Crypto markets are heading into 2025 with robust momentum, and investors are already scanning the space for tokens that would dominate the subsequent bull cycle. While Bitcoin will always continue to be the market chief, the real movement and exponential gains regularly come from altcoins. Among the numerous tasks competing for interest, three stand out as pinnacle initiatives: Ozak AI, Ethereum, and Solana. Together, they constitute a mix of innovation, adoption, and explosive upside capacity that would form portfolios in 2025.

Ozak AI: The Rising Star of AI + Crypto

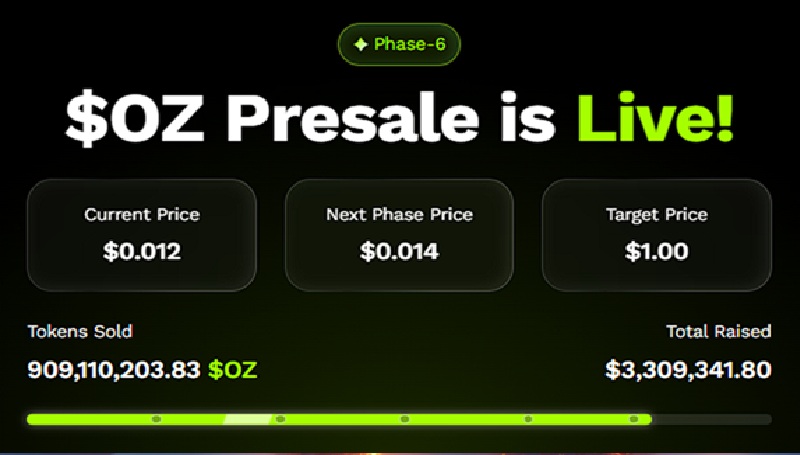

The biggest buzz in the crypto world right now is surrounding Ozak AI, a new token that is capturing attention with its presale success and bold growth potential. Currently in Stage 6 of its presale at $0.012, Ozak AI has already raised over $3.3 million. This momentum is fueled by the project’s unique value proposition—bringing artificial intelligence to blockchain in a way that benefits both traders and enterprises.

The narrative of AI + crypto is one of the most powerful drivers in the market. AI adoption is accelerating globally, and investors are betting that projects at this intersection will see extraordinary demand. Ozak AI isn’t just riding hype—it is building utilities such as predictive modeling, data-driven insights, and ecosystem rewards.

What makes Ozak AI so exciting is the ROI potential. Analysts speculate that the token could debut near $1 once it lists on major exchanges post-TGE. For presale buyers at $0.012, that would represent returns of 80x to 100x, a life-changing opportunity compared to the limited upside of more established tokens. With strong funding, community growth, and perfect timing in the cycle, Ozak AI could be the breakout altcoin of 2025.

Ethereum (ETH)

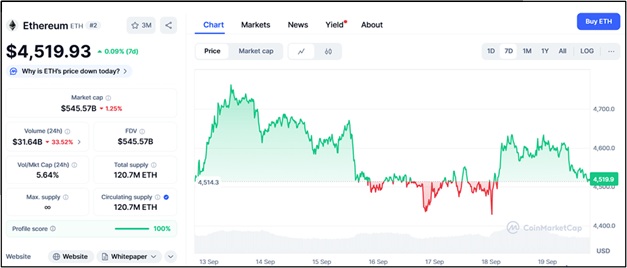

No discussion of top altcoins is whole without Ethereum (ETH), the second-largest cryptocurrency by market cap and the backbone of decentralized finance (DeFi). Trading close to $4,500, Ethereum remains the go-to community for smart contracts, decentralized applications, and token issuance.

Ethereum’s upcoming increase is tied to its scaling solutions and Layer-2 integrations, which can decrease transaction costs and increase throughput. Institutional adoption is also accelerating, with ETH being one of the few tokens along with Bitcoin to draw ETFs and mainstream economic interest.

Price predictions for Ethereum in 2025 are constructive, with many analysts anticipating ETH to attain or exceed $5,000–$6,000. While this doesn’t provide the 100x potential of Ozak AI, Ethereum stays a secure, high-fee asset that mixes stability with long-term increase. For traders, ETH remains a cornerstone asset.

Solana (SOL)

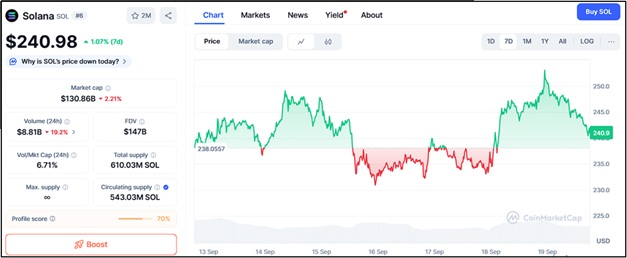

Another altcoin that remains firmly on buyers’ watchlists is Solana (SOL). Known for its speed and low fees, Solana has carved out a main function as a high-performance Layer-1 blockchain. Trading near $240, Solana has rallied strongly in 2024 and is entering 2025 with bullish momentum.

Solana is especially famous for DeFi protocols, NFTs, and gaming applications, in which its pace and value performance supply it with an edge over competitors. The ecosystem continues to increase with new dApps, projects, and partnerships that drive demand for SOL.

Technically, Solana faces resistance around $250, $270, and $300; however, it has robust help at $220, $200, and $185. If bullish momentum continues, many analysts expect Solana could take a look at new highs above $300 in 2025, making it one of the most attractive large-cap performers within the market.

Comparing Growth Potential

Each of these altcoins plays a different role in a balanced crypto portfolio. Ethereum provides security, adoption, and institutional-grade reliability. Solana offers speed, scalability, and a thriving ecosystem. Ozak AI, meanwhile, represents the high-risk, high-reward play with the potential for exponential gains.

The key difference lies in the upside potential. Ethereum and Solana may deliver steady 2x–3x growth, but Ozak AI has the realistic chance to generate 80x–100x returns from the OZ presale price, making it one of the most exciting tokens of the upcoming cycle.

As 2025 unfolds, crypto investors are preparing for what could be another historic bull run. Among the thousands of tokens in the market, three stand out as clear leaders to watch: Ethereum for its dominance, Solana for its speed and adoption, and Ozak AI for its presale-fueled breakout potential.

While Ethereum and Solana remain blue-chip altcoins, the possibility of flipping small Ozak AI bags into massive gains is what has retail investors excited. With $3.3 million raised already and growing hype around its launch, Ozak AI could very well become the defining altcoin story of 2025.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi