocurrency, it also leads the rest of the market in adoption. Bitcoin is so adopted that even countries are taking it up as legal tender – El Salvador leads the way.

Institutions have also taken up Bitcoin with a lot of enthusiasm. Companies like Microstrategy and Tesla now hold billions worth of Bitcoin, and many more are buying up Bitcoin through ETFs.

All this is happening against a tiny supply of Bitcoin that is capped at just 21 million BTC. When you put all these factors together, BTC stands out among the top potential cryptocurrencies to increase in value.

>>>Buy BTC Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

7. Axie Infinity (AXS)

Axie Infinity is one of the best altcoin to buy as the digital asset has the potential to explode in Value. AXS was one of the best performing cryptocurrencies last year. This had a lot to do with the hype around the Metaverse and the fact that Axie Infinity has a lot going on within its ecosystem.

For instance, Axie Infinity has been investing in increasing its Metaverse ecosystem’s depth. In 2021, Axie Infinity announced that it completed a funding round where $150 million was raised.

Since then, Axie Infinity has achieved a lot in new product launches. With more play-to-earn games coming up on the Axie Infinity Metaverse, AXS can’t miss among the best crypto to consider.

>>>Buy AXS Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

8. Chainlink (LINK)

From a fundamental perspective, Chainlink is one of the strongest cryptocurrencies in the market today. This has a lot to do with its dominance in its core market. Chainlink dominates the decentralized data oracles market by over 60%. This is a big deal because as this market grows, so will Chainlink’s prospects as an investment.

Besides, there are lots of growth prospects in its core market. Chainlink is all about connecting real-world data to smart contracts. In essence, as smart contracts increase in number, so does LINK’s potential. With DeFi and NFTs on a growth trajectory, LINK is set to explode.

>>>Buy LINK Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

9. Binance coin (BNB)

Binance coin is one of the most stable cryptocurrencies in the market today. And it has the most potential upside due to its mix of fundamentals and value growth. It is the cryptocurrency that powers the multi-billion dollar Binance ecosystem.

However, the biggest factor likely to drive BNB is the coin burn. This is the primary factor that has helped push BNB higher since its launch. It is also the key factor that could see the Binance coin rally even more, now that its adoption has its highest levels ever.

Besides, with Binance constantly launching new products that add value to the Binance ecosystem, the value of BNB can only go up in the long run.

>>>Buy BNB Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

How To Spot the Next Big Cryptocurrency

Before figuring out which cryptocurrency might be the next big winner, it helps to understand why so many investors are gravitating toward cryptocurrency in the first place. Aside from the above cryptocurrencies, many others can emerge big winners in 2022. The big question now is, how do you determine potential winners?

While there is no sure way to determine winners, there are steps you can take to increase your odds of winning. Some of them are as below:

Look at the tech

Cryptocurrencies are not only a way to trade goods and services; they also serve as an investment vehicle. The value of Bitcoin accumulated over time because people saw its potential in its tech as a blockchain pioneer.

Similarly, Ether can be used on the Ethereum Network, which is the world’s largest decentralized programmable computer.

Both of these two cryptocurrencies have succeeded because the tech is strong. Using the same approach, focus on cryptocurrencies that have strong tech for you to succeed. The stronger the tech, the better the odds of success.

The magnitude of the market the cryptocurrency represents

All new technology means that society will change in some way. The changes can vary from big (like smartphones) or small ones such as 3D printing for manufacturing industry professionals.

In crypto, the bigger the change that the crypto can bring to the market, the higher its potential to perform well over time. Even in the past, cryptocurrencies that have a big potential market are the ones that have performed well. In essence, focus on the potential market size before investing in any cryptocurrency.

Look at the potential rate of adoption

Before investing in a cryptocurrency, it is important to look at its adoption rate and the potential for more adoption. The best cryptocurrencies are those with a high level of adoption and have the potential for more adoption. For context, Ethereum has grown to become the number one Dapps platform because it is decentralized and highly secure.

Essentially, anyone who wants to launch a Dapp is sure that Ethereum will never go down, and curtail the operations of their Dapp. This is a factor that could see Ethereum keep growing in value over the years.

By applying the same principle to other cryptocurrencies, you can find other high-potential cryptocurrencies not just for 2022 but for many years to come.

Consider the price

It’s not just the price of a token that matters. How much you’re willing to invest also plays an important role in determining which tokens are worth your time and money, especially if there is more than one project available with similar features but varying prices – some may be cheaper while others cost more per piece.

If you are low on capital, it would be best to go for cryptocurrencies trading in pennies or around a dollar. This helps you get more units of a cryptocurrency, a factor that can help you make more if the price moves significantly in your favour.

Besides considering the units you can get, it is important to also consider your objective out of cryptocurrency investment.

If you are a short-term investor, then you should wait and only buy when the price is down. This increases your odds of making a profit once the price goes up. However, if you are investing long-term, the price cycles don’t really matter. That’s because, in the long run, prices are likely to go up, making you a winner regardless of the time of purchase.

For context, anyone who has withstood the multiple Bitcoin dips since launch is in massive profit at the moment.

Consider the coin supply

The coin supply is an important metric when investing in cryptocurrencies. As a rule, always go for cryptocurrencies that have a fixed supply. Even better, go for coins that have a very low supply.

The rationale is simple economics – when the quantity of a commodity is low and demand rises, the price goes up. However, when there is an infinite or a substantially large amount of a commodity, buyers can easily access it without pushing up the price.

To understand the importance of token supply, the top cryptos, Bitcoin, Ethereum, and BNB all have a pretty low supply. The exception to the rule is Dogecoin which has a pretty unlimited supply. However, you must understand that Dogecoin has Elon Musk constantly pushing it. An inflationary cryptocurrency without a similar advantage as Dogecoin may never go up in price.

Look at the transaction volumes

The crypto market is a competitive one. It’s important that the coin or token you are investing in has liquidity so your investment can be easily converted back into fiat currency without too much hassle and lost value.

Besides the ease of converting back to fiat, high-volume cryptocurrencies also tend to be safer. The crypto market has a lot of pump and dump scams that capitalize on the unregulated nature of the market. In most cases, it is the low-volume cryptocurrencies that are prone to such schemes.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.

Conclusion

Throughout this article, we’ve looked at some of the most potential cryptocurrencies primed for explosive growth. There are lots of them, such as SAND and MANA, that have a lot of upside potential. These two are targeting an aspect of the market that is taunted to be potentially worth trillions of dollars. You might also want to consider ATOM and FTM for their potential to take over the Dapps market and lead the Web 3.0 revolution.

Thousands of other cryptocurrencies can give you incredible gains in 2022 and beyond. However, due to the high number of scams in the crypto market, you need to research before committing money to any cryptocurrency.

>>>Buy Cryptos Now<<<

Virtual currencies are highly volatile. Your capital is at risk.