Computer-Based Testing (CBT), otherwise known as e-assessment, can be defined as a pattern of administering tests in which the responses are electronically recorded and/or assessed.

It is conducted by the examiners by the use of various Information Technology (IT) equipment or mechanisms to include computers, the internet, networking, with the aid of special softwares.

The candidates, on their part, can sit for the test with the use of personal computer (PC) or an apt computerized gadget such as cell phone, particularly Smartphone, either at a testing hall or in their respective homes, as the case may be.

CBT is currently used for different purposes by various educational institutions. Many deploy it for entrance aptitude tests, some others for Continuous Assessment (CA), whilst few use it for their semester examinations.

It’s noteworthy that it is mainly in the case of CA or quiz that candidates are allowed to attend to the questions from any locality of their choice, thus the questions would be answered under no supervision.

In recent times, several academic institutions in Nigeria have adopted the CBT as an alternative assessment mode in contrast to the manual method that involves the use of paper and pen/pencil.

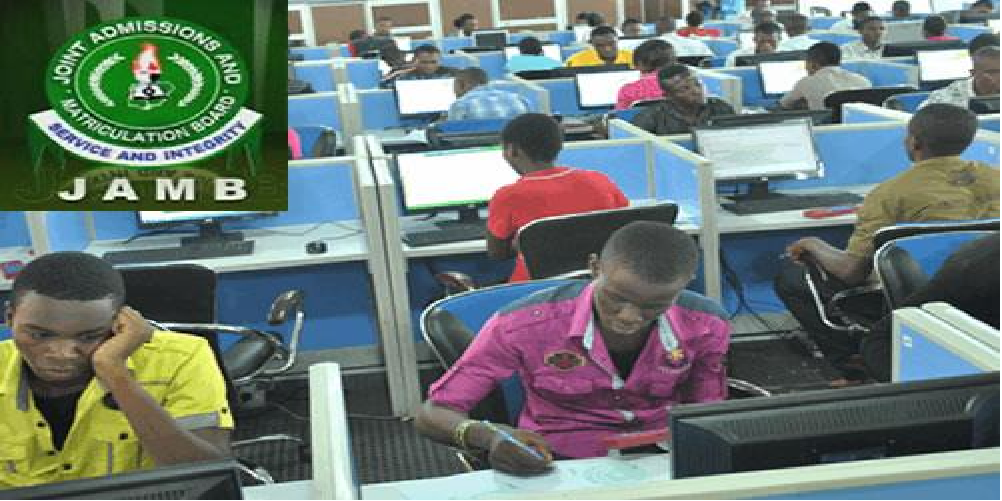

The Joint Admissions and Matriculation Board (JAMB) now deploys it for the Unified Tertiary Matriculation Examination (UTME) that tests the ability of candidates seeking admission in various citadels of higher learning in the country. JAMB fully commenced the use of CBT in the 2015/2016 UTME; prior to the said era, it was an elective mode.

Similarly, many professional bodies across the federation are making use of the CBT. It is equally used for promotional tests by some federal cum state’s Ministries, Departments and Agencies (MDAs).

There are two major types of CBT namely: linear and adaptive. A linear test is a full-length exam in which the computer selects different questions for the candidates without consideration of their performance level. This method is scored in the same way as a Paper-Based Test (PBT).

On the other hand, an adaptive test is one in which the computer selects the range of questions based on each of the candidate’s performance levels. This means that different test takers – even in the same exam room/hall – would receive different questions.

The CBT mode of assessment is arguably crucial and helpful, because it can measure different skills or sets of knowledge in order to provide new and better information about the candidate’s abilities. Moreover, the concerned institutions receive CBT results more quickly than those from the PBT, thereby enabling them to make their admission or promotion decisions, as might be the case, as fast as possible.

Furthermore, testing environments are more comfortable and individualized. Hence, candidates can write the test/exam with ease, or without much constraint.

For instance, in some such standardized tests as Test of English as a Foreign Language (TOEFL) and Graduate Record Examination (GRE), a word processor may be employed for writing essays more quickly contrary to the manual pattern.

In most CBT, a candidate might have access to immediate viewing of his or her scores on the computer screen, except in the case of essay-writing whose answers cannot be possibly programmed.

It’s worthy of note that one can sit for a CBT even if he/she has minimal or no previous computer experience. Instructions provided in a basic computer tutorial before the scheduled date of the test would give the candidate the required guidelines. This implies that any prospective candidate may have nothing to worry regarding an awaited CBT.

However, it’s imperative to acknowledge that there are numerous challenges attached to the CBT pattern required to be tackled, that if not duly addressed, both the candidates and the examiners would continue to groan while making use of it.

For the use of the CBT mode to be thoroughly successful in Nigeria, issues pertaining to power supply, software maintenance cum protection, and internet speed must be considered seriously. Also, cases concerning physical security, manpower, and what have you, ought not to be swept under the carpet.

Unsteady power supply can lead to many crises while the test is ongoing. Use of outdated softwares as well as lack of foolproof websites can warrant hacking among other dubious acts, which could make the test questions leaked to the public domain prior to the exam date. In the same vein, use of unreliable internet service providers or web browsers invariably leads to poor internet speed, and can as well make the site hang, freeze, or crash. Even bad hardwares such as mouse, keyboard and connectors, can cause several distortions.

Inadequate security personnel would enable criminals to invade the venue of the examination where valuables are kept with the purpose of causing obstruction or making away with the gadgets. Above all, the use of inexperienced manpower coupled with unavailability of IT experts cannot be undermined if we are truly determined to sustain this feat.

Aside from institutions that subscribe to the use of the CBT or e-assessment mode for entrance and promotional exams, which are usually annual or quarterly exercises, those who make use of it for CA are expected to be more vigilant and proactive.

The sites and gadgets being utilized ought to from time to time be upgraded, and a close monitoring and evaluation approach must be employed by the concerned authorities.

CBT is unarguably good and viable, but the users must endeavour to do the needful.

Like this:

Like Loading...