I created an article in 2020, ‘Idea and a Piece of Paper’ where I looked at the challenges facing young Nigerian Entrepreneurs. Over the ‘festive season’, it was suggested to me by Tekedia, that ‘Mc Keowns’ Hierarchy of Business Evolution©‘ would be something worth bringing out as a main topic.

At the time, on top of the usual challenges of the time of year, I was also involved in preparing my last piece on Predictions of the Decade, so could not detour to do it immediately.

In fact, the Predictions of the Decade article was fulfilling another undertaking that I had given at least six months earlier, when I was having a debate by LinkedIn ‘DM’ on how at some point in the ‘medium term’ future, various ‘value instruments’ and ‘investment vehicles’ in the world would suffer collective collapse (though not entirely for the same reasons. This would then ‘conspire’ (unwittingly) to diverse and unrelated options in different parts of Africa as being the ‘safest options’ left in an ‘investment intolerant’ world.

In an age when all IMF basket currencies collapse or at least become severely degraded, keeping ‘money’ is not avoiding making investments, it becomes perhaps, the most risky asset retention strategy of all! This leads to my final prediction of the decade : ‘WHEN AFRICA BECOMES THE ONLY SENSIBLE INVESTMENT STRATEGY POSSIBLE’

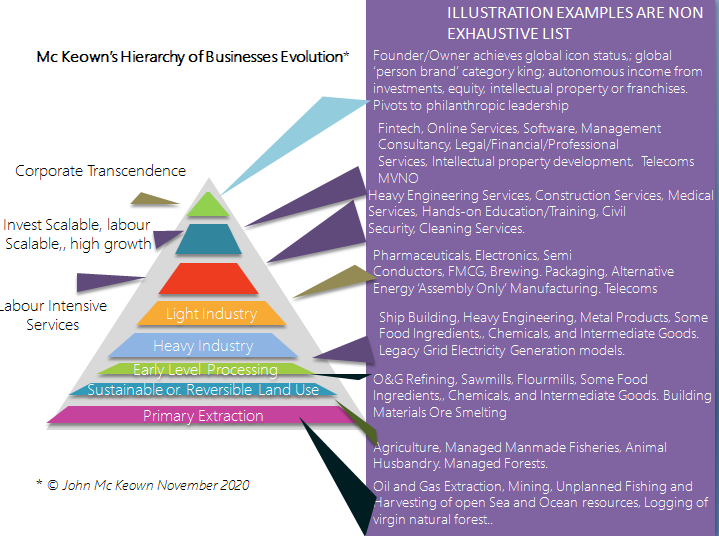

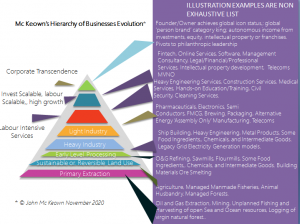

This is probably a good point to head into ‘Mc Keowns’ Hierarchy of Business Evolution©‘ because the mechanisms necessary to achieve at different levels of ascendancy on the hierarchy pyramid vary according to separate local industry profiles and dynamics. There are many complicated dependencies that aren’t visible at first glance. It is not strictly a ‘climbing the ladder’ effect, but the tiers on the pyramid do not have complete autonomy from the others either.

This is a dynamic that varies from one African nation to the next.

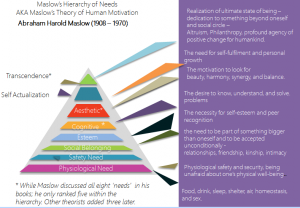

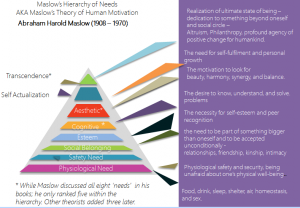

The first thing to understand about ‘Mc Keowns’ Hierarchy of Business Evolution©‘ is that it takes lead from Maslow’s ‘Hierarchy of Need’.

The importance of Maslow is underscored by the direction taken by Tekedia Mini MBA Faculty Member Edward Hudgins in his lectures on Exponential Technologies and Business Opportunities in the Age of Singularity – ‘The final arena for the entrepreneur is ‘The arena of self’. You are the entrepreneur of your own life… You are the CEO of ‘self’… To be an efficient entrepreneur in the market… you really have to change and work first and foremost on yourself’.

As human beings are capable of transcending though different levels of ‘need’, so too, the business ecosystem is capable of supporting elements within it. which are at various stages of upwards transcendence.

The common factor is that businesses are a product of human behaviour.

The ‘transcendence’ converges in both models, with a realization for the individual in Maslow, and a realization for the business leader in the Hierarchy of Business Evolution.

One of the major differences though is that in Maslow, it is a journey of human beings in a lifetime, and many will become arrested at various stages of progression.

