I received many notes from the community to comment on the B2C foodtech delivery company which collapsed in Kenya, after raising US$1 million: “Kune is a foodtech based in Nairobi that produces $2/$3 kunelicious meals for individuals & corporates”. The company collapsed last week.

(Sure, why is he piling on people who just lost a company? My feed is a school and when I write, I do hope some people here learn. I hope the founders do not read this piece though – and do not share it with them. We need to respect them at this time.)

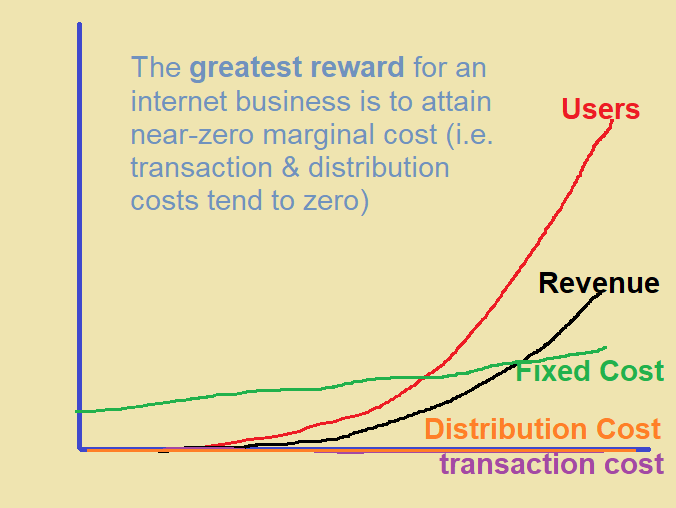

As I wrote in Harvard a few years ago, B2C business with a delivery component in sub-Saharan Africa is hopeless except in South Africa. The problem is not making a nice ecommerce website or nice foodtech app, the real deal is the logistics. Simply, a food delivery startup in Kenya cannot improve its marginal cost because as it grows, the distribution cost (a key component of marginal cost) will not go towards near-zero as you expect in great aggregators. In other words, it cannot compound its leverages over time!

Yes, it is very hard to run an aggregation business when supply is bounded and cannot be negotiated/commoditized for the cost element to become a non-factor. The supply here is the delivery system with the drivers as the main components. Even if you control demand – having many users ready to order food – unless you can reduce the cost of those deliveries down to near-zero, profitability will become hard. This is the reason why companies like Uber may not be profitable in their ride-sharing business unit for years; they influence and control demand, but they have no absolute control over supply which affects their margins; Uber drivers are not infinite and have push effects on the business.

Contrast with great aggregators like Google and Facebook where supply (contents generated by users) is nearly infinite and also free (Google caches your website, Facebook gets your baby photos, etc, free). With that, they just focus on discovery experience for users, thereby positioning themselves for super gross margins since the raw materials are nearly free. Kune is like Jumia which continues to struggle without the ability to curtail costs efficiently; Jumia’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) loss was $53 million in Q1 2022, a 70% year-over-year increase.

Uber, Kune, and Jumia are united by one thing: poor marginal cost. From Kalahari to Mocality to Efiritin to OLX (most bankrupt), when a digital business cannot improve marginal cost, it dies or will struggle to make profit over time! That is the reality which can only change when companies fix that distribution cost by going hybrid like Konga has done; Copia Kenya is another example which fixed that paralysis.

It is key to understand that B2C delivery firms in most parts of Africa are not digital businesses even though they have apps and websites. These are meatspace companies whose marginal costs are dominated by what happens in the physical world, during that delivery process.

My recommendation remains: do not run such companies. You will face a double whammy – a marginal cost problem on delivery and an unbounded competition from open markets (ecommerce) and bukkas (foodtech) which make it hard to adjust prices to compensate for those delivery costs.

The KUNE team will rise; it is nothing but an experience.

More on COPIA Business Model

Many questions on Copia business model. Many want to understand how Kenya’s Copia has also fixed the marginal cost paralysis I noted. It is very simple: when you can grow revenue and users without increasing distribution cost, good things happen.

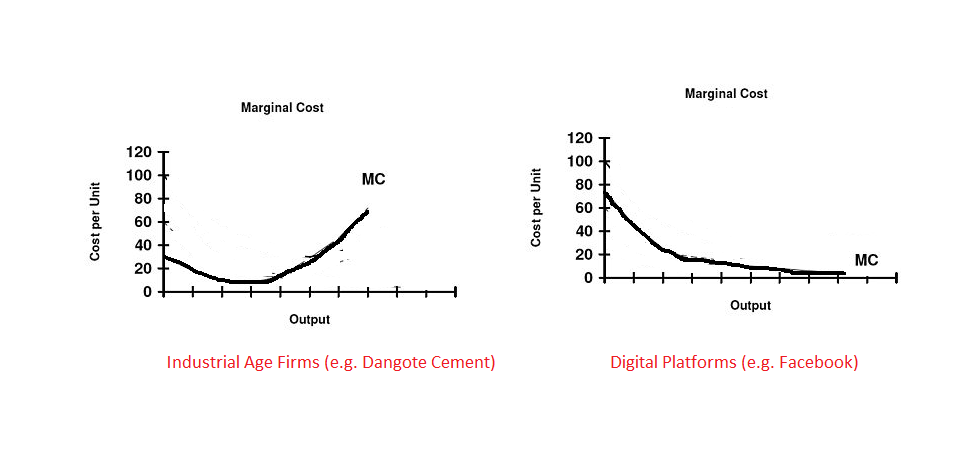

Copia’s networks of agents enable it to attain near-zero marginal cost even as it scales revenue. That is the reason I have noted that it runs the best ecommerce business model in Africa. When you plot its data, it will look like this plot below or the RHD (right hand side) . Most other ecommerce firms look like industrial age marginal cost (LHD) .

If you run an ecommerce or foodtech delivery business and the plot looks like the LHD plot, you are not actually running a “digital” firm. The digital nativity does not come by nomenclature, it comes from the marginal cost positioning which makes it possible to have great scalable advantage in the market.

Comment on LinkedIn Feed

Comment 1: On Copia, one tiny detail and its influence is missing, the grants that they receive which is not a loan, check such https://www.gatesfoundation.org/about/committed-grants/2014/10/opp1114460. I think it would be ideal to evaluate based on what the actual cost and profitability of a business is, without the support from grants. In essence, can a business sustain all aspects of its operations purely from the sales that they generate?

My Response: Gates Foundation gave them $275,119 but the last fund Copia raised was $50 million. Copia has raised $$millions and is not run on any grant money. I think it is doing a favour picking those grants so that the grantors can use its statistics to look good in their annual report. But no mistake, Copia rakes real money in 2019 – $26m https://qz.com/africa/1757623/kenyas-copia-global-raises-26-million-in-series-b-funding/ . In Jan 2022 – $50 million https://disrupt-africa.com/2022/01/20/kenyas-copia-global-raises-50m-series-c-to-ramp-up-african-expansion/ . Check their data, it is the fastest growing ecommerce firms in Africa and it raises tons of cash.

Do Not Waste Time Starting B2C Ecommerce Business in Nigeria