Gravity is pulling bitcoin down to earth. But that may not be the only story here. The biggest news is that Coinbase, the cryptocurrency exchange, is making a point that if it happens to go bankrupt, all the cryptos owned by members can go: “Coinbase, one of the largest cryptocurrency exchanges, said its users might lose access to their holdings if the company ever went bankrupt.”

A great irony in the world of decentralization where you decentralize on technology but centralize at the exchanges. For exchanges to run, they need bank accounts, and that means they need to be ordered by the ordinance of the fiat governments which register companies before banks can let them in. In other words, governments control exchanges and can have access to assets of those exchanges, including individual bitcoins depending on how courts, run by governments rule.

That discovery is causing panic in the world of Bitcoin. Coinbase has lost 86% of its value since IPO because the veil is being lifted. But of course, there is a way out: people need to go to the Capitol and ask the government to amend the necessary laws to help protect Bitcoin, etc. Hello, even the decentralized world needs a centralized world to have piece. Governments need to save Bitcoin!

“Because custodially held crypto assets may be considered to be the property of a bankruptcy estate, in the event of a bankruptcy, the crypto assets we hold in custody on behalf of our customers could be subject to bankruptcy proceedings and such customers could be treated as our general unsecured creditors,” the company said. That means users would lose access to their balances because they would become Coinbase’s property.

The Wall Street Journal was blunt with a heading – “Coinbase Says Users’ Crypto Assets Lack Bankruptcy Protections”. So, the big prayer is that the court has to protect Bitcoin assets if you expect institutional investors to touch the assets at large.

Finally, please stay calm. It is all coins: do not harm yourself because BTC is falling. A member called off at our school today because he is not happy with the Bitcoin price. That must not happen; do not harm yourself or others, please.

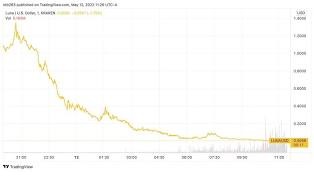

#Luna Issues: this crypto is dead

Worth $119.22 at its peak, LUNA LUNA -99.5%, the sister asset of troubled cryptocurrency TerraUSD UST -51.7%, collapsed to almost $0 overnight.

As of 10:45 a.m. ET, the token is trading at $0.005 with a market capitalization of $56 million, according to CoinMarketCap—a dramatic fall from $28 billion just a week ago. TerraUSD (UST), designed as an algorithmic stablecoin that should always be worth $1, lost its peg to the U.S. dollar last week, dropping to as low as 36 cents. It is currently worth $0.39.

Comment on LinkedIn Feed

Comment 1: Ironic that someone like you is a believer in big government. If coinbase’s stance is making a mockery of decentralisation, expect the market to solve that. There are people who believe in individual freedom and agency devoid of overlords, they have pushed that laudable agenda thus far, and we should hope that they win, for all our sakes. Governments are not needed, and they are not welcome in the crypto space.

My Response: Every crypto exchange is under the care of governments provided that exchange has a bank account. I do not understand how you can avoid that!

Follow up: You say that as if all the crypto assets being traded by millions of users round the globe somehow have their fiat equivalent passing through the exchange’s bank account. With all due respect, that’s not applicable all the time. In fact, it only applies in the rudimentary exchanges who have made the attempt to work round the FGN’s draconian anti-crypto policies. Trades occur between individuals, the exchange is where they meet to transact for a fee. Only those fees could go into the exchange ‘s bank account, if ever. If they close those bank accounts, the exchange does not cease to function. This is a monster that can’t be killed.

My Response to follow up: You made my point without acknowledging it. You can do what you noted with $200 in BTC. But if you want Goldman Sacks or Fidelity to invest $200 billion in BTC, it does not work that way. And without those, the growth will not happen. I can operate without a bank in my village, exchanging in Naira N400, N500, etc for years with kinsmen. But any day I want to do something big, invest or pay for N400 million, a bank account will become necessary. That is what is going on! How would you move $200 billion to someone with no KYC or known by anybody? Sure, BTC people can do that. But it may not be a smart move for any fund or company.

Comment 2: The power of a nation state is collective, not really divided as government vs people, because the people make up the government, so individual rebellion or recalcitrant attitude cannot stop a state from discharging its sacred duties. It is the very reason why suicide is illegal, and a state cannot watch you destroy your own wealth or lifesaving, just because you made them yourself, because if you go insane tomorrow or become a beggar, you will still create one more problem for the state.

Ideally, everyone would want to be left alone, whether in financial freedom or social adventures, unfortunately it’s impossible. As long as your identity is tied to a nation state, the state will always ‘meddle’ in your personal affairs, because you are part of its property, and the government has foremost responsibility of protecting lives and property…

The crypto universe should remain a play ground where young and creative people can try things out, figuring what works, while the state keeps a watch from the towers, even when the players believe that they are invisible; that way, we will all be fine.

My more response: You need to put more efforts to understand contexts. You can do your $100 BTC trading but those that will make BTC popular will not do that if the courts cannot protect their $billions in BTC. Just 30 years ago, email correspondence was not admissible in most global courts, discarding contracts executed via emails. Then govts passed laws and updated. Crypto is not a protected “asset” and serious money is rattled by that SEC update. Why send someone $200billion when you have no protection on it? I am not talking of your $10 in BTC, or $300 in BTC. I am talking of real money. Pay attention and stop the “you don’t understand “.

Comment 3:I understand that Coinbase made this disclosure based on how it accounts for Bitcoin in its financials. One can argue the wisdom of not demarcating customers assets from Coinbase. Or one can accept that SEC regulation is yet to catch up with advancement.

Coinbase chose to work with regulators to attract institutional investors. Hence, the accounting treatment. I’m sure things will eventually be okay seeing as the downturn is not restricted to crypto assets. That said, people should be mindful of so-called stable coins not backed by liquid assets. I’m sure you know what I’m referring to.

My Response: Good point. We need to understand that decades ago, emails were not admissible in courts, voiding contracts executed via emails. Laws were updated to change that. Today, crypto assets are not known by many laws. That is a problem for investors. So, regulators (yes governments) have to work.