Two years ago, I coined the word “fintechnolization” – a construct that every digital platform must have a maturity state of offering a fintech solution. I had watched all great digital platforms on how they ended up providing fintech solutions even when they began in an unrelated sector. It was also on that framework that I started Tekedia Capital since Tekedia itself is a platform. In that piece, I made a call that in 2021, I would start a financial services solution on Tekedia!

Later, one of the best in the world, Andreessen Horowitz, put out a piece titled “Every Company Will Spin Out a Fintech Company”, confirming the the observation.

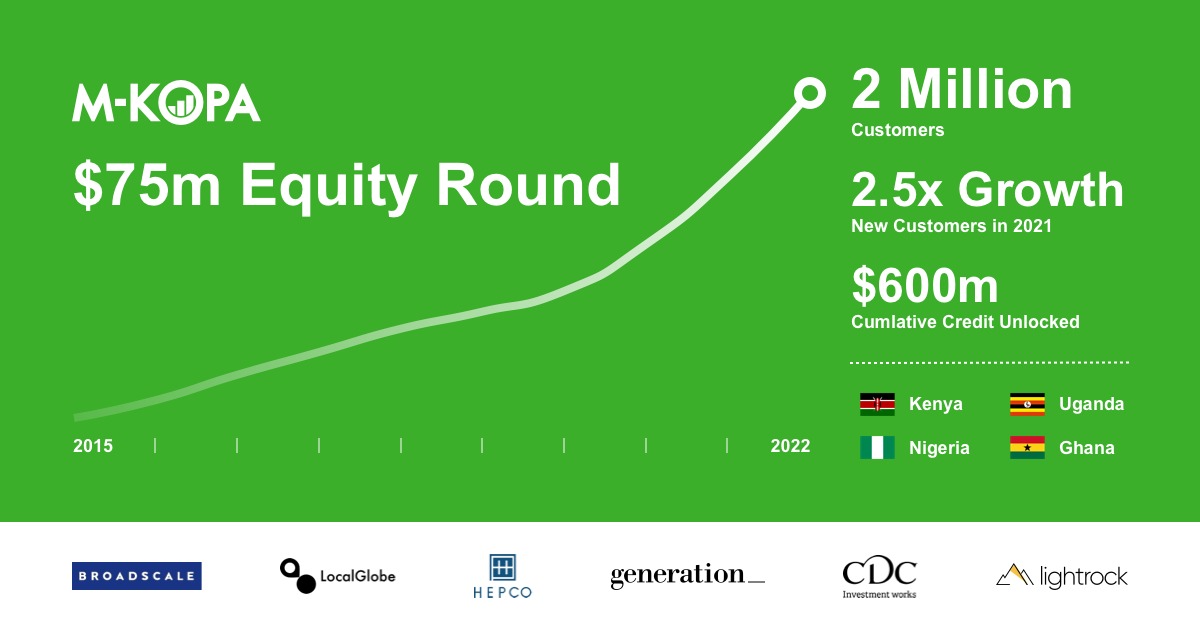

That validation continues across market domains and territories. M-KOPA which began as a solar startup is now a fintech company. In short, the company uses the word “fintech” to describe itself. It just raised $75 million: “To date, M-KOPA has unlocked over $600 million in financing and enabled 2 million customers to access a diverse set of products including smartphones, solar lighting, solar-powered appliances and digital financial services such as cash loans and health insurance. M-KOPA has recorded nearly 2.5X growth of new customers in 2021 and is projected to reach 3 million customers by the end of 2022.”:

Launched in 2011, M-KOPA combines the power of digital micropayments with the Internet-of-Things [IoT] technology to make financing more accessible to underbanked customers and enable them to build ownership of their assets as well as their credit histories. The company will use its raise to expand into additional countries, adding to its hubs in Kenya, Uganda, Nigeria and Ghana, as well as scale its financial service products beyond asset financing, including health insurance, cash loans and BNPL merchant partnerships.

A solar company does not enjoy great multiples like fintech startups . M-KOPA is smart to make itself known as a fintech over just a solar firm. With that, its valuation will be seen from the lens of fintechs.

