PeniWallet, the non-custodial crypto wallet developed by the SMC DAO ecosystem tied to $WKC and projects like WikiCatCoin, has indeed shattered expectations by processing over $900 million in total transaction volume within just six months of its official launch in June 2025.

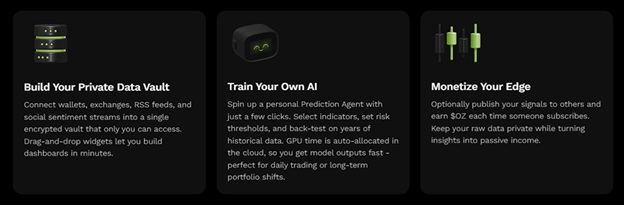

This milestone, tracked transparently via smcstats.com analytics, underscores the wallet’s rapid ascent in a crowded DeFi space—fueled by features like seamless BNB Chain support, mass transfers via “Spray” enabling sends to 1,000+ addresses in one tx, and bank-grade security without compromising user control.

As of early December 2025 from community-reported dashboards and on-chain data $900M+ up from $894M at the four-month mark in September, with daily peaks hitting $1M+ in August. 265K+ overall, with single-day highs of 6.5K August 12 and consistent weekly volumes like 8K txns/$540K late July.

64K+ wallets created, 52K+ app downloads ~10K+ on Google Play, 4K+ on iOS by July, accelerating post-backend upgrades. 1.9K+, tokens supported with $WKC dominating activity—driving burns and holder growth ~2K new holders in one day, 300B $WKC torched for $20K value. $30K+ for the ecosystem, highlighting early monetization via tx fees and integrations.

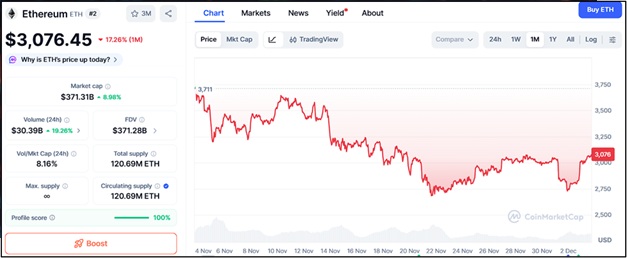

This isn’t hype—it’s verifiable momentum in a bearish 2025 crypto winter, where overall exchange volumes dipped to $1.59T monthly lows in November. PeniWallet’s growth mirrors Pendle’s TVL surge earlier in the year but on the wallet front, outpacing many incumbents like Trust Wallet in niche adoption speed.

Hitting $900M in half a year isn’t just a vanity metric—it’s a signal of structural shifts with ripple effects across DeFi, WikiCat $WKC, and beyond. In an era of hacks, $600M+ lost to exploits YTD, PeniWallet’s encryption, biometric auth, and self-custody model have converted skeptics.

64K wallets in six months implies ~10K/month organic growth, rivaling early MetaMask phases. Reduced friction for retail onboarding, especially in emerging markets via Spray’s charity/rewards tools—potentially slashing remittance costs by 50-70% vs. traditional rails.

Ecosystem Synergies with $WKC and SMC DAO

The wallet isn’t standalone; it’s the on-ramp for WikiCat’s deflationary mechanics, 1% auto-burn per txn and SMC’s community treasury. $WKC’s MC exploded from $7M to $255M post-launch, and volumes here directly amplify burns— 300B tokens in a day.

A self-reinforcing loop—higher wallet activity = more $WKC utility = scarcity-driven price pumps. Projections from community analysts peg $1B volume by year-end, which could 2-5x $WKC if historical patterns hold.

As the “flawed but fierce” precursor per founders, PeniWallet’s backend upgrades pave the way for Peniremit—a full remittance bank on BNB Chain, teased for September but delayed to Q4. Scaling to billions in cross-border flows could position SMC DAO as a “crypto-native Western Union,” capturing 1-2% of the $800B global remittance market.

Revenue share already $30K funnels back to DAO governance, boosting $WKC staking yields and community grants. Amid BTC ETF outflows ~$900M single-day in November and low vol, PeniWallet’s BNB focus dodges ETH gas woes while riding Solana-like speed narratives.

Upside in a liquidity thaw—whales could rotate from equities ~$900B inflows post-election into DeFi plays like this. Backend “frustrations” like transaction delays risk churn if unaddressed, and regulatory scrutiny on wallets/remittances could cap global expansion.

In short, $900M is the spark: PeniWallet’s proving wallets can be utility engines, not just keychains. For $WKC holders, it’s rocket fuel—expect volatility as Peniremit nears, but the trajectory screams multi-bagger potential.

WikiCat’s burn mechanism is turning scarcity into a superpower. With that 1% auto-burn on every transaction chipping away relentlessly, hitting 50% feels like it’s not just inevitable, but imminent.

No new tokens minting in, no team dumps lurking; it’s all about that daily grind toward diamond-hoofed deflation. Over 45% of the original 1 quadrillion total supply is already torched around 454 trillion gone, leaving roughly 546 trillion circulating.

At this pace—think 200-300 billion burned per day during peaks, like the 1T scorched in just five days back in August—the math points to crossing that historic half-burn mark in a matter of weeks, maybe sooner if volume spikes.

In a sea of inflationary memes, WikiCat’s setup is pure catnip for long-term plays: reduced supply + steady demand from the SMC DAO education ecosystem = upward pressure that could make early bags purr.

If you’re stacking, eyes on that liquidity pool—it’s already lean at ~14T, so any real inflows could ignite exponential pumps. What’s your take—riding the burn wave to the moon, or got a target price in mind for the 50% pop?