Tuesday, the 9th of August 2022 was a significant date in Kenyan political history. It was the day election for key positions was held all over Kenya.

Observers of the electoral process and the world at large are more interested in the outcome of the presidential election; who will be the 5th president of Kenya since the current president Mr. Uhuru Kenyatta has exhausted his term in office.

Since Kenya got its independence in the year 1963, it has had four presidents, starting from its first president Jomo Kenyatta (who happened to be the father of the current president). The late Jomo Kenyatta gave up power in 1978 to Kenya’s second President, Mr. Daniel Arap Moi. Moi was the longest serving Kenya president who served for 24 years. He was in power from the year 1978 till 2002 when he handed it over to Mr. Mwai Kibaki. Kibaki was in power till 2013 when he handed over to the current president Uhuru Kenyatta, who came in as the 4th president of Kenya.

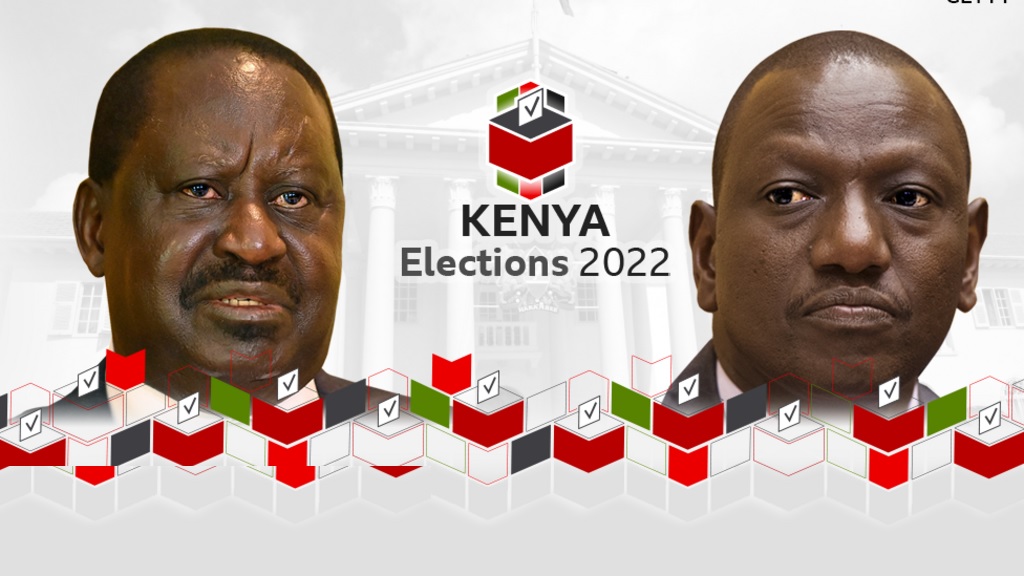

Four contestants are struggling to get hold of the presidential seat and become the next number one citizen of Kenya; amongst them are the opposition leader, Mr. Raila Odinga, the current Deputy President Mr. Williams Ruto, Prof. George Wajackoyah and David Waihiga. Truth be told that the battle is more between Raila Odinga and Williams Ruto as they are the most popular candidates and the winner of the presidential election is more likely to be one of these two.

I was in Nairobi last weekend and I was amazed that on the eve of the election the city of Nairobi was peaceful and calm and everything seemed normal unlike Nigeria.

Aside from this, some other significant things caught my attention while I was in Nairobi during this election period and having keenly observed and followed the electoral process. There are really some good electoral developments that Nigeria should at least learn and copy from Kenya and adopt for the upcoming Nigeria’s general election.

I was impressed to see that there is no politician or political figure in Kenya that is above the law. Honorable members of parliaments were arrested during the election for election violence and the police and other law enforcement agencies did not give them preferential treatment. In Kenya no matter who you are, once you are caught trying to destabilize the electoral process you will be arrested. For example, one candidate for parliament was arrested for fighting at a polling station and another parliamentary candidate was also arrested with 9 others for being in possession of machetes and other weapons at a voting center hours before the election was to kick off.

Secondly, Prisoners are allowed to vote in Kenya. That you are in prison will not rob you of your fundamental right to vote. There were polling centers and polling booths inside prisons for the sake of the inmate for them to exercise their franchise.

Also, Kenyans residing in other countries are allowed to vote too. Pooling centers were established in other countries so that Kenyan citizens dwelling in other countries other than Kenya can vote for candidates of their choice. There were voting centers in Canada, the USA, Germany, the UK, etc. That you do not reside in Kenya should not be the reason why your right to vote is taken from you.

Another significant thing I noticed in Kenya is that there is room for Independent candidacy in the Kenyan political system. Candidates must not contest under political parties, candidates do not have to have the backing or support of political parties for them to contest in an election or win elections. If you think you are popular enough to contest without the coverage or being a member of any political party you are free to do that.

Interestingly, some candidates who so far have lost the election or have seen that they are likely to lose the election have adopted the spirit of sportsmanship and they are willingly conceding defeat without recourse for unnecessary noise making, accusations and without even thinking of contesting the election results through judicial process or litigation.

Finally, there is no unnecessary pressure mounted on electoral authorities as they are given seven whole days to collate and announce the results of the election.

Generally, The election was fairly peaceful and so far free and fair. No violence or death is reported yet by the media to have occurred during the election.

Nigeria’s general election that is to be held a few months from now should at least learn and copy some few good points from Kenya’s that was just held.