In the Business Evolution Hierarchy, businesses exist at various levels of the pyramid, some locked in dependencies of symbiosis.

The Mc Keown pyramid is fairly fluid, particularly among the middle rungs. Not all ‘Light Manufacturing’ or ‘Intermediate Goods’ are in the same place on the pyramid.

Much depends on automation levels, digitization, use of robotics, AI, and other transcendence catalysts.

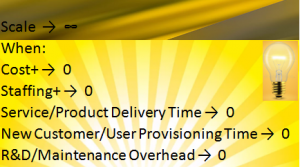

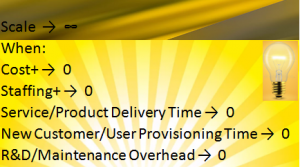

Ascending the pyramid is mostly about SCALING.

The more a business can scale, the higher a position it deserves in the ‘Mc Keowns’ Hierarchy of Business Evolution©‘

We can come up with many variables that can impact on a business’s ability to scale, but the primary drivers are cost, and pace of delivery. Most additional considerations are a function of one or both of these variables.

A third variable may be ‘Quality’.

The more revenue generating volume can be added while driving down impact on cost, delivery time to customers, or reduction in QoS (Quality of Service) or UX (User Experience), then the more scalability is improved. As additional overheads tend to 0 with growth expansion, then scalability tends to infinity.

Virtual businesses can be great for scalability, but that end-to-end ‘metaversity’ is only as scalable as the least ‘virtual’ component in the business model, or the most ‘bricks and mortar’ aspect of it, depending on perspective.

Dependency and Symbiosis.

Back in March of last year, Prof. Ndubuisi Ekekwe released a piece on Tekedia – The ‘Illusion of Leapfrogging – And Africa’s Missing Link’ which illustrates perfectly some of the characteristics of Dependency and Symbiosis.

Writing on Amazon, ‘Prof’ says: ‘Simply, behind the websites, great things are happening. So, if you just see the shiny website, you may not understand that Amazon is powered by the old economy which must run very well for the new economy to thrive.’

He goes on to introduce Tekedia Faculty Member, Dr.Henry Chan, explaining the dependencies and symbiosis of Alibaba’s activities in China.

His domestic reflection states: ‘The websites of Nigeria, and Africa cannot advance the region unless we still fix that power, water and support makers to make things in our economy.

So, when you see those posts, postulating on how an app could help Africa leapfrog the West, think again. When you download an ambulance finder app, remember that someone needs to have an ambulance in the city before the app offers any value.’

I have frequently made reference to the power dependency myself, though my favourite ‘go to’

is probably the burden of ‘metered’ internet access in Nigeria, particularly smartphone users and how it prevents OTT from being competitive.

This is the single most issue while services such as DsTV/Multi-choice etc, can survive in Nigeria without being usurped by services like Netflix, which reign in countries where affordable unmetered service is available with fit for purpose data transfer rates.

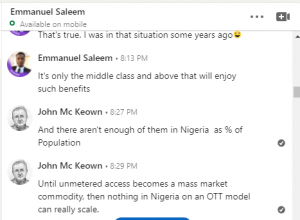

I was in DM with Emmanuel Saleem relating it is important that business persons looking at OTT within the Nigeria space do not pay attention to Macro data made available by so called global statistical data companies.

‘When they provide data on percentages of population with internet access, they are including people in possession of a smartphone making ex-contract ‘recharge card’ purchases as part of the ‘connected community’.

We all know this form of data use is cost prohibitive..‘. the conversation continues….

The DsTV/Multi-choice model survives.. at least for now… because they provide their own content delivery infrastructure, supported in part by independent connectivity solution operators providing additional federal backbone and international capacity circuits as and when needed.

Subscription based OTT vendors cause two cost centres, one for the subscription itself, and another from the data package to support the transfer, which the Nigeria based subscriber needs to provide.

That dependency reduces the scalability, and will not improve until 4G operators in Nigeria offer unmetered packages with fit for purpose transfer rates.

A good example of a ‘bricks and mortar’ impediment for end-to-end service scalability for example, would be the state of the Nigerian postal service compared to the standard many take for granted outside Africa.

For now, my advice to entrepreneurs in Nigeria’s virtual space is to look for models that can appeal to a global, rather than local market, so that the local market is not critical to the business model, and can grow in relevance at its own pace. Otherwise scrutinize and re-scrutinize the model for Scalability, Dependency and Symbiosis issues.

The local market has some way to go before businesses high on the pyramid can reach the resilience and robustness needed to realistically command that position within the ‘Mc Keowns’ Heirarcy of Business Evolution©‘

Like this:

Like Loading...