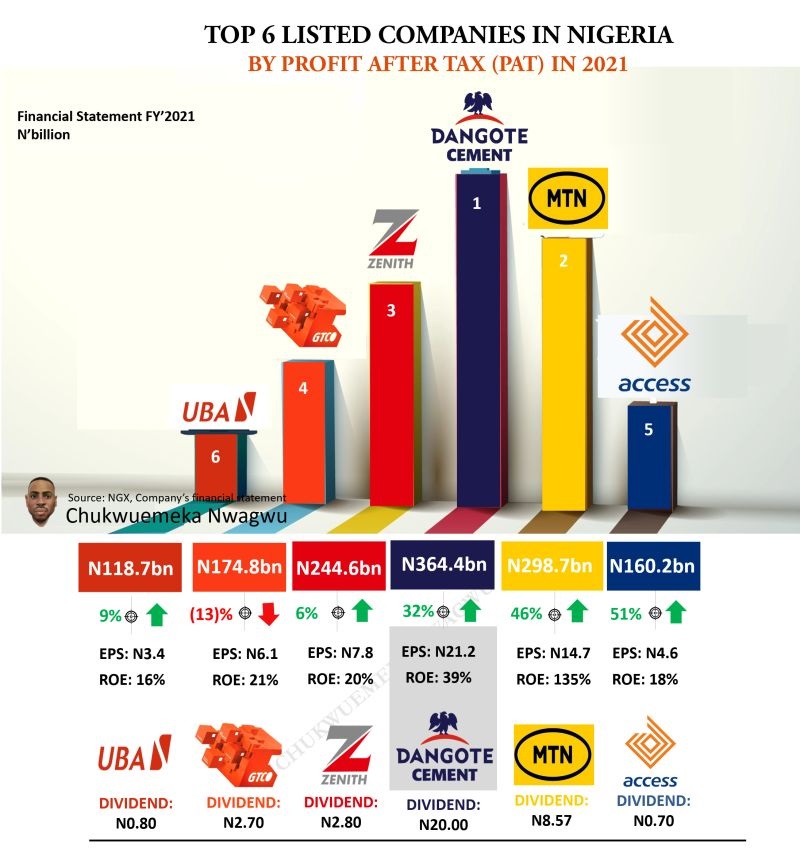

My home state of Abia has a budget of N147.28 billion for 2022; Dangote Cement made a profit after tax of N364.4 billion in 2021. Who should be His Excellency? The one managing N147 billion or the person generating N364 billion.

Like Hamlet answered Lord Polonius “Words, Words, Words”, in Hamlet, by William Shakespeare, at this moment, it is “Profit. Profit. Profit”. Like Samuel Taylor Coleridge’s “The Rime of the Ancient Mariner” where those lines were dropped: “Water, water everywhere, / Nor any drop to drink”. Turns of profit in Nigeria, yet, many are seeking for the home of abundance.

Good People, Chinua Achebe said it all, “an adult does not sit and watch while the she-goat suffers the pain of childbirth tied to a post”; shine ya eyes for Naija. Yes, opportunities remain because frictions abound. Sure, we can do better. But note this – abundance LIVES here.

Credit: from Chukwuemeka Nwagwu Bsc, Msc

Comment on LinkedIn Feed

Comment: It tells you where true value lies, that government is not the answer but entrepreneurship. Check every person who has blamed the government for his/her misfortunes and lack of success, there’s always a glaring capability gap.

We have not achieved sufficiency in anything, but most people can’t still see the opportunities therein. Between developed and developing country, which should hold greater opportunities? But again, you need that visioning capability to make sense of unharvested abundance.

Entrepreneurs lead, governments follow, but when you expect governments to lead in wealth creation, poverty and miseries abound.

The social media everyone enjoys today wasn’t a creation of governments, but after its emergence, governments started coming into the space to assert their relevance, that is government for you. What would have happened if governments were tasked with creating social media for all peoples? It would have been unusable.

Worry more about your lack of capacity and foresight, not government inefficiencies. Anything you want to see happening, get to work, and once you create big activities there, government will take notice and work with you to make it better.

Those who create wealth are the true excellencies.