–Press release

M-KOPA, the fintech platform that provides connected financing and digital financial services to underbanked consumers across four markets in Africa, today announced its $75M Growth Equity round*. The round was led by Generation Investment Management and Broadscale Group, with participation from new investors including LocalGlobe’s Latitude Fund and HEPCO Capital Management. M-KOPA’s existing investors, CDC Group** and LGT Lightrock also participated in the round. This capital injection brings M-KOPA’s total equity funding to $190M. Today’s news also coincides with M-KOPA providing financing to two million customers.

With the funding, M-KOPA plans to expand into additional countries, adding to its hubs in Kenya, Uganda, Nigeria and recently launched Ghana, to further scale its footprint across the continent. The company will also continue expanding its flexible daily and weekly payments model to go beyond asset financing, by scaling its financial services products such as health insurance, cash loans and BNPL merchant partnerships that have proven to be popular with customers.

Launched in 2011, M-KOPA’s financing platform enables underbanked customers to access a broad range of products and services without collateral or a guarantor. By combining the power of digital micropayments with the Internet-of-Things [IoT] technology to make financing more accessible, customers are enabled to build ownership of their assets as well as build their credit histories over time through a flexible payment model. To date, M-KOPA has unlocked over $600 million in financing and enabled 2 million customers to access a diverse set of products including smartphones, solar lighting, solar-powered appliances and digital financial services such as cash loans and health insurance. M-KOPA has recorded nearly 2.5X growth of new customers in 2021 and is projected to reach 3 million customers by the end of 2022.

Speaking on the round, Jesse Moore, M-KOPA CEO and Co-founder said, “We’re thrilled to partner with leading global investors with deep experience supporting growth-stage companies as we expand our platform to serve more of our customers’ needs. Our innovative model means we have enabled financial empowerment for over two million people already through micro-payments, but there are still millions of people across the continent that are stuck with limited economic options. With this funding, we will expand to more markets across Africa and scale to over 10 million customers in the next few years.”

“M-KOPA’s unique technology-enabled approach to providing essential consumer goods and financial services is an inspiring engine of empowerment perfectly aligned with our mission of Disruption for Good,” said Broadscale’s Managing Partner, Andrew Shapiro. “The company’s rapid customer growth demonstrates the massive unmet demand in this sector, and we look forward to working with M-KOPA as they continue to scale their reach and impact across Africa”

“We believe M-KOPA is a critical part of the push to accelerate access to digital and financial tools that will empower millions of people across Africa whilst increasing access to clean energy, clean mobility and connectivity. We were early supporters of M-KOPA and continue to be impressed by the continued innovation of its product offerings and ability to accelerate at a significant scale. We are pleased to continue supporting M-KOPA as it scales further”, said Dave Easton, Partner in Generation Investment Management’s Growth Equity team.

In Sub-Saharan Africa, 85% of the population live on less than $5.50 per day per adult, and as a result, cannot afford to major purchases outright without credit. However, access to credit remains severely limited across the continent, as the majority of consumers are underbanked, offline and hard-to-reach. M-KOPA’s offering costs an average monthly interest rate of 3.1%, lower than the typical interest rates offered by alternative sources of credit their customer base can access. Through this, M-KOPA is powering financial and digital inclusion by making micropayments accessible and leveraging data to unlock credit solutions. The company was recently recognised as one of Fortune Magazine’s Impact 20, which highlights the top 20 global venture and private-equity backed companies tackling key social and environmental issues as part of their business model.

Mayur Patel, M-KOPA’s Chief Commercial Officer, added, “By leveraging our unique data and market knowledge in serving customers over the last decade at M-KOPA, we’ve seen extraordinary growth across our markets in East Africa and our recently launched operations in Nigeria and Ghana. There is a massive opportunity in front of us to make everyday essentials more accessible by better matching fractional payment terms with customers’ daily or weekly earning and spending cycles.”

As a result of its rapid scaling, M-KOPA has created over 500 new full-time jobs across Africa since 2019 and is currently recruiting for commercial operations & engineering roles globally as part of its expansion plan.